Strategy Stock Could Climb as New Rival Twenty One Validates Its Bitcoin Strategy

TD Cowen says launch of Twenty One could shift institutional sentiment and validate MSTR’s long-term bitcoin strategy.

Michael Saylor's bitcoin buying strategy had both believers and skeptics. But a new rival just emerged, already holding nearly $4 billion BTC on its balance sheet—and it's a bullish sign, according to at least one Wall Street analyst.

When SoftBank, Tether, and Cantor Fitzgerald unveiled plans to launch a new bitcoin investment company called Twenty One, structured explicitly around holding bitcoin as its primary business, many called it a significant rival to Saylor's Strategy (MSTR). Its day-one bitcoin balance sheet holding would rank it as the third-largest publicly held bitcoin treasury on day one.

In traditional finance, one could argue that such a big competition could hamper a dominant company's market share and capital raise opportunities, especially since Twenty One is already potentially launching with over 42,000 BTC at launch (worth nearly $4 billion at spot price).

However, TD Cowen analysts Lance Vitanza and Jonnathan Navarrete see it as the exact opposite: "The proposed launch of Twenty One reflects the most-meaningful validation of Strategy's bitcoin treasury operations to date," leaving the analysts "incrementally bullish" on the stock.

The analysts added that the new rival could even convert MSTR's biggest skeptics, institutional investors, into believers in Saylor's bitcoin buying strategy. The move would also increase demand for bitcoin from a high-profile entrant, which could outweigh any pressure on Strategy’s cost of capital and attract more capital into buying bitcoin.

“Certainly this is what Michael Saylor professes to believe,” the analysts wrote, pointing to the Strategy founder’s long-standing push for more companies to adopt similar strategies.

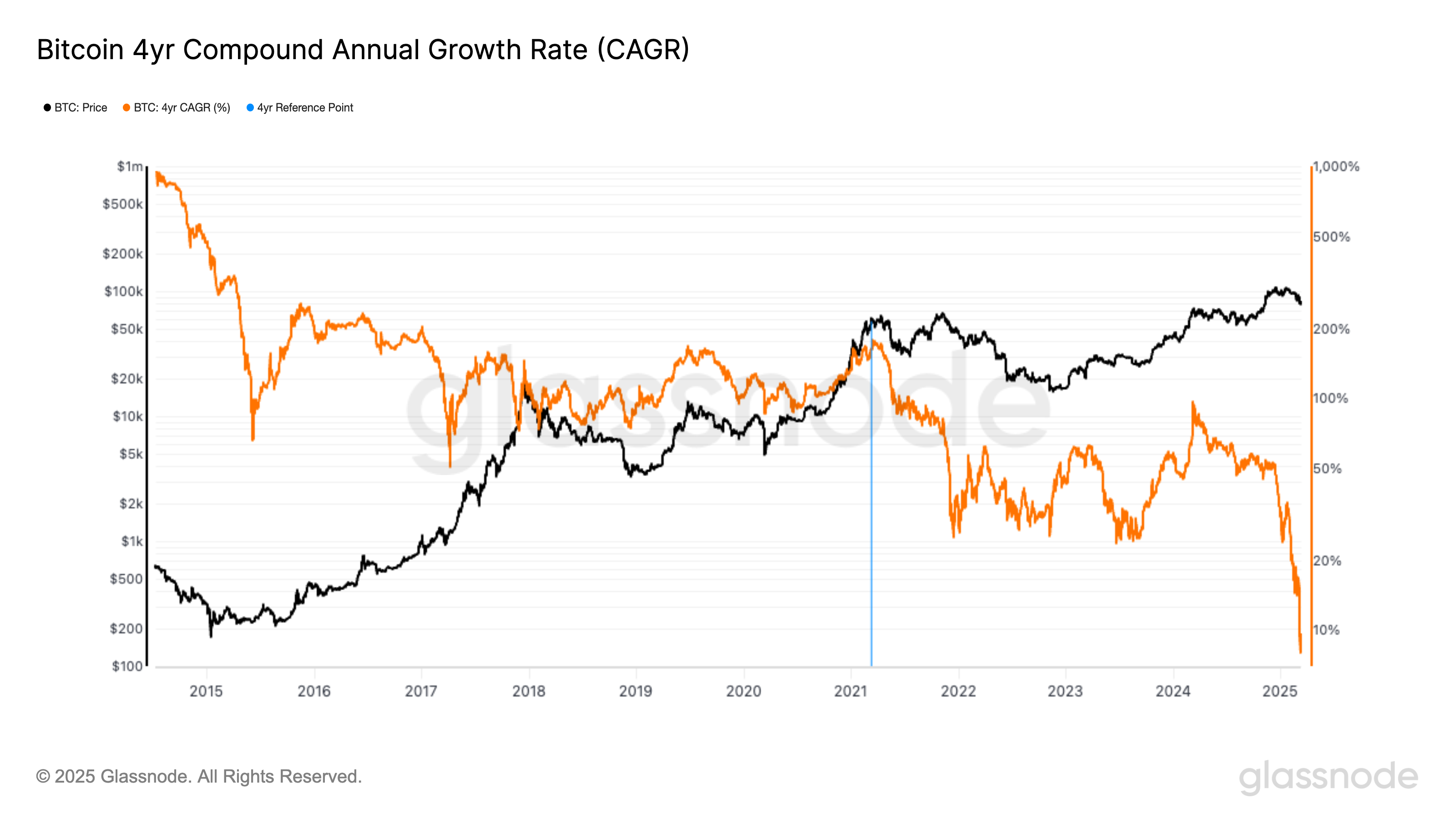

TD Cowen maintained its $550 price target for MSTR and projects the company could hold 757,000 BTC by the end of fiscal year 2027 — about 3.6% of bitcoin’s total supply. The analysts said that if bitcoin hits an average price of $170,000 by then, TD Cowen estimates that stash could be worth $129 billion.

The bullish impact of this rivalry is already prominent in the market. The shares of Cantor Equity Partners (CEP), Twenty One's SPAC vehicle, have already climbed as much as 130% since the announcement, while MSTR stocks held strong.

Read more: Cantor Skyrockets 130% as Traders FOMO Into the Stock on Bitcoin SPAC Frenzy

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)