Congress on the Clock: Can 2025 Deliver Real Crypto Reform in the US?

The winds have shifted in Washington. Just months into his second term, President Donald Trump's administration has made a decisive pivot from regulatory hostility to enthusiastic support for crypto. Executive orders, agency shakeups, and bold declarations have redefined digital assets as strategic financial infrastructure rather than speculative distractions. But even with this new momentum, one major obstacle remains: Congress.Despite the White House's crypto embrace, the legislative branch holds the keys to a stable and lasting regulatory framework. Many crypto leaders are sounding the alarm that now is the time to act by creating a clear regulatory framework for the future. One that is founded on the lessons learned during crypto’s continued maturation process. Binance CEO Richard Teng discussed the evolution of crypto regulation at the DC Blockchain Summit held March 26, 2025, “Crypto adoption was less than 1% globally. When you think about rules and regulations … in 2017 it was a totally different narrative. The regulators were not paying attention, the institutions were not embracing this, the rules were nascent at best." Teng continued by commenting on Binance’s commitment to compliance, “It's close to 25% of our global staff. It's a very key commitment and investment. Binance is the most regulated company, operating in 22 different jurisdictions."For years, lawmakers have struggled to produce comprehensive crypto legislation. In 2025, that dynamic may finally change—but only if Congress can act before the clock runs out.From Enforcement to Engagement: A New US Crypto PostureOne of the clearest signals of a policy shift came when the Securities and Exchange Commission (SEC) paused its civil lawsuit againstBinance in February. The agency cited theformation of a new Crypto Task Force, led by Commissioner Hester Peirce, as a reason to reconsider its enforcement-first approach.Then, in March, Ripple settled its legal case with the SEC for $50 million—less than half the initial fine. The agency also dropped its appeal of a ruling that XRP is not a security when traded on public exchanges.These moves were no coincidence. They followed a January 23 executive order from President Trump thatdeclared digital assets a national priority. The order emphasized permissionless blockchains, dollar-backed stablecoins, and regulatory clarity—while banning any federal work on central bank digital currencies (CBDCs). It also established a President's Working Group on Digital Asset Markets to coordinate policy development across federal agencies.On March 6, Trumpsigned another executive order creating a Strategic Bitcoin Reserve and a US Digital Asset Stockpile. The reserve, seeded with seized government-owned BTC, is intended to serve as a long-term store of value. Other digital assets, including stablecoins and altcoins, will be consolidated in the stockpile and managed by the Treasury Department. These orders reflect a broader strategy: positioning crypto as a national asset class, not just a private sector innovation.At the SEC, Acting Chair Mark Uyeda has furthered this agenda byforming a Crypto Task Force and deprioritizing enforcement.Trump's nominee to permanently lead the agency, former SEC Commissioner Paul Atkins, is widely known for his pro-crypto stance and opposition to "regulation by enforcement." If confirmed, Atkins is expected to push for clearer token classification rules, pragmatic registration paths, and broader engagement with the industry.Congress at a Crossroads: The Push for Crypto LegislationWhile the executive branch has acted quickly, Congress faces mounting pressure to deliver. After years of gridlock, the 2024 election reshaped the political landscape. With Republican control of both chambers and growing bipartisan support, the 119th Congress is considered the most crypto-friendly in US history.At the heart of this legislative push are two stablecoin bills: the STABLE Act and the GENIUS Act. Both wereintroduced in early 2025 andpassed by the House Financial Services Committee on April 3.The STABLE Act provides oversight for payment stablecoins, sets reserve standards, and defines eligible issuers. The GENIUS Act, introduced by Senator Bill Hagerty and co-sponsored by Democrat Kirsten Gillibrand, complements the House bill by assigning regulatory responsibilities to the Federal Reserve and the Office of the Comptroller of the Currency (OCC) while allowing smaller issuers to remain under state oversight.These bills reflect a pragmatic, dual-structure approach: large stablecoin issuers would fall under federal scrutiny, while smaller firms could continue operating with state licenses. Lawmakers and industry advocates hope this framework will provide clarity without stifling innovation—especially as global competitors like the EU advance their own stablecoin regulations.Broader market structure legislation is also in the works. A revived version of theFinancial Innovation and Technology Act (FIT

The winds have shifted in Washington. Just months into his second term, President Donald Trump's administration has made a decisive pivot from regulatory hostility to enthusiastic support for crypto. Executive orders, agency shakeups, and bold declarations have redefined digital assets as strategic financial infrastructure rather than speculative distractions. But even with this new momentum, one major obstacle remains: Congress.

Despite the White House's crypto embrace, the legislative branch holds the keys to a stable and lasting regulatory framework. Many crypto leaders are sounding the alarm that now is the time to act by creating a clear regulatory framework for the future. One that is founded on the lessons learned during crypto’s continued maturation process.

Binance CEO Richard Teng discussed the evolution of crypto regulation at the DC Blockchain Summit held March 26, 2025, “Crypto adoption was less than 1% globally. When you think about rules and regulations … in 2017 it was a totally different narrative. The regulators were not paying attention, the institutions were not embracing this, the rules were nascent at best." Teng continued by commenting on Binance’s commitment to compliance, “It's close to 25% of our global staff. It's a very key commitment and investment. Binance is the most regulated company, operating in 22 different jurisdictions."

For years, lawmakers have struggled to produce comprehensive crypto legislation. In 2025, that dynamic may finally change—but only if Congress can act before the clock runs out.

From Enforcement to Engagement: A New US Crypto Posture

One of the clearest signals of a policy shift came when the Securities and Exchange Commission (SEC) paused its civil lawsuit againstBinance in February. The agency cited theformation of a new Crypto Task Force, led by Commissioner Hester Peirce, as a reason to reconsider its enforcement-first approach.

Then, in March, Ripple settled its legal case with the SEC for $50 million—less than half the initial fine. The agency also dropped its appeal of a ruling that XRP is not a security when traded on public exchanges.

These moves were no coincidence. They followed a January 23 executive order from President Trump thatdeclared digital assets a national priority. The order emphasized permissionless blockchains, dollar-backed stablecoins, and regulatory clarity—while banning any federal work on central bank digital currencies (CBDCs). It also established a President's Working Group on Digital Asset Markets to coordinate policy development across federal agencies.

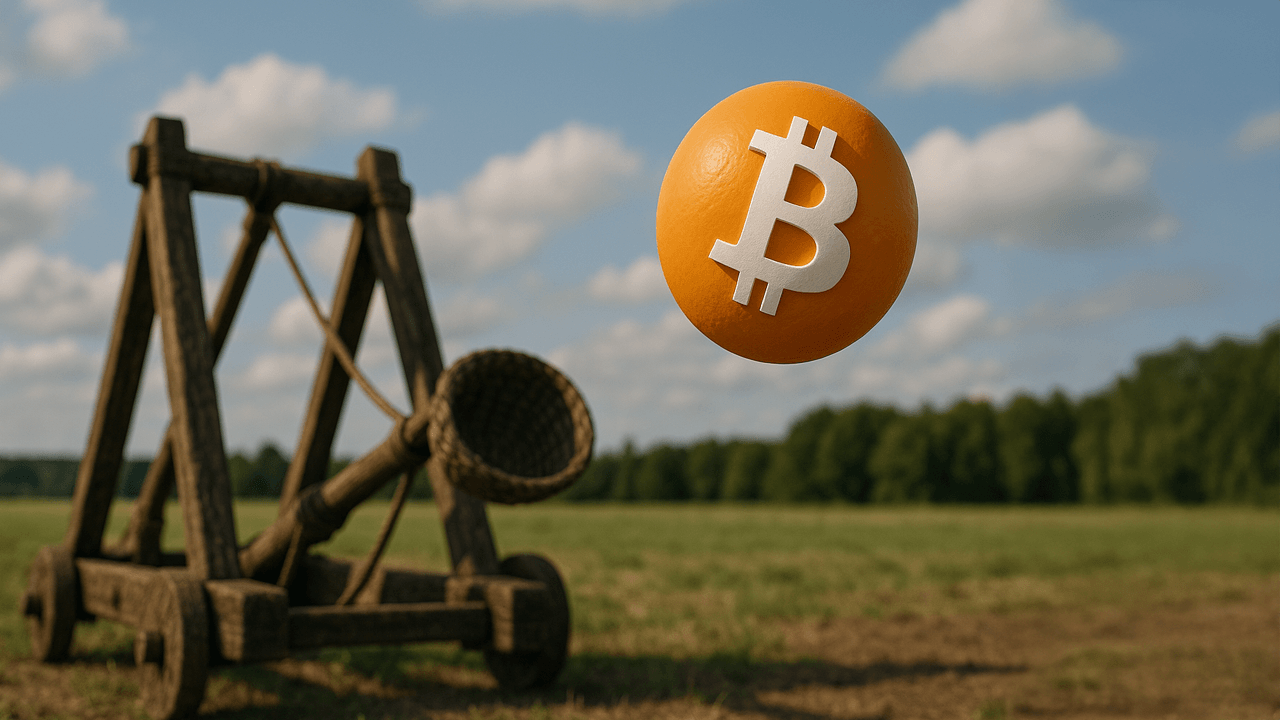

On March 6, Trumpsigned another executive order creating a Strategic Bitcoin Reserve and a US Digital Asset Stockpile. The reserve, seeded with seized government-owned BTC, is intended to serve as a long-term store of value. Other digital assets, including stablecoins and altcoins, will be consolidated in the stockpile and managed by the Treasury Department. These orders reflect a broader strategy: positioning crypto as a national asset class, not just a private sector innovation.

At the SEC, Acting Chair Mark Uyeda has furthered this agenda byforming a Crypto Task Force and deprioritizing enforcement.Trump's nominee to permanently lead the agency, former SEC Commissioner Paul Atkins, is widely known for his pro-crypto stance and opposition to "regulation by enforcement." If confirmed, Atkins is expected to push for clearer token classification rules, pragmatic registration paths, and broader engagement with the industry.

Congress at a Crossroads: The Push for Crypto Legislation

While the executive branch has acted quickly, Congress faces mounting pressure to deliver. After years of gridlock, the 2024 election reshaped the political landscape. With Republican control of both chambers and growing bipartisan support, the 119th Congress is considered the most crypto-friendly in US history.

At the heart of this legislative push are two stablecoin bills: the STABLE Act and the GENIUS Act. Both wereintroduced in early 2025 andpassed by the House Financial Services Committee on April 3.

The STABLE Act provides oversight for payment stablecoins, sets reserve standards, and defines eligible issuers. The GENIUS Act, introduced by Senator Bill Hagerty and co-sponsored by Democrat Kirsten Gillibrand, complements the House bill by assigning regulatory responsibilities to the Federal Reserve and the Office of the Comptroller of the Currency (OCC) while allowing smaller issuers to remain under state oversight.

These bills reflect a pragmatic, dual-structure approach: large stablecoin issuers would fall under federal scrutiny, while smaller firms could continue operating with state licenses. Lawmakers and industry advocates hope this framework will provide clarity without stifling innovation—especially as global competitors like the EU advance their own stablecoin regulations.

Broader market structure legislation is also in the works. A revived version of theFinancial Innovation and Technology Act (FIT21) aims to define the roles of the SEC and the Commodity Futures Trading Commission (CFTC) across digital asset markets. The bill's complexity, however, may delay progress. As Congressman French Hill noted in a February press conference, stablecoin legislation is likely to move first, while comprehensive crypto oversight will take more time.

The Narrow Window for Reform

With bipartisan interest growing and industry lobbying at an all-time high, the opportunity for reform is real—but it's also fleeting. The Republican majority in the House is razor-thin, and the 2026 midterms are already on the horizon. If legislation doesn't advance in 2025, the political window may close for years.

Still, there are reasons for optimism. Even crypto skeptics like Senator Elizabeth Warren have shown a willingness to reconsider blanket policies, particularly on issues like debanking. Congressional hearings in early 2025 have included testimony from digital asset firms and reflected a new seriousness about regulation, not just rhetoric.

At the same time, agencies like the Office of Foreign Assets Control (OFAC) and the Treasury Department are expected to remain vigilant—especially on sanctions enforcement and stablecoin misuse. A crypto-friendly regulatory shift doesn't mean a free pass for bad actors. The industry will still need to demonstrate compliance, transparency, and strong internal controls to win long-term trust. This article was written by Finance Magnates Staff at www.financemagnates.com.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)