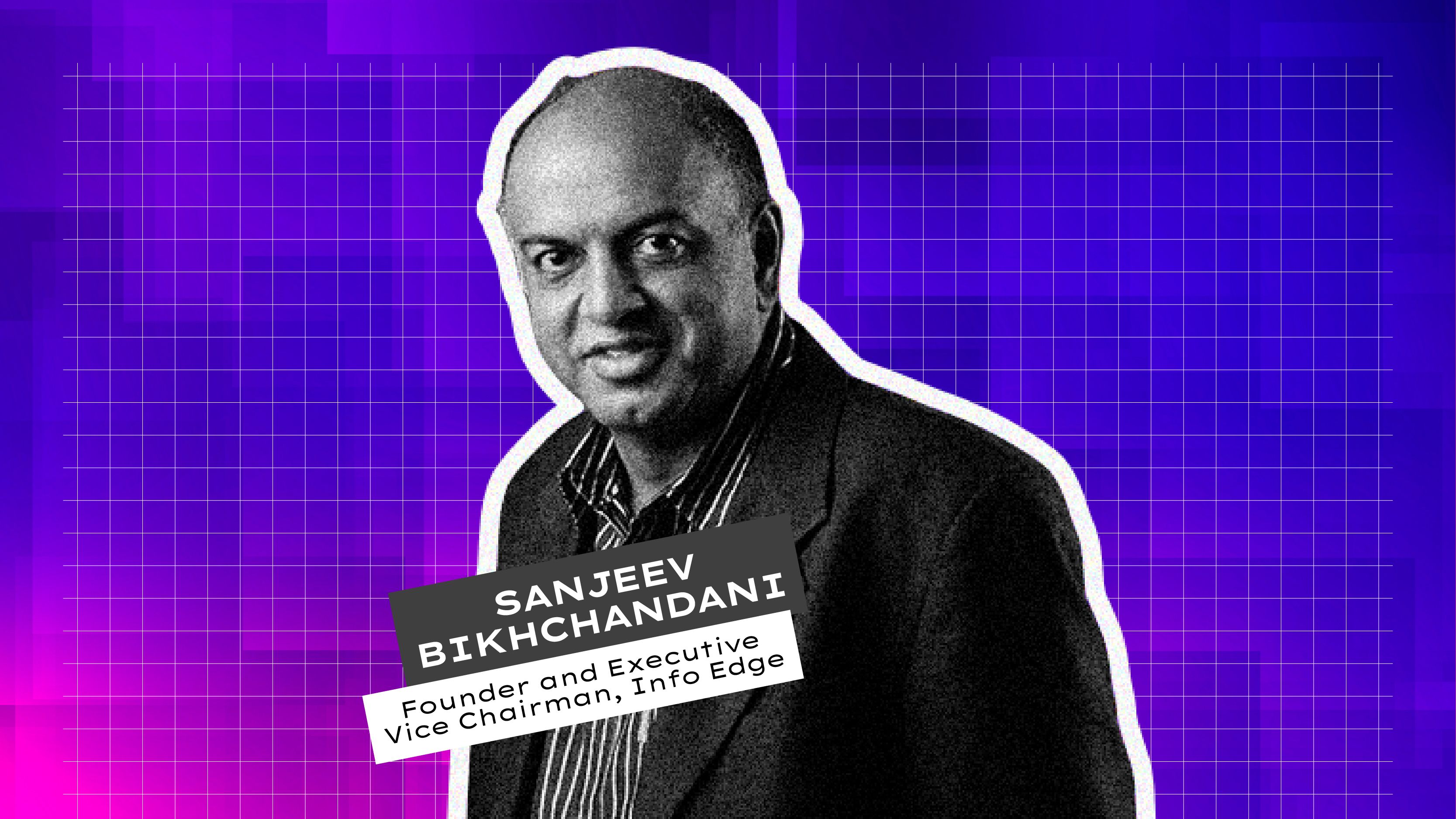

‘Invested in 18 deeptech cos over the past 5 years’: Info Edge's Bikhchandani on India’s deeptech debate

Info Edge is adding one or two new companies each quarter, with its current portfolio spanning drug discovery, and mental health technologies, among others.

Amid the growing debate over the need for Indian startups to focus on deeptech and artificial intelligence, Info Edge founder Sanjeev Bikhchandani has revealed that the firm has invested in eighteen deeptech companies over the past five years.

“There has been a lot of talk in the last couple of weeks about the need for Indian startups to work on deep tech and AI and for VCs to invest in the sector in India. At Info Edge we have been investing in these areas for the past five years. We have a separate pool of capital for deep tech investments,” said Bikhchandani’s post on X (formerly Twitter).

Info Edge has made the bulk of these investments through its subsidiary Red Start and its venture arms Capital2B and Info Edge Ventures. The group is adding one or two new companies each quarter, he noted, with its current portfolio spanning across drug discovery, mental health technologies, advanced materials, and spacetech applications.

This includes companies such as Matter Motors, Pantherun, Leumasware, Manastu Space, Ahammune BioSciences, Marbles Health, BrainSight AI, ePlaneCo, and NexStem, among others.

Bikhchandani further explained what makes a deeptech startup in India, highlighting the operational and funding hurdles they face, along with suggesting ways to draw more capital into the sector.

“Deep-tech ventures are built on scientific discoveries or engineering innovations, born out of intense research and are based around unique, protected or hard-to-reproduce technological or scientific advantages (IP). These companies are positioned at the scientific knowledge frontier and have a strong focus on R&D efforts, usually with long development cycles,” he noted.

He also emphasised that the definition of deeptech evolves over time—as new breakthroughs shift the baseline of what’s considered revolutionary. For example, he cited Tesla’s success with electric vehicles, SpaceX’s advancements in rockets, and Moderna’s COVID-19 vaccine, which have reset industry standards, showing that the most impactful technologies start as complex innovations.

“The most impactful technologies in the world follow the path of being extremely hard and complex, to becoming completely invisible over time (electricity, internal combustion engine, semiconductors, internet, cloud computing),” he added.

He further urged that deeptech is important from a ‘national strategic priority perspective’ for India to progress in science and technology. “There is this gap between it being a national priority versus it making sense for an individual entrepreneur or an individual founding team and individual VC firms. This gap needs to be bridged.”

Bikhchandani further argues that India’s deeptech pipeline stalls mainly because such ventures need far longer than a typical VC fund’s 8-12‑year life to reach product‑market fit and profitability.

“Because of this structural challenge in getting VC money in deeptech, while there are enough deeptech companies getting very early stage funding - angel, seed and very small VC funding, when it comes to Series A, B and C, there is a dearth of capital simply because these companies take longer to generate revenue and reach product market fit than a typical funded startup,” he said.

Compounding the problem, he noted, is that most scientist‑founders are not ‘commercially savvy’, making it harder for them to convert their IP into businesses.

Bikhchandani says deeptech ventures need billions of dollars and years of patience—far more than most startups or venture funds can supply. To bridge that gap, he suggests tapping the country’s biggest balance sheets: conglomerates such as Reliance, Tata, Birla, and Adani; large IT services firms like TCS and Infosys, or ONGC and NTPC; or the government itself.

“These are points to be pondered. It can't just be the responsibility of the startup world to build deeptech because the funds required may be far too large, the time horizon is far too long, and this needs to be thought through. I don't see enough large pools of capital otherwise which have infinite patience. And that is what is needed in deep tech and foundational AI, LLMs,” he proclaimed.

These remarks come at the heel of Commerce Minister Piyush Goyal’s comments on the Indian startup ecosystem last week, which drew sharp responses from several entrepreneurs.

Speaking at the second edition of Startup Mahakumbh, Goyal critiqued the focus of India’s consumer startups and urged founders to build deeptech companies to accelerate the country’s progress.

Edited by Jyoti Narayan

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)