Bitcoin rebounds as bulls eye $100K and bears scramble to cover short positions

Key takeaways: Bearish Bitcoin traders were caught off guard by BTC’s rally above $90,000.Spot volumes are driving the Bitcoin price rally.Derivatives positions with a bearish bias remain at risk of liquidation.Bitcoin (BTC) held above the $93,000 mark on April 24, suggesting a potential conclusion to the 52-day bear market that bottomed at $74,400. Although Bitcoin is beginning to show signs of decoupling from the stock market, professional traders have not altered their strategies, as indicated by BTC futures and margin market data.BTC top traders' long-to-short ratio. Source: CoinGlassA higher long-to-short ratio reflects a preference for long (buy) positions, while a lower ratio indicates a tilt toward short (sell) contracts. Currently, the top traders’ long-to-short ratio on Binance stands at 1.5x, a notable decrease from the 2x level observed ten days earlier. At OKX, the ratio peaked near 1.1x on April 17 but has since lost momentum and now sits at 0.9x.Bitcoin shines as dollar weakens and S&P 500 targets are slashedBitcoin’s 10% rally between April 20 and April 24 coincided with a more conciliatory stance from US President Donald Trump regarding import tariffs and his criticism of Federal Reserve Chair Jerome Powell, who has faced scrutiny for maintaining high interest rates. On April 24, Trump stated he had “no intention” of firing Powell, marking a notable shift from his previous rhetoric.Amid economic uncertainty, Deutsche Bank strategists have reduced their year-end S&P 500 target by 12% to 6,150. Meanwhile, the US dollar has weakened against other major currencies, pushing the DXY index below 99 for the first time in three years. Despite a modest 6% gain over the past 30 days, Bitcoin’s performance has secured it a place among the world’s top eight tradable assets, with a market capitalization of $1.84 trillion.The sharp move above $90,000 caught Bitcoin bears off guard, resulting in over $390 million in leveraged short (sell) futures liquidations between April 21 and April 22. More significantly, aggregate open interest in BTC futures remains just 5% below its all-time high, indicating that bearish traders have not fully exited their positions.BTC futures liquidation heatmap, USD. Source: CoinGlassIf Bitcoin’s price maintains its upward momentum and breaks above $95,000, an additional $700 million in short (sell) futures positions could be liquidated, according to CoinGlass data. This potential short squeeze may prove especially challenging for bears, given the robust inflows into spot Bitcoin exchange-traded funds (ETFs), which totaled over $2.2 billion between April 21 and April 23.A newly announced joint venture involving SoftBank, Cantor Fitzgerald, and Tether aims to accumulate Bitcoin through convertible bonds and equity financing, which could further strengthen the bullish case. Named “Twenty One Capital,” the Bitcoin treasury company is led by Strike founder Jack Mallers and plans to launch with 42,000 BTC.Related: Sovereign wealth funds piling into BTC as retail exits — Coinbase execThe muted response from top traders in BTC margin and futures markets suggests that the recent buying pressure has originated mainly from spot markets, which is generally considered a positive indicator for a sustainable bull run.The longer Bitcoin consolidates above $90,000, the greater the pressure on bears to cover their shorts, as this level reinforces the narrative that Bitcoin is decoupling from the stock market. This could provide the confidence needed to challenge the $100,000 psychological threshold.This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Key takeaways:

Bearish Bitcoin traders were caught off guard by BTC’s rally above $90,000.

Spot volumes are driving the Bitcoin price rally.

Derivatives positions with a bearish bias remain at risk of liquidation.

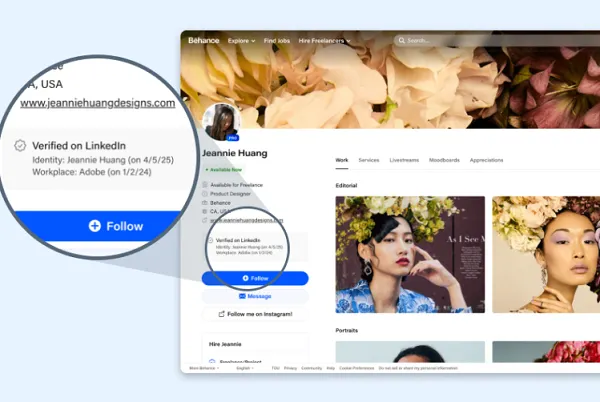

Bitcoin (BTC) held above the $93,000 mark on April 24, suggesting a potential conclusion to the 52-day bear market that bottomed at $74,400. Although Bitcoin is beginning to show signs of decoupling from the stock market, professional traders have not altered their strategies, as indicated by BTC futures and margin market data.

A higher long-to-short ratio reflects a preference for long (buy) positions, while a lower ratio indicates a tilt toward short (sell) contracts. Currently, the top traders’ long-to-short ratio on Binance stands at 1.5x, a notable decrease from the 2x level observed ten days earlier. At OKX, the ratio peaked near 1.1x on April 17 but has since lost momentum and now sits at 0.9x.

Bitcoin shines as dollar weakens and S&P 500 targets are slashed

Bitcoin’s 10% rally between April 20 and April 24 coincided with a more conciliatory stance from US President Donald Trump regarding import tariffs and his criticism of Federal Reserve Chair Jerome Powell, who has faced scrutiny for maintaining high interest rates. On April 24, Trump stated he had “no intention” of firing Powell, marking a notable shift from his previous rhetoric.

Amid economic uncertainty, Deutsche Bank strategists have reduced their year-end S&P 500 target by 12% to 6,150. Meanwhile, the US dollar has weakened against other major currencies, pushing the DXY index below 99 for the first time in three years. Despite a modest 6% gain over the past 30 days, Bitcoin’s performance has secured it a place among the world’s top eight tradable assets, with a market capitalization of $1.84 trillion.

The sharp move above $90,000 caught Bitcoin bears off guard, resulting in over $390 million in leveraged short (sell) futures liquidations between April 21 and April 22. More significantly, aggregate open interest in BTC futures remains just 5% below its all-time high, indicating that bearish traders have not fully exited their positions.

If Bitcoin’s price maintains its upward momentum and breaks above $95,000, an additional $700 million in short (sell) futures positions could be liquidated, according to CoinGlass data. This potential short squeeze may prove especially challenging for bears, given the robust inflows into spot Bitcoin exchange-traded funds (ETFs), which totaled over $2.2 billion between April 21 and April 23.

A newly announced joint venture involving SoftBank, Cantor Fitzgerald, and Tether aims to accumulate Bitcoin through convertible bonds and equity financing, which could further strengthen the bullish case. Named “Twenty One Capital,” the Bitcoin treasury company is led by Strike founder Jack Mallers and plans to launch with 42,000 BTC.

Related: Sovereign wealth funds piling into BTC as retail exits — Coinbase exec

The muted response from top traders in BTC margin and futures markets suggests that the recent buying pressure has originated mainly from spot markets, which is generally considered a positive indicator for a sustainable bull run.

The longer Bitcoin consolidates above $90,000, the greater the pressure on bears to cover their shorts, as this level reinforces the narrative that Bitcoin is decoupling from the stock market. This could provide the confidence needed to challenge the $100,000 psychological threshold.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)