XRP jumps 30% as Ripple nears SEC settlement, plans $1.25B acquisition

Ripple aims to scale RLUSD stablecoin through Hidden Road’s network. XRP trades above its 50-day moving average for the first time in months. Ripple’s cross-border payment network spans over 70 financial institutions. Ripple’s legal fight with the US Securities and Exchange Commission (SEC) may finally be nearing its conclusion. On Wednesday, Ripple and the SEC […] The post XRP jumps 30% as Ripple nears SEC settlement, plans $1.25B acquisition appeared first on CoinJournal.

- Ripple aims to scale RLUSD stablecoin through Hidden Road’s network.

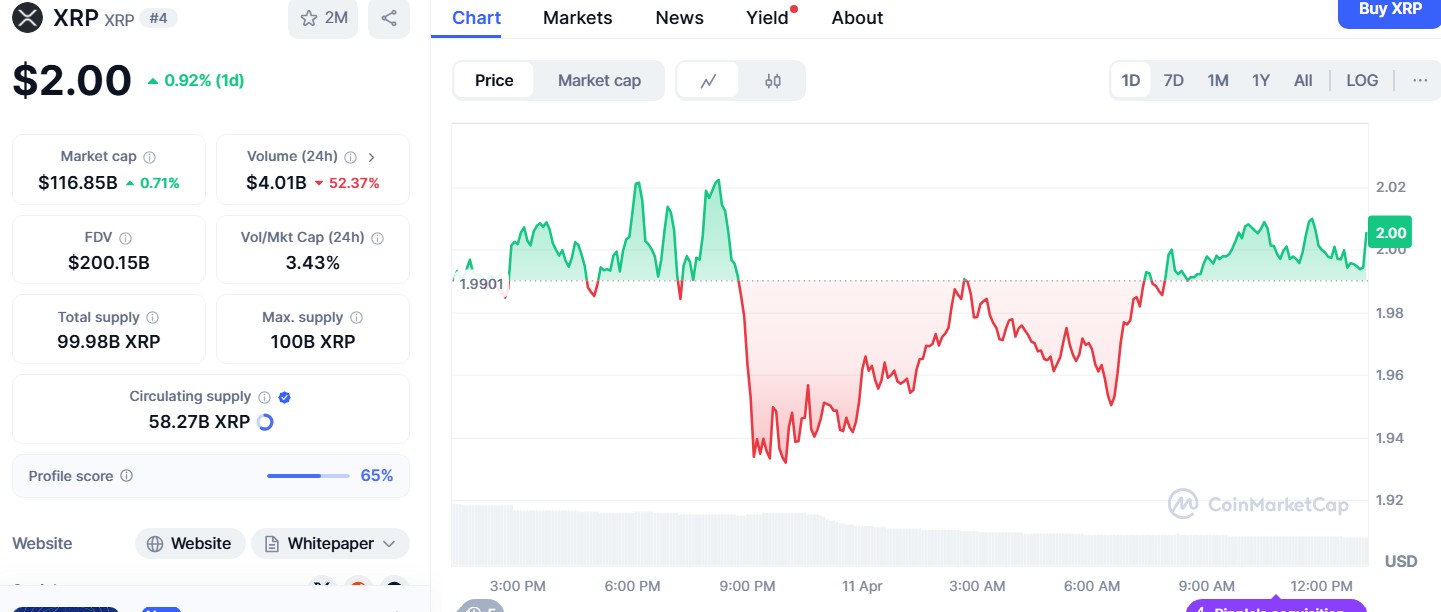

- XRP trades above its 50-day moving average for the first time in months.

- Ripple’s cross-border payment network spans over 70 financial institutions.

Ripple’s legal fight with the US Securities and Exchange Commission (SEC) may finally be nearing its conclusion.

On Wednesday, Ripple and the SEC filed a joint motion to suspend their pending appeals, signalling that a long-awaited settlement could be imminent.

This comes as Ripple announces its $1.25 billion acquisition of Hidden Road, a prime crypto brokerage.

The twin developments have triggered a 30% surge in XRP’s price from recent lows, reviving investor confidence.

With global trade tensions easing and the US taking a more pro-crypto stance under President Trump, XRP’s position as a cross-border payments asset appears to be strengthening.

SEC case against Ripple enters final stage

The legal battle between Ripple and the US SEC, ongoing since December 2020, took a decisive turn as both parties submitted a joint motion to suspend their appeals.

The motion, confirmed by legal analyst James Filan on Wednesday, paves the way for a negotiated settlement.

Under SEC Chair Paul Atkins, who has taken a notably softer regulatory approach, XRP has reportedly been classified as a payment asset rather than a security.

This reclassification reduces regulatory risk for XRP and aligns with Ripple’s strategy of pushing for global adoption of its blockchain-based payment systems.

While full terms of the potential settlement have not been disclosed, the pause in legal proceedings marks a critical step forward for Ripple’s expansion efforts.

Ripple’s $1.25B Hidden Road deal targets institutional growth

Just as legal clarity emerges, Ripple has announced the acquisition of Hidden Road, a London-based prime brokerage known for its crypto liquidity solutions.

The $1.25 billion transaction is aimed at strengthening XRP’s market infrastructure and accelerating adoption among banks and financial institutions.

Ripple is also expected to expand its new stablecoin, RLUSD, across the Hidden Road platform. With this deal, Ripple intends to improve access to on-chain liquidity and trading efficiency for its institutional clients.

The acquisition follows several strategic hires by Ripple in Europe and Asia, underlining its focus on building enterprise-grade products for cross-border settlements.

Hidden Road’s existing client base and regulatory licences across multiple jurisdictions provide Ripple with a springboard for greater international reach, especially in the Asia-Pacific region.

XRP price breaks key technical levels

XRP’s price has rallied strongly, climbing nearly 30% over the past week. The token recently broke above its 50-day moving average and now trades at $2.00 for the first time since early 2024.

Source: CoinMarketCap

Market analysts have identified $2.50 as the next resistance zone, with potential for further gains if XRP enters price discovery mode.

On the downside, XRP has support at $1.50, where buy orders have clustered.

The Relative Strength Index (RSI) currently sits at 65, approaching overbought levels, indicating some potential for short-term pullbacks.

Ripple’s recent moves—including legal progress and strategic acquisitions—have driven up trading volumes and opened the door to renewed institutional interest.

With clearer regulatory direction, XRP’s use as a bridge currency for real-time settlements could see faster integration in global finance.

Global backdrop turns favourable for Ripple and XRP

The broader macro environment has also become more supportive.

The US is reportedly engaging in fresh tariff negotiations with the European Union and China, easing fears of another trade war.

These developments have helped stabilise global markets, encouraging risk-on sentiment and improving conditions for crypto assets.

With President Donald Trump returning to office and SEC leadership shifting towards pro-business stances, digital assets like XRP may see fewer regulatory roadblocks in the months ahead.

If the Ripple-SEC settlement proceeds as expected, it would mark one of the most significant legal resolutions in the US crypto industry to date.

Ripple’s cross-border payment solutions already serve over 70 financial institutions.

If confidence continues to build, more banks may begin using XRP as a bridge asset, further boosting demand and liquidity.

The post XRP jumps 30% as Ripple nears SEC settlement, plans $1.25B acquisition appeared first on CoinJournal.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)