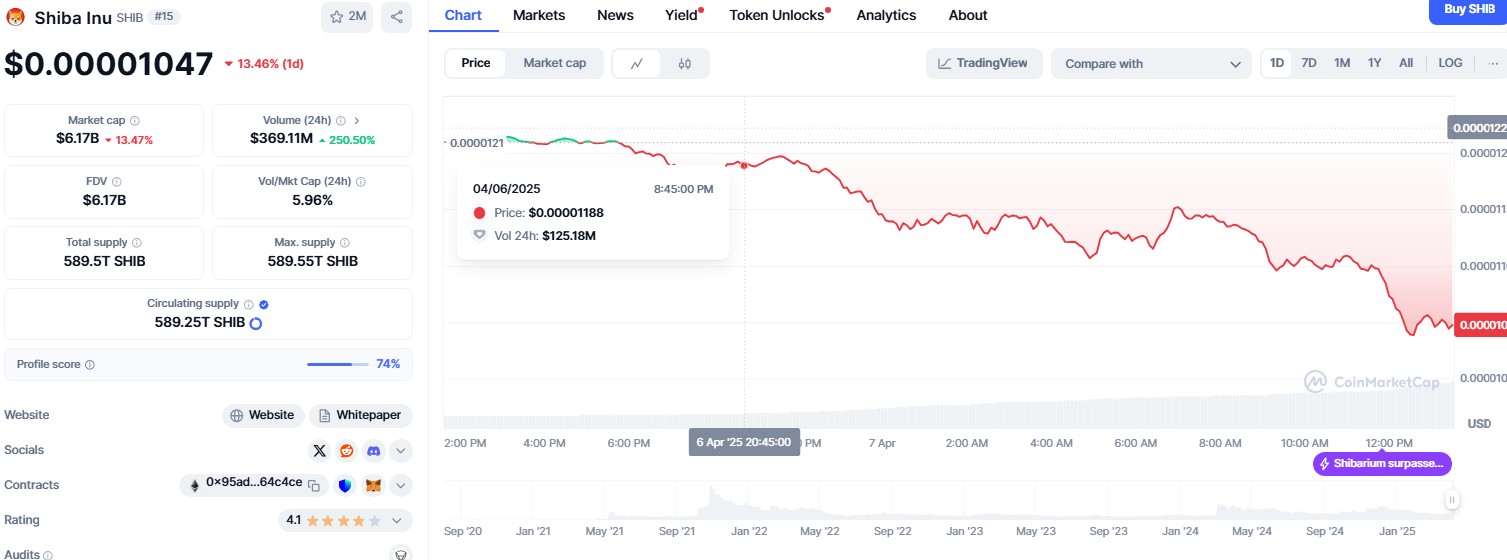

Block settles $40 million crypto investigation linked to Cash App

This follows an earlier $80 million penalty paid to other US state regulators in 2024. Cash App now has over 57 million active users and supports various crypto services. Block reported $6.03 billion in 2024 revenue, with earnings per share up 51%. Block Inc., the parent company of Cash App, has agreed to a $40 […] The post Block settles $40 million crypto investigation linked to Cash App appeared first on CoinJournal.

- This follows an earlier $80 million penalty paid to other US state regulators in 2024.

- Cash App now has over 57 million active users and supports various crypto services.

- Block reported $6.03 billion in 2024 revenue, with earnings per share up 51%.

Block Inc., the parent company of Cash App, has agreed to a $40 million settlement with the New York Department of Financial Services (NYDFS) following findings of compliance shortcomings tied to its crypto services.

The settlement follows a state investigation that uncovered weaknesses in anti-money laundering (AML) controls, including failures to detect suspicious activity and monitor high-risk Bitcoin transactions.

Block, co-founded by Jack Dorsey, resolved the matter without admitting wrongdoing, stating the issues stemmed from legacy systems within Cash App’s historical compliance programme.

AML lapses flagged

Block’s compliance failures included insufficient customer due diligence, weak transaction monitoring, and inadequate screening of high-risk crypto activity.

The NYDFS concluded that the company’s systems were not robust enough to detect suspicious patterns tied to Bitcoin usage.

Block had been under investigation since 2023, and the company disclosed the probe and related negotiations in regulatory filings with the US Securities and Exchange Commission.

The $40 million settlement comes just months after Block paid $80 million in penalties to multiple state regulators earlier this year, also tied to AML compliance.

The back-to-back fines have renewed scrutiny on fintech platforms offering crypto services as regulators increase oversight of digital assets.

Crypto business grows

Despite facing multiple compliance challenges, Block continues to grow its crypto and banking offerings through Cash App.

The platform, which has enabled Bitcoin purchases since 2018, integrated tax-reporting software TaxBit in 2023 to support users managing their crypto liabilities.

As of early 2024, Cash App had more than 57 million monthly active users and generated $1.38 billion in gross profit in the fourth quarter alone.

Block’s financial health remains strong, reporting $6.03 billion in revenue for 2024, up 4.5% year-on-year, and per-share earnings of $0.71—an increase of 51%. The company’s gross payment volume grew 10% to $61.95 billion.

However, investors remain wary. Block’s share price has fallen 32% since the beginning of the year and more than 80% since its 2021 high.

Banking push stalls

As Block faces pressure from regulators, it is also confronting challenges in turning Cash App into a full-service banking platform.

The company has launched marketing efforts in major US cities and introduced services such as high-yield savings accounts, debit cards, short-term loans via Cash App Borrow, and buy now, pay later products through Afterpay.

The direct deposit feature reached 2.5 million users by December, an important milestone for broader financial services uptake.

Still, building trust remains a hurdle. In early 2024, the Consumer Financial Protection Bureau ordered Cash App to refund up to $120 million to users over deficiencies in fraud investigations.

Analysts are questioning whether Cash App can compete with fintech players like Robinhood, which have begun offering higher-interest accounts and more comprehensive banking products.

Block’s efforts to reposition Cash App as a digital bank come at a time when regulatory scrutiny of fintechs is intensifying, particularly around cryptocurrency compliance and fraud prevention.

While the company has avoided admitting guilt in its settlements, the multiple investigations have raised questions about its readiness to scale its financial services model within a tightly regulated environment.

The post Block settles $40 million crypto investigation linked to Cash App appeared first on CoinJournal.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)