Response to Jack Dorsey

Bitcoin: The Asset That Becomes Money Jack Dorsey recently warned: “If Bitcoin only becomes a store of value—and never becomes a medium of exchange—then it has failed.” He wasn’t wrong. Bitcoin was never meant to just sit in cold storage. It was meant to move—to be money for the people, not just wealth protection for the elite. And that fear—that Bitcoin would be hoarded, locked up, too volatile to spend—has hung over it like a shadow. But the truth is: It’s not a failure. It’s a phase. Time hasn’t disproved Jack’s vision—it’s been fulfilling it all along. ⸻ Act I: The Realization When I first understood Bitcoin’s potential, I didn’t realize how fragile everything else was. I knew it was a breakthrough—but I didn’t yet grasp that fiat money fails constantly. Banks freeze accounts. Governments print wealth away. Currencies collapse under pressure. Bitcoin, on the other hand, just… keeps going. When Michael Saylor went all in, I listened. When BlackRock and Larry Fink built a fund, a critical barrier to legitimacy vanished. When Ray Dalio laid out the historical cycles of empire and warned that fiat currencies inevitably fail, it added a chilling layer of urgency—and clarity. And now, as global leaders and institutions begin advancing policy reform—legalizing, integrating, and innovating around Bitcoin’s presence in the financial system—what once felt radical starts to look inevitable. What was once a fringe experiment is becoming the foundation of a new monetary era. That’s when I realized: Bitcoin isn’t some experiment. It’s the beginning of a new monetary foundation. ⸻ Act II: The “Even Ifs” What makes Bitcoin extraordinary is how it responds to pressure—not with fragility, but with strength. • Even if governments ban it, the network runs in 100+ countries. • Even if exchanges collapse, your keys still work. • Even if price crashes 80%, conviction rebounds. • Even if institutions try to manipulate it, the supply stays fixed. • Even if better tech emerges, none can replicate its trust. • Even if quantum computing advances, it can upgrade. • Even if energy use is criticized, it accelerates clean power. • Even if whales dump, decentralization spreads. • Even if the internet goes dark, satellites keep blocks flowing. • Even if CBDCs rise, Bitcoin becomes the alternative people choose. These aren’t just hypotheticals—they’re stress tests that Bitcoin has passed. Every cycle. Every challenge. Every time. ⸻ Act II.5: The Paradox of Adoption As Bitcoin grows, so does the paradox: • Nations create legal frameworks. • Corporations buy it as a treasury reserve. • Wall Street builds infrastructure. We celebrate this adoption—but it also stirs anxiety: “Will this be co-opted? Captured? Controlled?” But here’s the brilliance of Bitcoin: It welcomes all, but bends for none. You can buy it. You can trade it. You can regulate around it. But you can’t change it. There’s no CEO. No boardroom. No backdoor. Even if every nation held a million coins, they couldn’t rewrite the code. Adoption doesn’t mean control. Participation doesn’t mean domination. Every new node run, every cold wallet held, makes it stronger—not weaker. Bitcoin absorbs the world, but never becomes it. ⸻ Act III: The Transformation The next phase is obvious: Bitcoin’s market cap will surpass gold. Not just because of hype—but because of function. And when it does—at $14 trillion and beyond—volatility drops: • From wild 4–5% daily swings • To 0.5–1%, like gold or fiat • Because it takes too much capital to shake it And that’s where Jack Dorsey’s fear gets laid to rest. Because his concern wasn’t wrong—it was just early. Bitcoin won’t stay in this high-volatility adolescence forever. Time forces it into maturity. Stability is coming. And when it arrives, everything unlocks. Layer 2 networks like Lightning are already built. Infrastructure is waiting. And now, sats become spendable, stable, and global. Bitcoin becomes not just a vault for value… But a working, living currency. ⸻ Act IV: And Then I’d Spend It At that moment— when the volatility fades, and the supply remains hard, and the infrastructure hums— I’d start spending Bitcoin. Because it won’t just be an asset anymore. It will be the most honest money ever created: • Fixed in supply • Trustless in function • Global in reach • Fast, portable, and incorruptible No fiat currency can match it. Not the dollar. Not the euro. Not the yuan. They’ll still be printed. They’ll still be inflated. Bitcoin won’t. ⸻ The Endgame Jack Dorsey was right to be worried. But time is solving his fear. Because Bitcoin is moving—slowly, relentlessly—toward being perfect money: • A store of value • A medium of exchange • A unit of account It doesn’t beg for trust. It earns it. Block by block. Cycle after cycle. Hype and crash, bear and bull. Until one day, the world stops calling it an asset… And starts calling it what it’s always been: Our money. submitted by /u/Few_Temperature7935 [link] [comments]

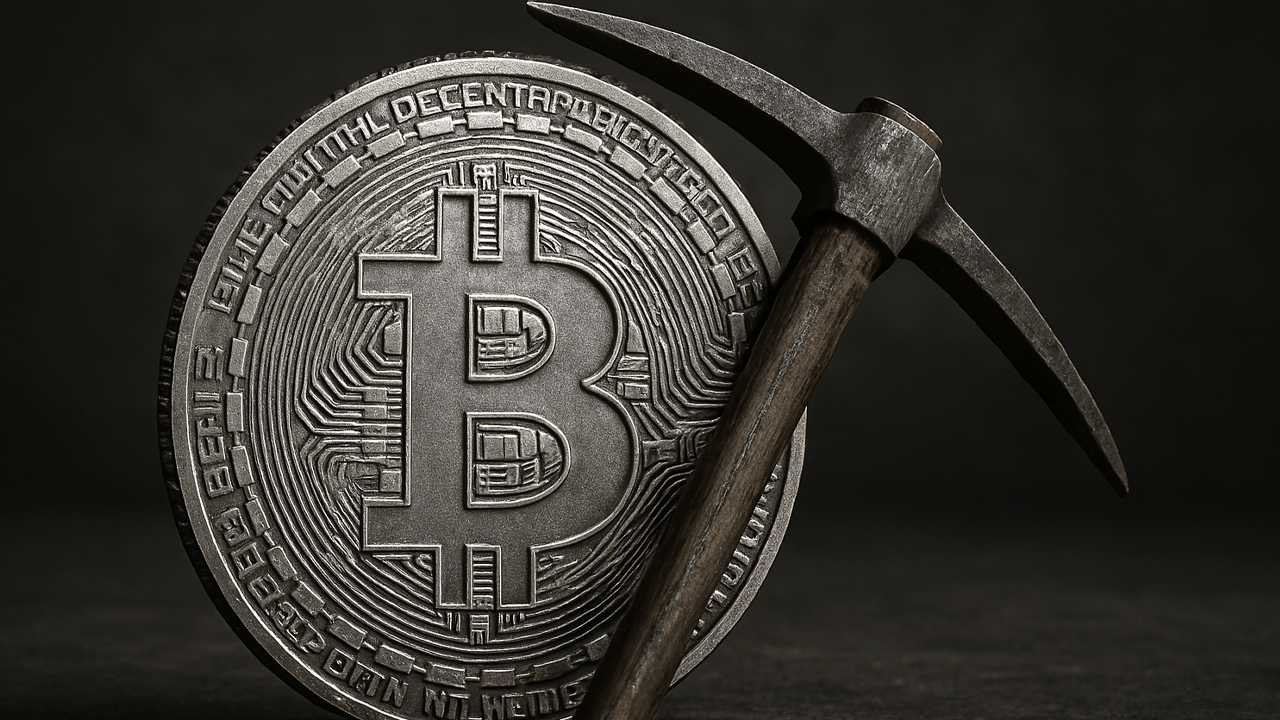

Bitcoin: The Asset That Becomes Money

Jack Dorsey recently warned:

“If Bitcoin only becomes a store of value—and never becomes a medium of exchange—then it has failed.”

He wasn’t wrong. Bitcoin was never meant to just sit in cold storage. It was meant to move—to be money for the people, not just wealth protection for the elite.

And that fear—that Bitcoin would be hoarded, locked up, too volatile to spend—has hung over it like a shadow.

But the truth is: It’s not a failure. It’s a phase. Time hasn’t disproved Jack’s vision—it’s been fulfilling it all along.

⸻

Act I: The Realization

When I first understood Bitcoin’s potential, I didn’t realize how fragile everything else was.

I knew it was a breakthrough—but I didn’t yet grasp that fiat money fails constantly. Banks freeze accounts. Governments print wealth away. Currencies collapse under pressure.

Bitcoin, on the other hand, just… keeps going.

When Michael Saylor went all in, I listened. When BlackRock and Larry Fink built a fund, a critical barrier to legitimacy vanished. When Ray Dalio laid out the historical cycles of empire and warned that fiat currencies inevitably fail, it added a chilling layer of urgency—and clarity.

And now, as global leaders and institutions begin advancing policy reform—legalizing, integrating, and innovating around Bitcoin’s presence in the financial system—what once felt radical starts to look inevitable. What was once a fringe experiment is becoming the foundation of a new monetary era.

That’s when I realized:

Bitcoin isn’t some experiment. It’s the beginning of a new monetary foundation.

⸻

Act II: The “Even Ifs”

What makes Bitcoin extraordinary is how it responds to pressure—not with fragility, but with strength. • Even if governments ban it, the network runs in 100+ countries. • Even if exchanges collapse, your keys still work. • Even if price crashes 80%, conviction rebounds. • Even if institutions try to manipulate it, the supply stays fixed. • Even if better tech emerges, none can replicate its trust. • Even if quantum computing advances, it can upgrade. • Even if energy use is criticized, it accelerates clean power. • Even if whales dump, decentralization spreads. • Even if the internet goes dark, satellites keep blocks flowing. • Even if CBDCs rise, Bitcoin becomes the alternative people choose.

These aren’t just hypotheticals—they’re stress tests that Bitcoin has passed. Every cycle. Every challenge. Every time.

⸻

Act II.5: The Paradox of Adoption

As Bitcoin grows, so does the paradox: • Nations create legal frameworks. • Corporations buy it as a treasury reserve. • Wall Street builds infrastructure.

We celebrate this adoption—but it also stirs anxiety:

“Will this be co-opted? Captured? Controlled?”

But here’s the brilliance of Bitcoin:

It welcomes all, but bends for none.

You can buy it. You can trade it. You can regulate around it. But you can’t change it. There’s no CEO. No boardroom. No backdoor.

Even if every nation held a million coins, they couldn’t rewrite the code.

Adoption doesn’t mean control. Participation doesn’t mean domination. Every new node run, every cold wallet held, makes it stronger—not weaker.

Bitcoin absorbs the world, but never becomes it.

⸻

Act III: The Transformation

The next phase is obvious: Bitcoin’s market cap will surpass gold. Not just because of hype—but because of function.

And when it does—at $14 trillion and beyond—volatility drops: • From wild 4–5% daily swings • To 0.5–1%, like gold or fiat • Because it takes too much capital to shake it

And that’s where Jack Dorsey’s fear gets laid to rest.

Because his concern wasn’t wrong—it was just early.

Bitcoin won’t stay in this high-volatility adolescence forever. Time forces it into maturity. Stability is coming.

And when it arrives, everything unlocks.

Layer 2 networks like Lightning are already built. Infrastructure is waiting. And now, sats become spendable, stable, and global.

Bitcoin becomes not just a vault for value… But a working, living currency.

⸻

Act IV: And Then I’d Spend It

At that moment— when the volatility fades, and the supply remains hard, and the infrastructure hums—

I’d start spending Bitcoin.

Because it won’t just be an asset anymore. It will be the most honest money ever created: • Fixed in supply • Trustless in function • Global in reach • Fast, portable, and incorruptible

No fiat currency can match it. Not the dollar. Not the euro. Not the yuan. They’ll still be printed. They’ll still be inflated.

Bitcoin won’t.

⸻

The Endgame

Jack Dorsey was right to be worried.

But time is solving his fear. Because Bitcoin is moving—slowly, relentlessly—toward being perfect money: • A store of value • A medium of exchange • A unit of account

It doesn’t beg for trust. It earns it. Block by block. Cycle after cycle. Hype and crash, bear and bull.

Until one day, the world stops calling it an asset…

And starts calling it what it’s always been: Our money.

[link] [comments]

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)