XRP could hit $15 if ETF inflows surge, says analyst using multiplier model

XRP market cap jumped $7.74B on just $12.87M inflows on 12 April 2025. Current XRP market cap is $125B, price trades around $2.13. Nine firms filed for spot XRP ETFs with the SEC in recent months. As interest in cryptocurrency exchange-traded funds (ETFs) intensifies, XRP is gaining attention for its price potential fuelled by institutional […] The post XRP could hit $15 if ETF inflows surge, says analyst using multiplier model appeared first on CoinJournal.

- XRP market cap jumped $7.74B on just $12.87M inflows on 12 April 2025.

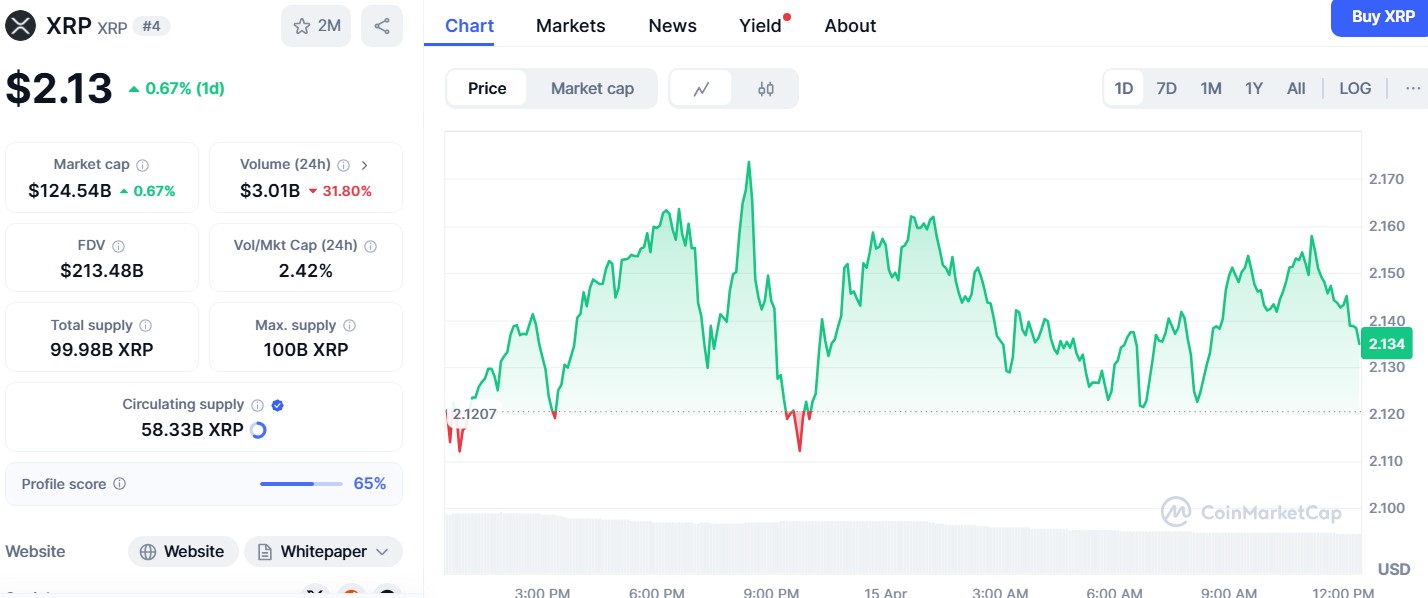

- Current XRP market cap is $125B, price trades around $2.13.

- Nine firms filed for spot XRP ETFs with the SEC in recent months.

As interest in cryptocurrency exchange-traded funds (ETFs) intensifies, XRP is gaining attention for its price potential fuelled by institutional inflows.

According to financial analyst Zach Rector, XRP could hit $15 in 2025 if ETF inflows reach $4 billion, leveraging a market cap multiplier model.

This estimate arrives at a time when multiple asset managers, including Grayscale, VanEck, and Ark Invest, are queuing up to launch spot XRP ETFs in the United States.

Ripple’s pending legal resolution is also feeding speculation that the SEC may approve one or more XRP ETFs by year-end.

A sharp multiplier effect

Rector’s analysis is rooted in a simple yet powerful concept: the market cap multiplier. This metric divides the change in an asset’s market capitalisation by the size of its net inflow, offering a way to gauge the impact of capital entering the market.

On 12 April 2025, XRP’s market cap jumped by $7.74 billion within eight hours, with just $12.87 million in inflows—equating to a 601x multiplier.

Using a more conservative 200x multiplier, Rector projected what would happen if JPMorgan’s lower-bound forecast of $4 billion in XRP ETF inflows were realised.

According to his model, that could drive an $800 billion increase in market cap. Based on an assumed supply of 60 billion XRP tokens, this would place XRP’s price at $15, up from its current price of around $2.13. That implies a 597% price rise.

Source: CoinMarketCap

ETF filings add to momentum

The prospect of an XRP ETF gained further traction this month as nine fund managers filed for spot products with the US Securities and Exchange Commission.

The list includes Franklin Templeton, WisdomTree, 21Shares, and Bitwise. At the same time, Ripple is expected to resolve its long-running court case with the SEC in 2025, removing a key regulatory obstacle.

Meanwhile, a leveraged XRP ETF from Teucrium Investment Advisors recently began trading on NYSE Arca. While not a spot ETF, its approval has raised hopes that similar funds could follow.

Internationally, Brazil approved a spot XRP ETF in March 2025, making it the first country to do so. Polymarket currently places the odds of US approval by the end of the year at 78%.

JPMorgan expects major inflows

JPMorgan earlier this year estimated that XRP ETFs could attract between $4 billion and $8 billion in net inflows during their first year. Rector’s forecast used the lower end of this range, avoiding more aggressive assumptions.

Even so, the underlying logic of a multiplier effect means modest capital inflows can have an outsized effect on market capitalisation.

At present, XRP has a market cap of about $125 billion. If the multiplier model holds and inflows total $4 billion, a move to $925 billion in valuation could be possible.

However, Rector also acknowledged his model does not factor in futures markets, decentralised trading on the XRP Ledger, or changes in token supply—all of which could shift price dynamics further.

While Ethereum’s ETF products have seen underwhelming inflows of only $2.28 billion since July 2024, XRP’s recent price action and ETF interest could set it apart.

But regulatory timelines and investor risk appetite will ultimately decide how the scenario plays out.

The post XRP could hit $15 if ETF inflows surge, says analyst using multiplier model appeared first on CoinJournal.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)