Stocks fall as Trump administration waffles on trade deals

Trump downplayed progress on Tuesday as investors await the Federal Reserve.

President Trump threw cold water on negotiating deals with trade partners, sparking a market sell-off on Tuesday by investors hoping for clarity on the White House’s tariff plans. At a meeting with Canadian Prime Minister Mark Carney, Trump argued that his administration doesn’t “have to sign deals,” an apparent backtrack from his own top officials, who have promised progress. “They want a piece of our market,” said Trump. “We don’t want a piece of their market.”

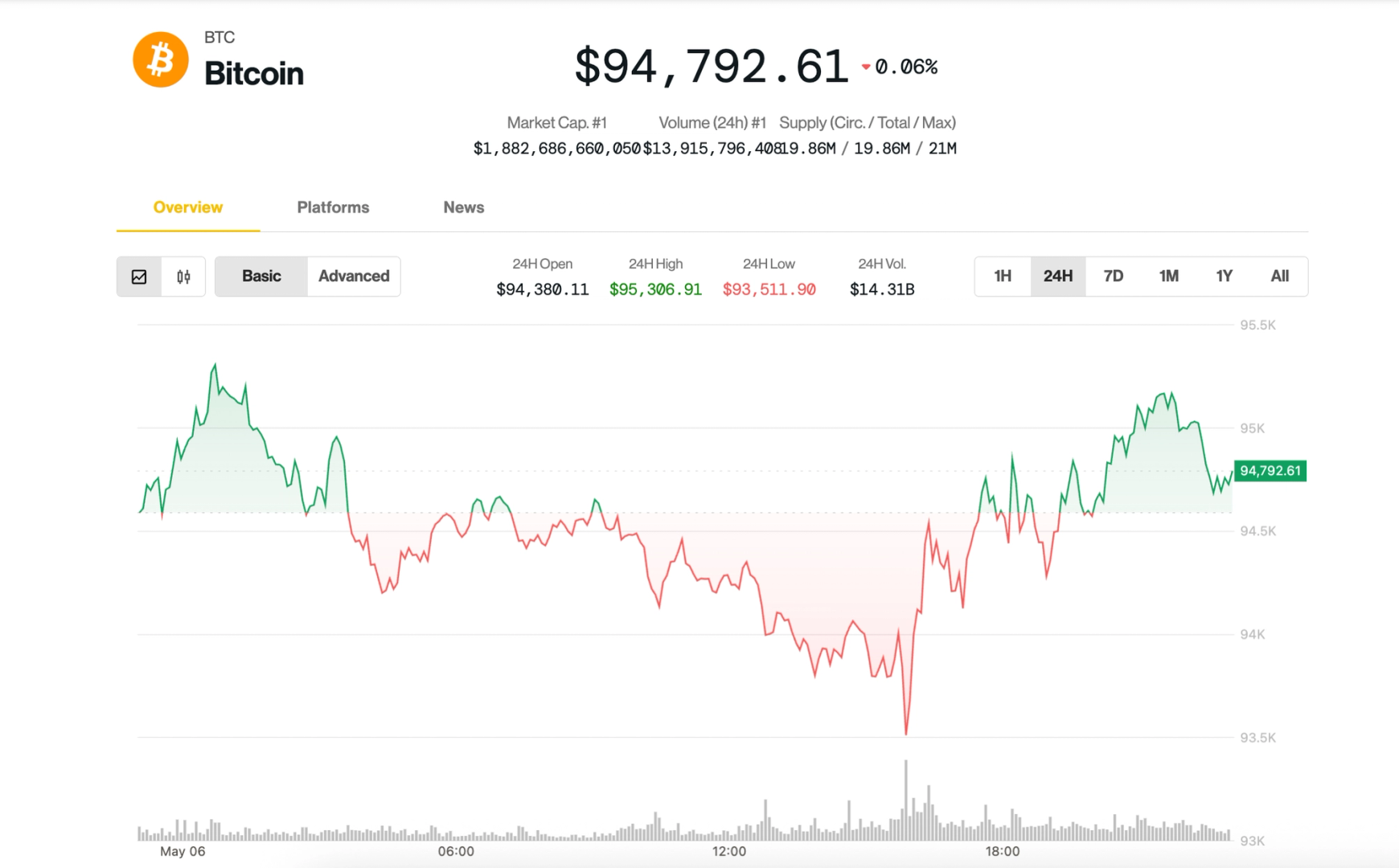

The comments led to a fall in stock prices on the heels of a drop on Monday that followed a nine-session winning streak, its longest since 2004. The S&P 500 slipped by 0.77%, with investors also anticipating a decision from the Federal Reserve later this week on whether the central bank will hold interest rates steady.

The whiplash between Trump and his advisors reflects increasingly unstable macro conditions, with companies waiting for clear guidance on the U.S. government’s trade stance.

Continued uncertainty

Ever since the Trump administration hosted its April “Liberation Day” reveal, where Trump announced stiff and wide-ranging tariffs against trade partners, markets have been unable to gain a steady foothold due to shifting declarations from the White House.

A rotation of key Trump officials, including Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, has hinted at imminent trade deals with top allies such as India and Japan, spurring stocks to climb in the past couple of weeks. Trump’s comments on Tuesday, however, spurred renewed negative sentiment.

Hosting Carney at the White House, Trump reiterated his policy of tariffs against Canada, as well as his insistence that Canada should become part of the U.S. “Having met with the owners of Canada over the course of the campaign last several months, it's not for sale,” Carney said. “Never say never,” Trump responded.

More consequential, however, were Trump’s broader comments at the meeting about signing new arrangements with other partners. While advisors like Bessent and Lutnick, as well as Trump himself, have signaled that the U.S. could soon reach deals, Trump said that he was tiring of the discussion. “I wish they’d ... stop asking, how many deals are you signing this week?” Trump said.

Tech stocks, including Meta and Amazon, fell modestly on Tuesday.

While the White House waffles on tariff negotiations, the Fed’s interest rate decision will be the next major signal for investors. Analysts expect the central bank to hold rates steady, though Trump continues to apply pressure on Chair Jerome Powell to lower rates, arguing on his social media platform Truth Social that there is “no inflation” and citing incorrect prices for gas and eggs. Deutsche Bank’s Jim Reid wrote that the bank’s economists expect the next rate to occur in December.

Consumers could soon start to feel the impact of the White House’s policy decisions. RSM chief economist Joseph Brusuelas wrote in a note on Monday that a tariff-induced recession could start on the docks of Los Angeles, caused by supply-chain-related rising prices and unemployment.

“The price of those policies will be first paid at the ports and then spread to the rest of the economy,” Brusuelas wrote.

This story was originally featured on Fortune.com