One97 Communications posts Rs 544.6 Cr loss in Q4; revenue, expenses decline

For the full fiscal year, the Paytm parent company’s net loss narrowed to 663.2 crore, compared to Rs 1,422.4 crore in FY24.

One97 Communications Ltd., the parent of Paytm, reported a net loss of Rs 544.6 crore in Q4 FY25, a 1.08% improvement from the Rs 550.5 crore loss in the same quarter a year earlier (Q4 FY24).

Revenue from operations clocked in at Rs 1,911.5 crore, down 15.68% from Rs 2,267.1 crore in Q4 FY24.

Meanwhile, total expenses for the quarter dipped, falling 19.93% to Rs 2,154.9 crore from Rs 2,691.4 crore in the corresponding previous quarter.

The company also incurred a non-cash exceptional expense of Rs 492 crore in the quarter due to the acceleration of ESOP costs, following the voluntary forgoing of 2.1 crore ESOPs by CEO Vijay Shekhar Sharma.

This is expected to reduce ESOP expenses to Rs 75–100 crore in Q1 FY26, compared to Rs 169 crore in Q4 FY25.

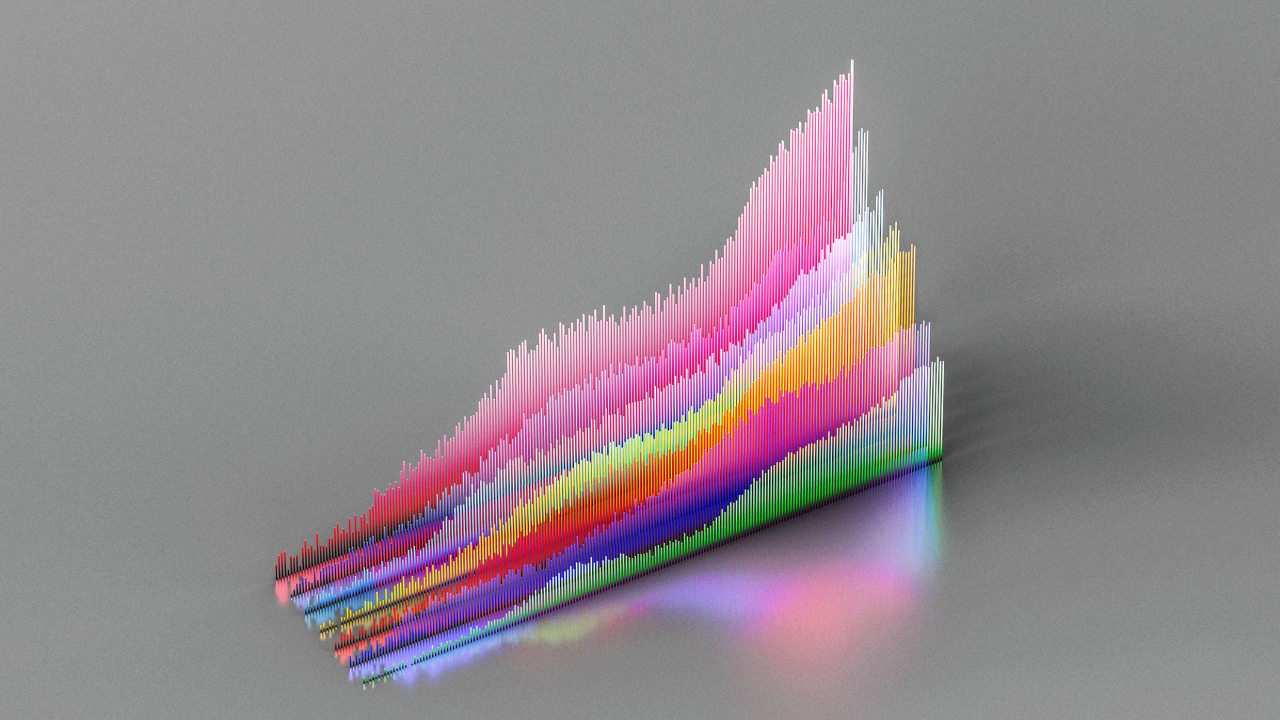

Gross merchandise value (GMV) touched Rs 5.1 lakh crore, up 1% QoQ despite the post-festive seasonal dip. The net payment margin, including UPI incentives, was Rs 578 crore. Excluding incentives, it rose 4% QoQ to Rs 508 crore.

Paytm’s merchant device subscriber base expanded to 1.24 crore, adding 8 lakh devices in the quarter. The company expects innovations like the Solar Soundbox to deepen merchant engagement, especially in Tier II and III towns.

Revenue from financial services grew 9% QoQ to Rs 545 crore, led by higher merchant loan distribution and increased trail revenue from Default Loss Guarantee (DLG) portfolios. While the number of financial services customers remained stable at 5.5 lakh, the average loan ticket size increased, and repeat borrowers now account for over 50% of disbursals.

Merchant loans grew from Rs 1,386 crore in FY22 to Rs 13,958 crore in FY25, with Q4 alone seeing disbursements worth Rs 4,315 crore. Personal loan disbursals, however, declined to Rs 1,422 crore amid tightened lender risk policies.

For the full fiscal year, the Paytm parent company’s net loss narrowed to 663.2 crore, compared to Rs 1,422.4 crore in FY24.

Annual revenue dipped 30.84% to Rs 6,900.4 crore from Rs 9,977.8 crore a year ago. Meanwhile, total expenses for the year dropped 21.88% to Rs 90,95.9 crore from Rs 116,44.6 crore.

Edited by Jyoti Narayan