Samaya AI, startup building AI for financial services, raises $43.5 million in VC funding

NEA led the round for the company, which is also backed by ex-Google CEO Eric Schmidt, Meta AI's Yann LeCun, Two Sigma's David Siegel, and former Goldman Sachs executive Marty Chavez

Samaya AI, a startup that creates AI models that assist financial analysts and which is backed by a number of leading figures both in Silicon Valley and on Wall Street, has raised $43.5 in new venture capital financing.

Venture capital firm New Enterprise Associates led the funding round. The valuation of Samaya following the new funding was not disclosed. Also participating in the new investment round were former Google CEO turned prominent Silicon Valley investor Eric Schmidt; AI “godfather” Yann LeCun, who is Meta’s chief AI scientist; David Siegel, who is a confounder of the hedge fund Two Sigma; and Marty Chavez, the former Goldman Sachs technology executive who is now vice chair of the investment firm Sixth Street Partners.

The company was founded in 2022 by AI researchers who were working at leading AI labs, including Google Brain, Meta’s Fundamental AI Research lab, Amazon Web Services, and the Allen Institute for Artificial Intelligence. Maithra Raghu, Samaya’s co-founder and CEO, said that she and her co-founders were seeing the development of generative AI within these labs and saw obvious applications in financial services.

But at the same time, she says, the founders believed that rather than developing broad, general-purpose large language models (LLMs) that were designed to perform any task, better quality results could be obtained from creating products that would be specialized for particular domains. “We deeply believed back then that expert intelligence emerges from specialization,” she said. “It is hard to hit the level of quality and reliability [financial firms require] without specialization.”

The company’s first product is a tool that can conduct financial research and analysis. It can both look across the web for high quality sources of financial data—such as SEC filings—or be attached to a firm’s own knowledge base and data sources and use those to find information. The system can be used to find comparable companies and compare their financial valuation and performance—a task financial analysts often undertake. It can also be used to help with due diligence on potential investments.

It is already being deployed at Morgan Stanley’s International Securities Group and at a number of hedge funds. Katy Huberty, global director of research at Morgan Stanley, said that Samaya is creating “actionable insights from both our extensive Research library as well as external sources, enhancing our ability to provide world class analysis to our clients.”

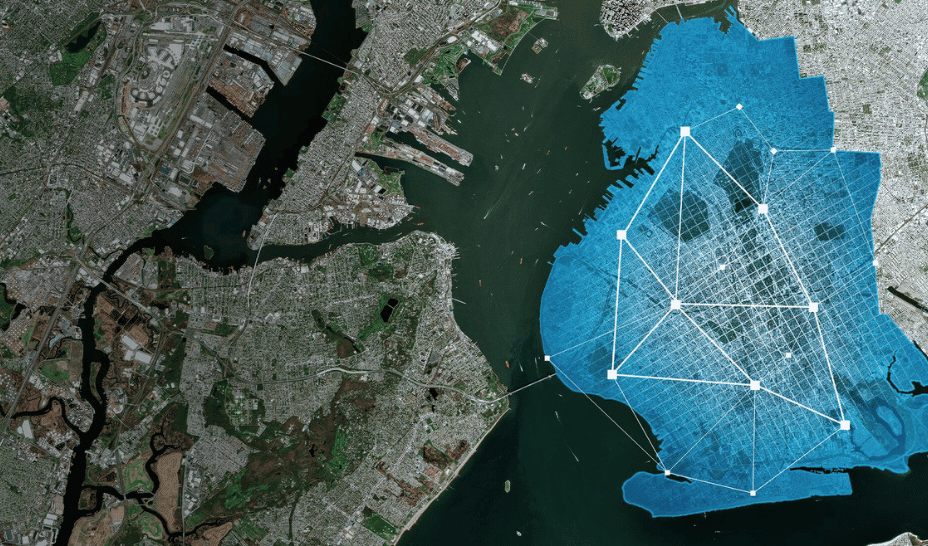

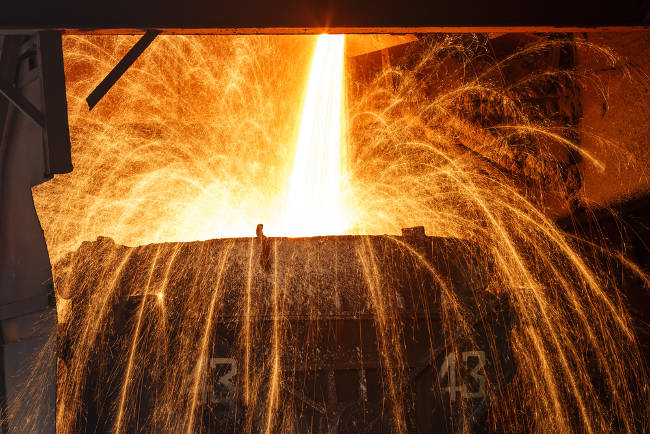

Today Samaya also announced the debut of a new AI agent it calls Causal World Models. The system excels at modeling economic systems. In a trial project, Samaya used the new AI software to model the effect of the Trump administration’s proposed tariffs on the entire U.S. economy. The system produced a complex flow diagram highlighting the interaction between various economic sectors and providing both quantitative and qualitative analysis.

Raghu said a preview version of Causal World Models had proved popular with Samaya’s customers, many of which have used it to model the effects of Trump’s tariffs on different companies and industry sectors. But she said that the system could be used to answer all kinds of different economic questions too.

While past LLMs have been good at finding correlations, they have often failed to understand cause and effect. But Raghu said that Causal World Models uses a multi-stage process to build a graph that maps cause and effect and then can reason about the question it is trying to answer using that graph.

Samaya’s previous analysis tool can produce outputs that are in some ways similar to what one might get from one of the so-called “deep research” tools that have been debuted by OpenAI, Google DeepMind, Anthropic, or Perplexity—with the difference being that Samaya AI’s products seem to have greater fluency with financial information and ability to perform financial analysis accurately. Samaya also has tools that can produce results in specific formats, beyond just research reports, that are common in financial services—such as PowerPoint decks and Excel spreadsheets.

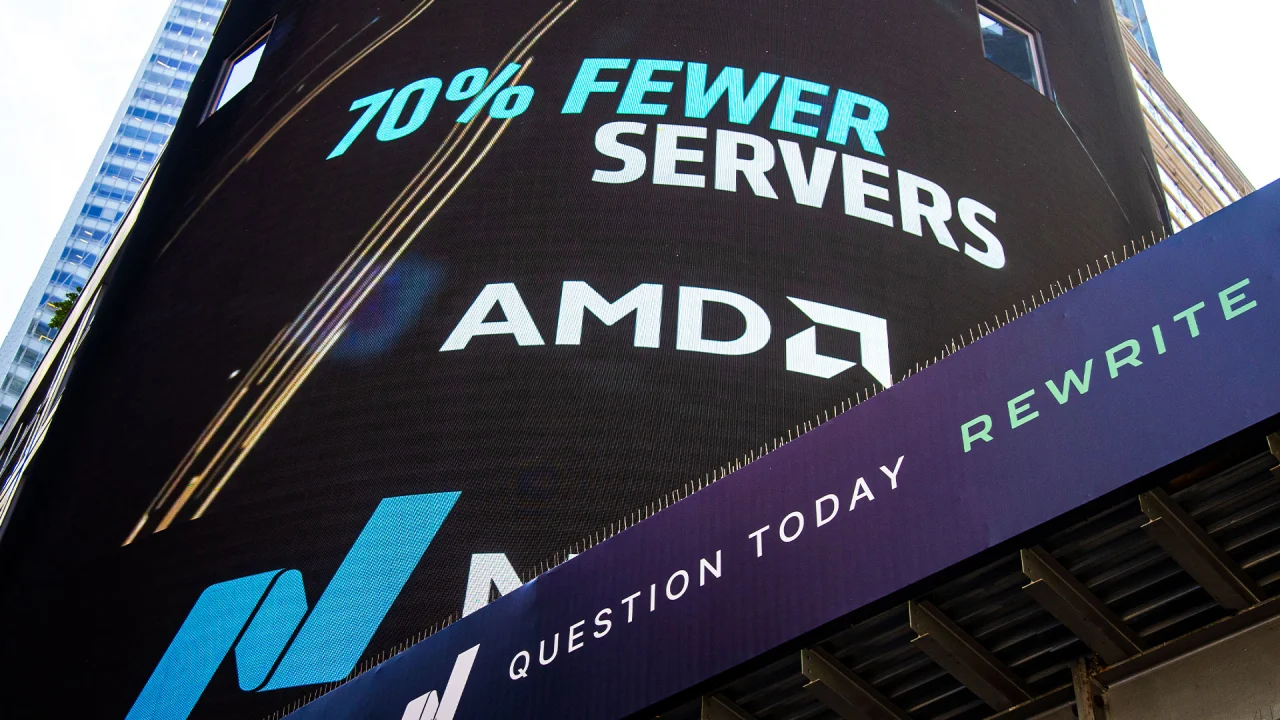

Under the hood, Raghu said that its first research tool is engineered differently than the giant LLMs that power OpenAI’s ChatGPT or Anthropic’s Claude. Samaya uses what Raghu calls a “a lattice of experts architecture” that includes many smaller language models, each taking on a portion of a research tasks, and with some of the models used to check the output of others. She said that this approach greatly reduces the chances of hallucination—where an AI model invents information.

Investing in specific industry verticals

Tiffany Luck, partner at NEA, said Samaya fits her investment firm’s thesis that specific AI tools will need to be designed for specific industry verticals. She also said that accuracy was extremely important in financial services. “90% accuracy is not good enough,” she said. NEA liked that Samaya could provide that kind of accuracy and could serve different kinds of financial services users, with both junior analysts and senior leaders within financial services firms getting benefit out of Samaya’s tools.

“This is redefining how AI can partner with financial services,” Schmidt said in a statement.

Samaya is not the only company targeting the financial services sector. Morgan Stanley has also been using OpenAI’s models. JPMorgan has a large team of AI researchers developing tools for use within the bank. Financial data and news giant Bloomberg has been building AI models designed specifically for financial data and financial service firms. And a number of other startups are also competing with Samaya in building AI tools for financial research, including Model ML, V7 Labs, and Rogo.

This story was originally featured on Fortune.com

![SWOT Analysis: What It Is & How to Do It [Examples + Template]](https://static.semrush.com/blog/uploads/media/86/6a/866a1270ca091a730ed538d5930e78c2/do-swot-analysis-sm.png)