JPMorgan Chase steps beyond ‘walled garden’ to settle transaction on public blockchain

This is the first time the U.S.'s largest bank has built out a system to interface with a public blockchain.

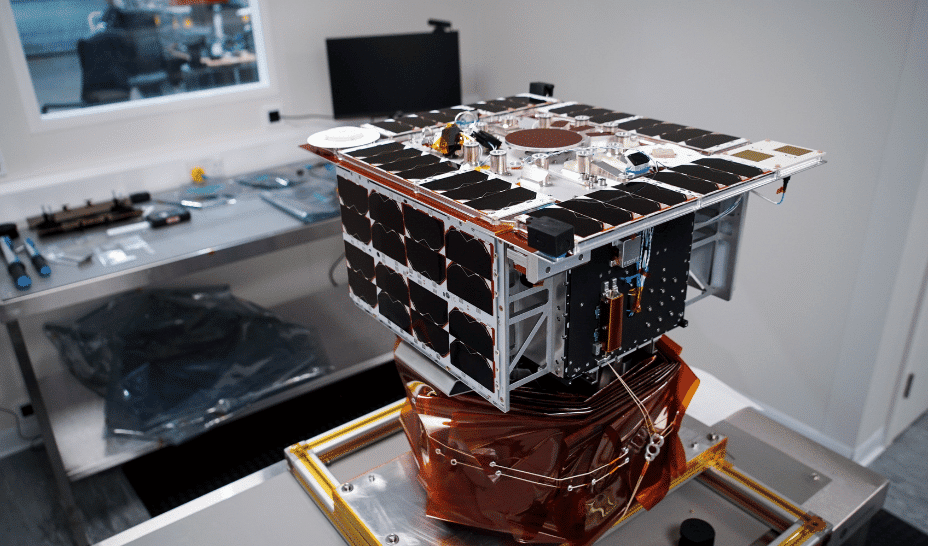

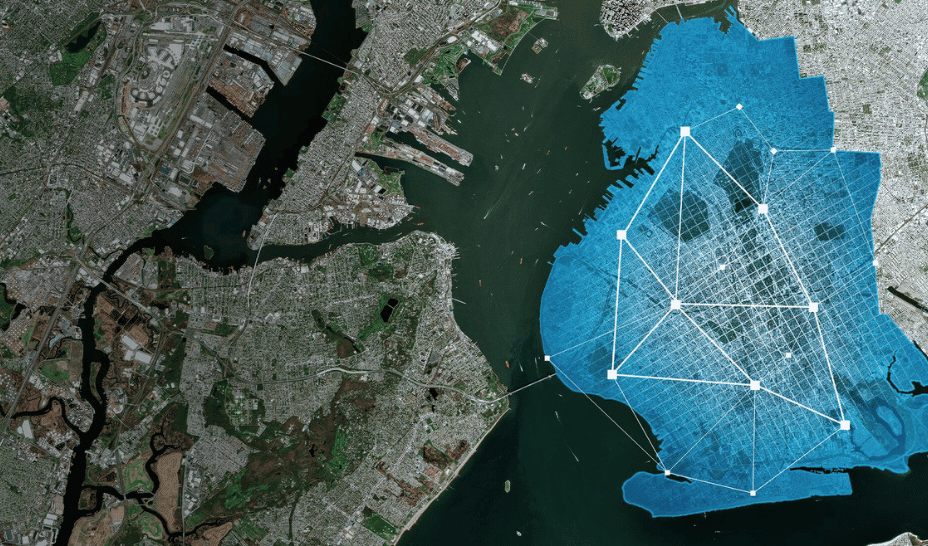

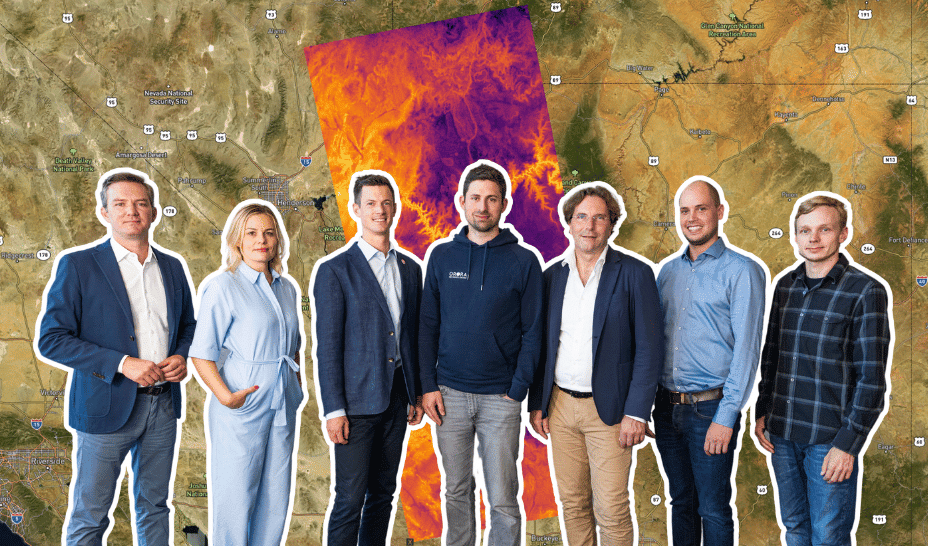

JPMorgan Chase has been steadily developing its own blockchain tech for years. But, instead of integrating it with public blockchains, the U.S.’s largest bank has taken what many in crypto call the “walled garden” approach and built out a private network only its customers can use. Now, JPMorgan is venturing beyond that garden. On Wednesday, it announced that it had settled a transaction on a public ledger with the help of the crypto firms Chainlink and Ondo Finance.

In early May, JPMorgan's blockchain division, Kinexys, transferred money between two accounts on its private blockchain to settle the purchase of tokenized treasuries on Ondo’s public ledger. (Tokenized treasuries are money market funds that live on the blockchain.) To trigger the payment, JPMorgan used Chainlink, a communication protocol that lets blockchains process outside information.

The Ondo transaction isn’t the first time JPMorgan has experimented outside its walled garden. The bank has announced several proofs of concept over the years, including a 2024 experiment with Siemens Digital. “A lot of big things happen as incremental steps,” Nelli Zaltsman, head of platform settlement solutions at Kinexys, told Fortune.

Still, this is the first time JPMorgan has built out a structure to interface with a public blockchain, said Zaltsman. “This is not just another POC [proof of concept],” added Sergey Nazarov, cofounder of Chainlink. “This is the beginning of something big.”

Nazarov added that the structure is on track for “production,” a term for when software is ready for more widespread use.

JPMorgan’s testing of the crypto waters comes amid a regulatory about-face in the U.S. Under former President Joe Biden, the Securities and Exchange Commission led a crackdown on the biggest companies in crypto, including Coinbase, Binance, and Robinhood. But, over the past four months, President Donald Trump, who branded himself a “pro-crypto” candidate in his campaign for reelection, has implemented a slew of policies favorable to the industry, including a directive to create a strategic reserve of Bitcoin and digital assets.

Meanwhile, traditional finance giants have renewed their inroads into crypto. Fidelity has said it's testing its own stablecoin, Morgan Stanley is reportedly working on a plan to offer crypto trading to its E*Trade customers, and BlackRock continues to expand its tokenized treasury product.

But JPMorgan's recent venture outside the walled garden isn't due to shifts in the political winds or investors' recent enthusiasm for crypto, said Zaltsman, the executive at Kinexys. Rather, this has been part of JPMorgan's roadmap for years, she said. In fact, she and Sergey, the cofounder of Chainlink, first met at a conference two years ago and have been in conversations with them since.

This story was originally featured on Fortune.com

![SWOT Analysis: What It Is & How to Do It [Examples + Template]](https://static.semrush.com/blog/uploads/media/86/6a/866a1270ca091a730ed538d5930e78c2/do-swot-analysis-sm.png)