Pandora CEO says producing jewelry in America ‘simply won’t work’: ‘I can’t find that amount of talent that actually has this craft experience in the U.S.’

The U.S. jewelry company employs nearly 15,000 Thai workers to produce its charm bracelets and rings.

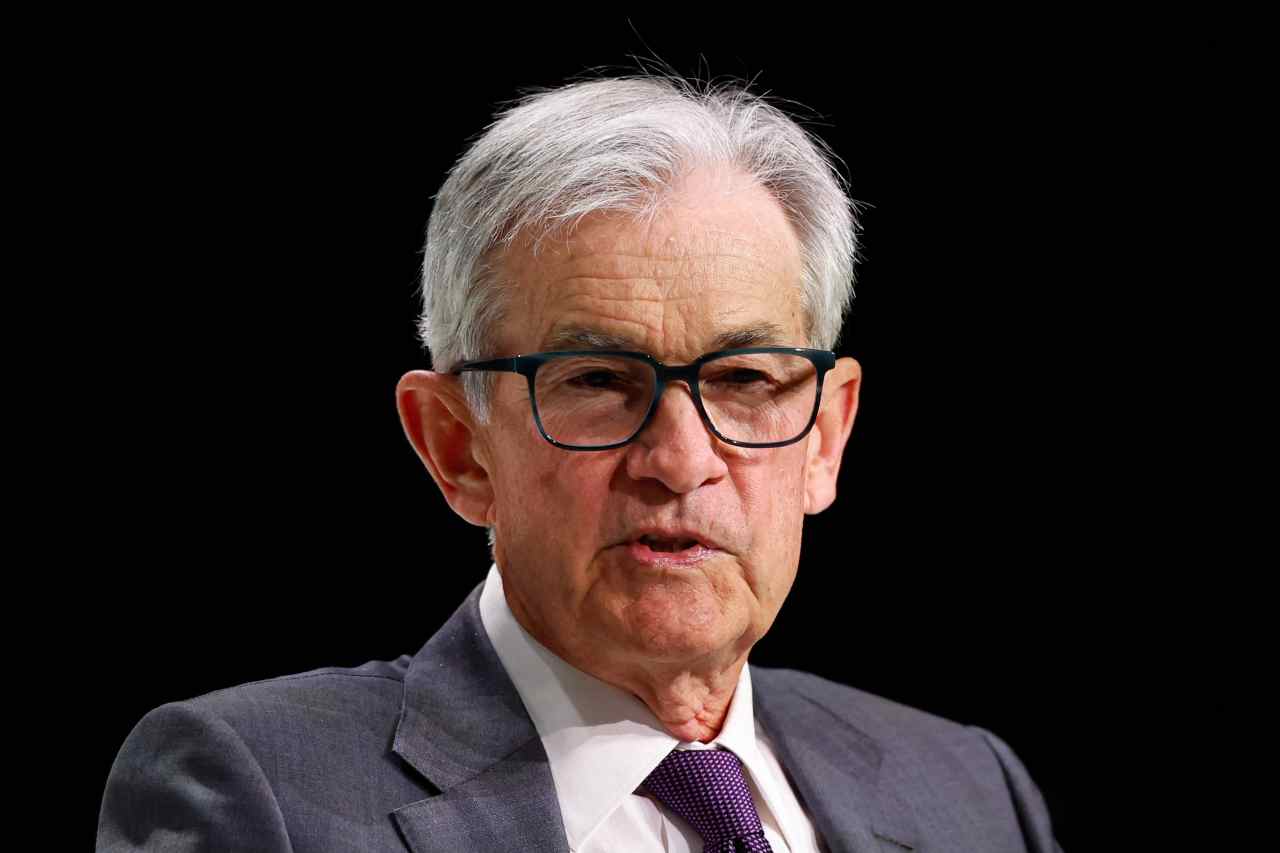

- Despite reciprocal tariffs on Thailand, where Copenhagen-based Pandora produces most of its jewelry, CEO Alexander Lacik said the company will not set up shop in the U.S. Pandora employs nearly 15,000 workers in Thailand and is unable to build a workforce of enough specialized employees in the U.S., Lacik told media outlets on Wednesday.

Tariffs are an “unwelcome aspect” of business for Danish jewelry-maker Pandora, but CEO Alexander Lacik concedes the new challenges won’t mean the company will move production to the U.S.

Moving to the U.S. “simply won’t work” because Pandora relies so heavily on a specialized and less expensive foreign workforce, Lacik told Bloomberg TV on Wednesday. About 95% of Pandora’s jewelry is produced in Thailand, where the company employs nearly 15,000 workers. With a value proposition of remaining affordable, Pandora has to take into consideration the impact of an increase in labor expenses and finding new skilled employees associated with moving its supply chain. Pandora says it employs about 8,000 workers in the U.S.

“I employ up to 15,000 craftspeople in Thailand,” Lasik said in a Wednesday CNBC interview. “I can’t find that amount of talent that actually has this craft experience in the U.S. So it’s actually not so much a matter of cost to begin with, it’s about having skilled people who can actually craft the jewelry.”

With so much of its production happening in Thailand, as well as Vietnam, India, and China, Pandora has been hit by President Donald Trump’s reciprocal “Liberation Day” tariffs announced on April 2. Those levies range from 36% on Thailand to 46% on Vietnam. The jewelry company—the largest maker in the world by volume—last month said the impact of the taxes would be worth 1.2 billion kroner ($182 million) annually, costing 700 million kroner ($68 million) in 2025.

Trump later announced a 90-day tariff pause and lowered tariffs to 10% on all countries except China.

Pandora has already raised prices twice in the past 12 months as a result of the rising value of silver, which has more than doubled over the past half decade. The company increased its price tags by 5% in October 2024 and 4% this April, according to its earnings report.

While it did not factor additional tariffs (beyond the 10%) into its guidance, citing uncertainty, Pandora trimmed its fiscal 2025 profitability guidance, citing the sinking U.S. dollar. The company now expects a 24% margin on earnings before interest and tax, down from its previous aim of 24.5%. Its organic growth guidance of 7-8% remains the same.

Uncertainty driving business decisions

Despite its exposure, Pandora will be able to manage tariffs at the 10% level, Lasik said, and has already taken steps to mitigate the impact of the taxes. The company sources much of its point-of-sales material—such as store furniture and boxes—from China and it is finding new countries from which to source those supplies, Pandora told Fortune. While the company provides its stores in Canada and Latin America with jewelry shipped to its Baltimore distribution center, it is now working to rejig its deliveries directly to those countries without having to pass through the U.S.

The danger to the business, and to consumers, would be if the reciprocal tariffs rise to or above what Trump initially introduced last month. Beyond steeper costs, new tariffs would also create further uncertainty, making it difficult for Pandora to make meaningful supply-chain adjustments to help it both dodge tariffs and save on labor costs.

“The more worrying thing in all this, is that it’s not predictable,” Lacik told CNBC. “I think this plagues most people like myself that sit on the business side of things.”

Pandora isn’t the only jewelry company contending with tariffs. Most other competitors source labor from parts of Asia, meaning everyone in the industry is experiencing the same challenges. While the taxes essentially level the playing field, it’s bad news for consumers, who will feel the impact of tariffs on the rising cost of jewelry.

“You could have an argument, if these tariffs remain, then it's going to be more expensive for everybody that plays somehow,” Lacik said. “And therefore we should expect that the consumer pricing will see some change to it.”

This story was originally featured on Fortune.com