More than 60% of CEOs predict a recession or slowdown in the coming months: ‘This uncertainty needs to stop’

The share of chief executives who predict a recession is growing.

- CEOs are worried about tariffs and economic uncertainty—so much so that 62% of them predict a recession or slowdown is coming. Some top executives have said publicly they see a recession, including Bridgewater Associates’ Ray Dalio and JPMorgan’s Jamie Dimon. Some banks have also recently adjusted their recession odds.

The name of the economic game recently has been uncertainty. Thanks to President Donald Trump’s on-again, off-again tariff policies against some of the U.S.’s biggest trading partners, the stock market has been on a tumultuous roller-coaster ride, and consumer sentiment has worsened.

And top business leaders are taking notice. As a result of major economic uncertainty, a whopping 62% of CEOs forecast a recession or slowdown in the next six months, according to survey results released by Chief Executive on Monday.

“This uncertainty needs to stop,” Donald H Lloyd II, president and CEO of St. Claire HealthCare in Kentucky, said in a statement. “I support tariffs but believe they need to be applied strategically, not globally.”

The share of CEOs who predict a recession has grown in recent months. In March, Chief Executive reported 48% of CEOs saw a recession in the future, jumping 14 percentage points just one month later.

While two consecutive quarters of GDP contraction is an unofficial rule of thumb for recessions, the National Bureau of Economic Research is the official arbiter and defines them as a “significant decline in economic activity that is spread across the economy and lasts more than a few months.”

In April, 14% of CEOs reported they predict a “severe recession,” according to Chief Executive, and 39% said they’d be decreasing headcount this year.

“I hope I’m wrong, but I expect the ‘pain’ to be here for a while,” Maura Dunn, president and CEO of TrailBlazer Consulting, said in a statement. “I do not trust the administration to self-correct.”

The survey comes as Wall Street has been increasingly sounding the alarm about a recession—and more.

Ray Dalio, founder of Bridgewater Associates, warned the U.S. could see something “worse than a recession.”

“Right now, we are at a decision-making point and very close to a recession. I’m worried about something worse than a recession if this isn’t handled well,” Dalio told NBC. “We have something that’s much more profound, we have a breaking down of the monetary order.”

Other CEOs have also highlighted that a recession isn’t the only—or the biggest—concern. On an April 11 call with analysts, JPMorgan CEO Jamie Dimon said he “almost doesn’t really care” about how the U.S. economy performs during the next two quarters and the country has weathered recessions before. It’s more important the “Western world stays together economically” and “we get through all this militarily to keep the world safe and free for democracy.”

Still, JPMorgan raised its recession risk to 60% during the market selloff earlier this month in an analyst note titled “There will be Blood.”

“If sustained, this year’s [approximate] 22%-point tariff increase would be the largest U.S. tax hike since 1968,” analysts wrote. “A strong case can be made that the latest tariffs are more damaging given that the share of imports and broader globalization are considerably larger now than in the 1930s.”

Plus, Dimon—although he put geopolitical risks above U.S. economic ones—still admitted a recession is likely.

“No one’s wishing for that, but hopefully, if there is one, it’ll be short,” he told Fox News last week. “Fixing these tariff issues and trade issues would be a good thing to do.”

BlackRock CEO Larry Fink also said last week in an interview at the Economic Club of New York most of the CEOs he talks to think the U.S. is already in a recession.

Other banks like Goldman Sachs have actually lowered their recession risk forecasts following Trump’s announcment of a 90-day pause on some tariffs. But economists aren’t convinced the pause will prevent a recession.

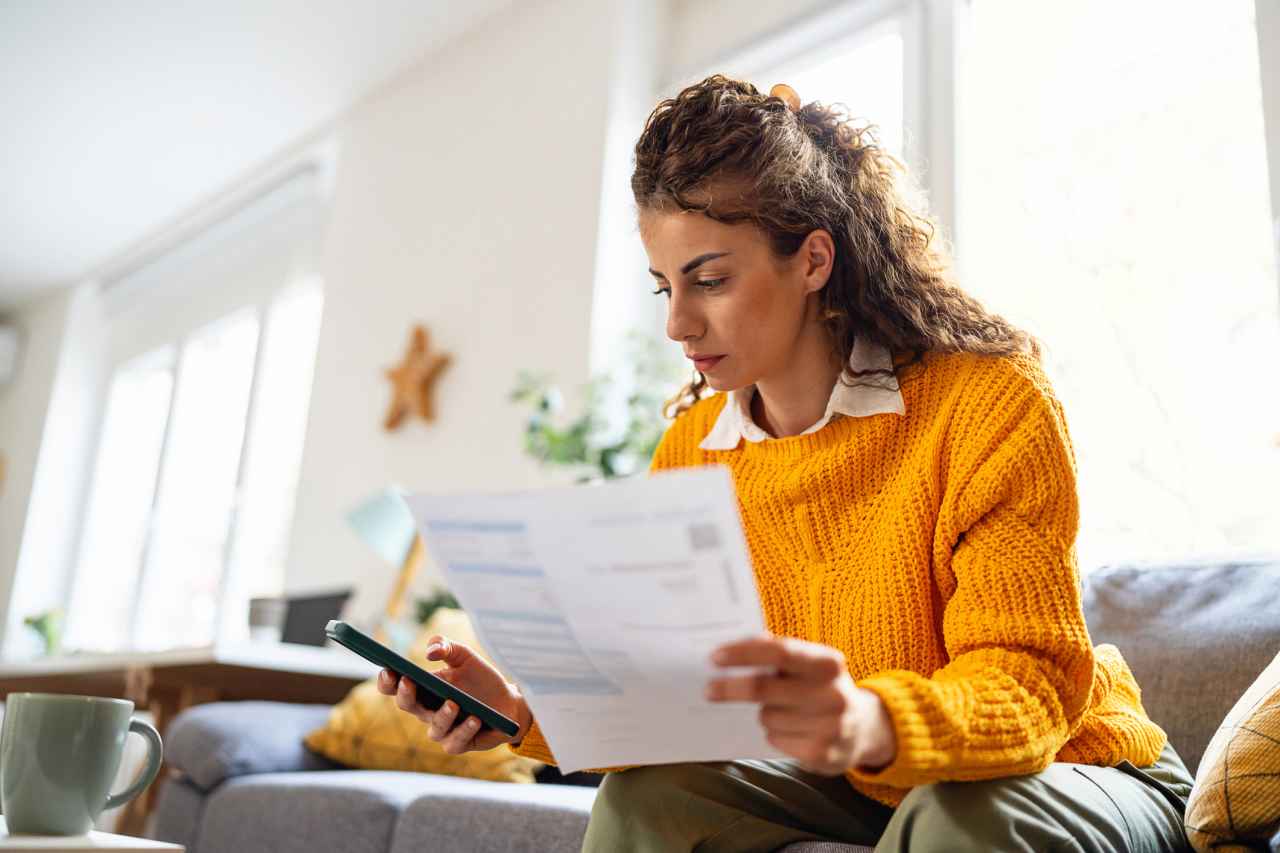

“I take no solace in the president’s announcement to delay the reciprocal tariffs for 90 days,” Moody’s chief economist Mark Zandi told Fortune’s Alena Botros. “Even if the administration can cut a few deals during this period, it will leave us with significantly higher tariffs, which are tax increases on American consumers and businesses.”

This story was originally featured on Fortune.com

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)