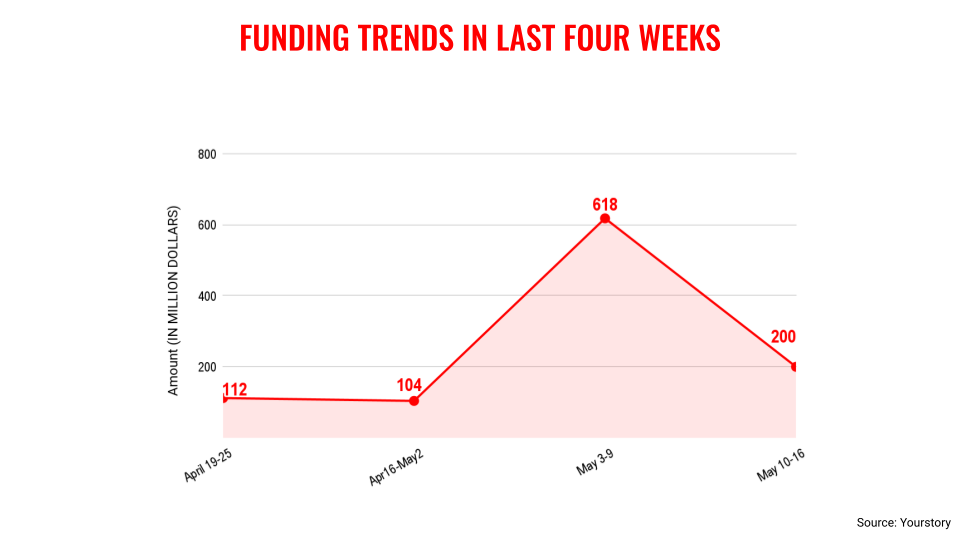

[Weekly funding roundup May 10-16] Large deals remain a no-show

Venture capital funding into Indian startups saw a sharp decline in the third week primarily due to the absence of large deals.

![[Weekly funding roundup May 10-16] Large deals remain a no-show](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)

Venture capital funding into Indian startups saw a steep decline in the third week of May after touching a new high in the previous week. This fall in capital inflow can be largely attributed to the absence of large deals.

The total funding for the week was $200 million across 24 deals. In contrast, the previous week saw a total of $618 million being raised.

This decline in venture capital funding is also a reflection of the current investment environment, where investors continue to remain cautious. The funding inflow of $618 million in the previous week seems to be a positive aberration. However, during the week in review, there was not a single deal with a value of $50 million.

The present situation continues to remain challenging for the Indian startup ecosystem as since the middle of March this year, weekly venture funding has been on average hovering in the range of $100-200 million.

On the other hand, the Indian startup ecosystem continues to witness interesting developments as Zepto introduced a new analytics platform for its vendors. The companies from the ecosystem like Makemytrip and Delhivery delivered positive numbers.

Key transactions

Makhana brand Farmley raised $40 million from L Catterton, DSG Consumer Partners, and BC Jindal.

B2B e-commerce platform JSW One Platforms raised Rs 340 crore ($39.7 million approx.) from Principal Asset Management, OneUp, JSW Steel, and other investors.

Hygiene product manufacturer Nobel Hygiene raised Rs 170 crore ($20 million) led by Neo Asset Management.

SaaS startup Celebal Technologies raised $15 million from InCred Growth Partners Fund I and Norwest Capital.

AI infrastructure startup Flam raised $14 million from RTP Global, Dovetail and other strategic investors.

Retail chain India Family Mart raised $12 million from Gulf Islamic Investments, Foundation Private Equity, Carpediem Capital Partners, and Capri Global Holdings.

M1xchange, a fintech startup, raised $10 million from Filter Capital.

Ice cream brand Hocco raised $10 million from Chona Family Office and Sauce VC.

Agentic AI platform Hyperbots raised $6.5 million from Arkam Ventures, Athera Venture Partners, JSW Ventures, Kalaari Ventures, Sunicon Ventures, and Darashaw & Co.

Omnichannel quick service restaurant Biryani Blues raised $5 million from Carpediem Capital’s new fund Yugadi Capital, along with participation from other investors.

Edited by Kanishk Singh

![Epic Games: Fortnite is offline for Apple devices worldwide after app store rejection [updated]](https://helios-i.mashable.com/imagery/articles/00T6DmFkLaAeJiMZlCJ7eUs/hero-image.fill.size_1200x675.v1747407583.jpg)

.jpg)