BRICS may adopt Ripple’s XRP to bypass dollar in gold-backed trade push

Russia’s SWIFT exclusion in 2022 spurred alternative system planning. BRICS members seek autonomy in international settlements. XRP’s speed and cost-efficiency seen as ideal for institutional use. A new theory circulating among cryptocurrency and geopolitical analysts suggests that BRICS nations—Brazil, Russia, India, China, and South Africa—may be working behind the scenes to develop a gold-backed financial […] The post BRICS may adopt Ripple’s XRP to bypass dollar in gold-backed trade push appeared first on CoinJournal.

- Russia’s SWIFT exclusion in 2022 spurred alternative system planning.

- BRICS members seek autonomy in international settlements.

- XRP’s speed and cost-efficiency seen as ideal for institutional use.

A new theory circulating among cryptocurrency and geopolitical analysts suggests that BRICS nations—Brazil, Russia, India, China, and South Africa—may be working behind the scenes to develop a gold-backed financial system using Ripple’s XRP Ledger.

This comes as the bloc continues efforts to reduce dependency on the US-led SWIFT network and the dollar-dominated global economy.

While unconfirmed by any government, the theory is gaining attention due to mounting evidence of BRICS cooperation on currency independence and blockchain innovation.

How the US maintains dominance in global finance

The global financial system is largely underpinned by three core levers of Western influence: the dominance of the US dollar, the SWIFT interbank messaging system, and the liquidity framework governed by Western central banks.

SWIFT enables international banking communication and has become a tool for enforcing sanctions. In 2022, Russia was ejected from SWIFT as part of coordinated Western sanctions, prompting the Kremlin to accelerate efforts to create alternative channels for cross-border payments.

By cutting off access to dollar reserves and freezing foreign-held assets, the US has demonstrated the strategic power of financial infrastructure.

Countries seen as politically adversarial or non-aligned are increasingly wary of this system, viewing it as a vulnerability rather than a neutral platform for trade.

Why BRICS wants out of the dollar system

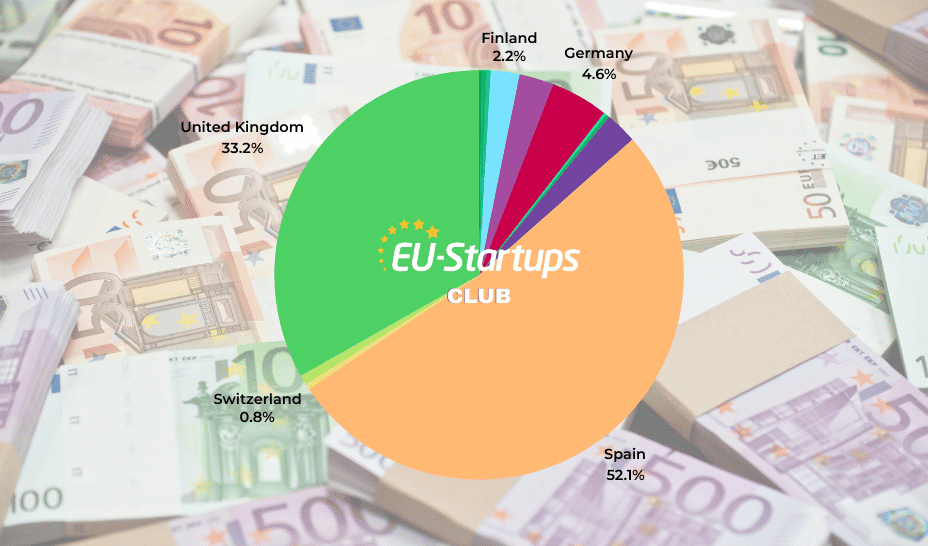

Each member of BRICS has its own incentive to reduce exposure to the dollar. Russia’s exclusion from SWIFT and asset seizures have forced it to pursue financial independence. China is seeking to insulate its growing economy from Western financial pressure.

India and Brazil are looking to increase autonomy in international settlements, while South Africa has expressed interest in strengthening regional currencies.

This shared objective has sparked renewed calls within the bloc for a new system of value exchange—one that does not rely on Western mechanisms.

BRICS nations have already discussed launching a shared currency backed by commodities, and gold is viewed as the most viable asset for such backing due to its stability and global acceptance.

XRP Ledger as a bridge for gold-backed trade

According to the theory, Ripple’s XRP Ledger could serve as the digital bridge between local currencies and a gold-backed reserve system. XRP was designed for high-volume institutional transfers, with a transaction time of 3-5 seconds and low fees.

Unlike Bitcoin or Ethereum, XRP offers scalability and predictable costs—key for governments and central banks processing large transactions.

In this model, BRICS would not issue a new public token but instead use XRP’s existing infrastructure to settle trades. Gold could be held in national vaults or regional repositories, and XRP would be the mechanism through which value is transferred quickly and securely.

This would allow BRICS countries to bypass SWIFT and the dollar, while maintaining compliance and auditability through the XRP Ledger.

Strategic signals and unconfirmed moves

Although no official confirmation exists that BRICS is actively testing or adopting XRP, several developments have drawn speculation. Russia has already proposed a gold-pegged stablecoin for cross-border trade with friendly nations.

China continues to expand its digital yuan pilot. Ripple has also been expanding its presence in Asia, the Middle East, and Latin America—regions aligned with BRICS interests.

The theory remains speculative, but it is rooted in a broader trend of de-dollarisation and growing interest in blockchain-based infrastructure for sovereign financial systems.

Analysts argue that if BRICS succeeds in deploying a decentralised, asset-backed settlement model, it could reshape the future of international finance and challenge the existing power structures dominated by the West.

The post BRICS may adopt Ripple’s XRP to bypass dollar in gold-backed trade push appeared first on CoinJournal.

![[Weekly funding roundup May 10-16] Large deals remain a no-show](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)

![Epic Games: Fortnite is offline for Apple devices worldwide after app store rejection [updated]](https://helios-i.mashable.com/imagery/articles/00T6DmFkLaAeJiMZlCJ7eUs/hero-image.fill.size_1200x675.v1747407583.jpg)

.jpg)