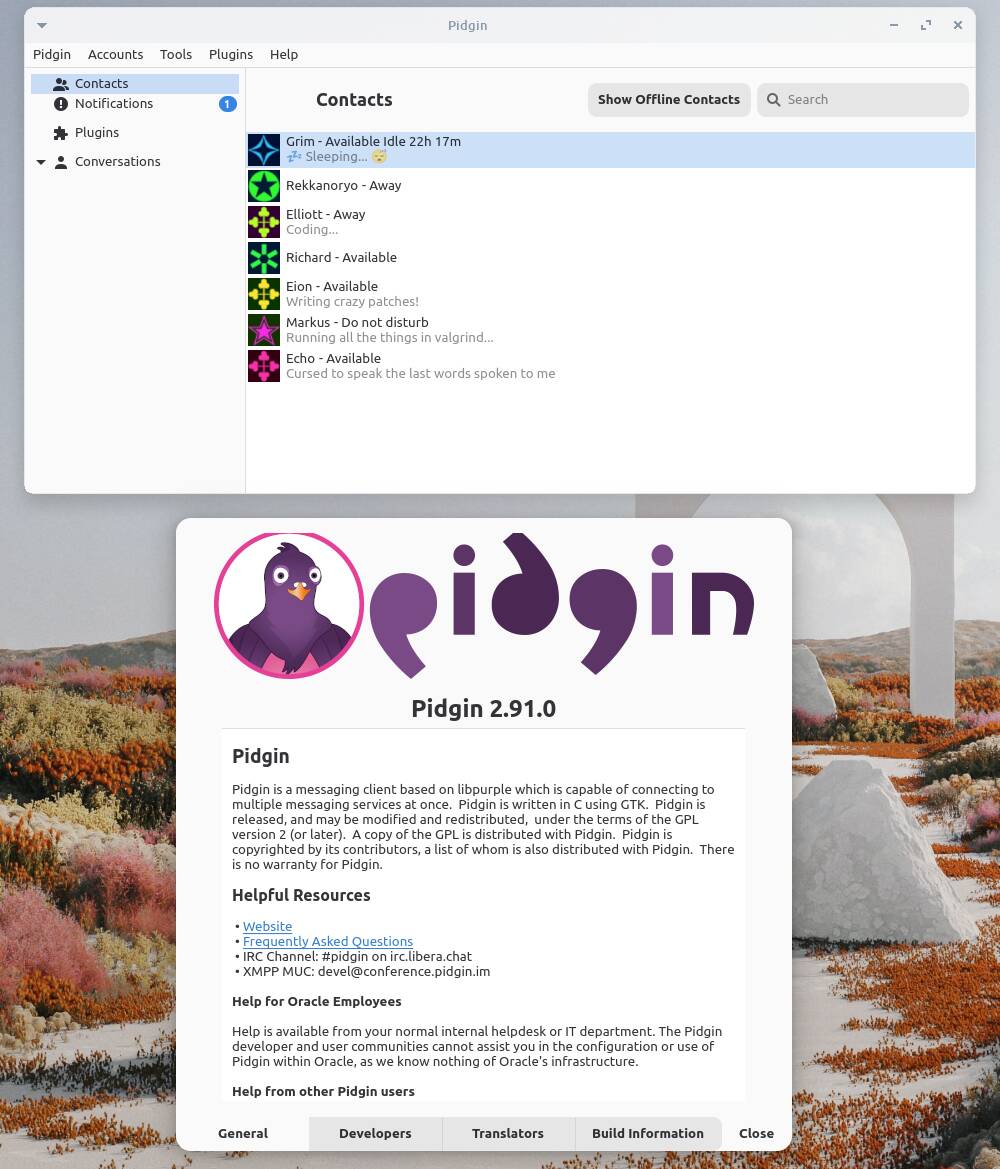

Warren Buffett's $173 Billion Warning to Wall Street Has Played Out Perfectly -- and the Time to Be Greedy Is Rapidly Approaching

The recent tumult on Wall Street is beginning to create price dislocations, which is what a value-focused investor like Buffett thrives on.

For the last 60 years, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has made it a habit to run circles around Wall Street using old-school research tactics and relying on time to be his greatest ally. Since taking the reins in the mid-1960s, he's overseen a jaw-dropping cumulative return of 5,962,825% in his company's Class A shares (BRK.A), as of the closing bell on April 8.

The Oracle of Omaha's outsized returns have earned him quite the following. Both professional and everyday investors eagerly await Berkshire's quarterly Form 13F filings to see which stocks Buffett and his top advisors, Todd Combs and Ted Weschler, have been buying and selling.

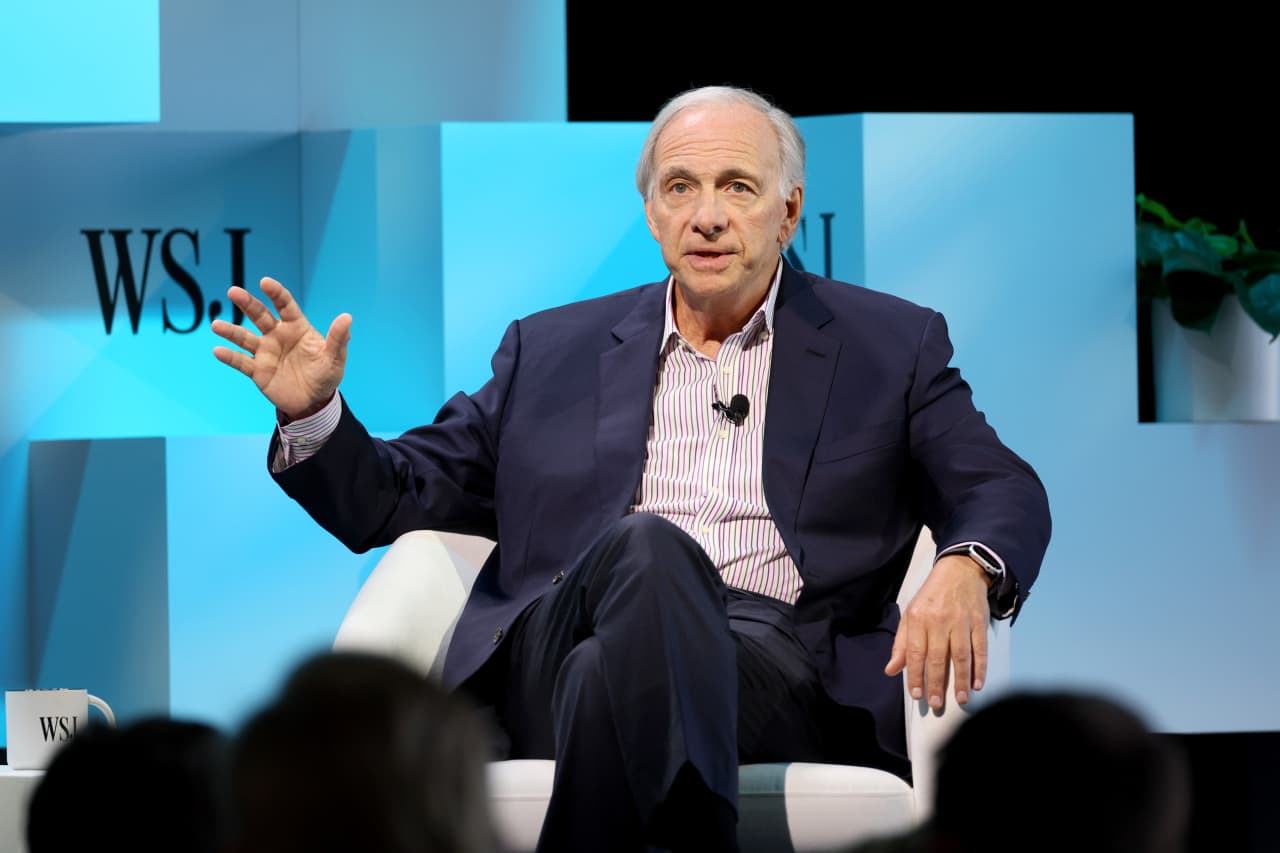

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)