Up 17% in 2025, Has Warren Buffett-Led Berkshire Hathaway Run Up Too Far, Too Fast?

Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) is up 17% year to date (YTD) at the time of this writing -- handily crushing an 8.3% decline in the S&P 500 (SNPINDEX: ^GSPC). Berkshire Hathaway has been on such a tear that it is one of the top 40 best-performing S&P 500 components in 2025.Hovering around an all-time high, Berkshire's market cap is now $1.15 trillion -- making it the sixth-most valuable U.S. company behind Apple (NASDAQ: AAPL), Microsoft, Nvidia, Amazon, Alphabet, and Meta Platforms.With Berkshire up around 50% in just the last three years, some investors may be concerned that the stock has run up too far, too fast. Here's an overview of the moving parts that make up Berkshire, and if the value stock is still worth buying now despite the meteoric surge.Continue reading

Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) is up 17% year to date (YTD) at the time of this writing -- handily crushing an 8.3% decline in the S&P 500 (SNPINDEX: ^GSPC). Berkshire Hathaway has been on such a tear that it is one of the top 40 best-performing S&P 500 components in 2025.

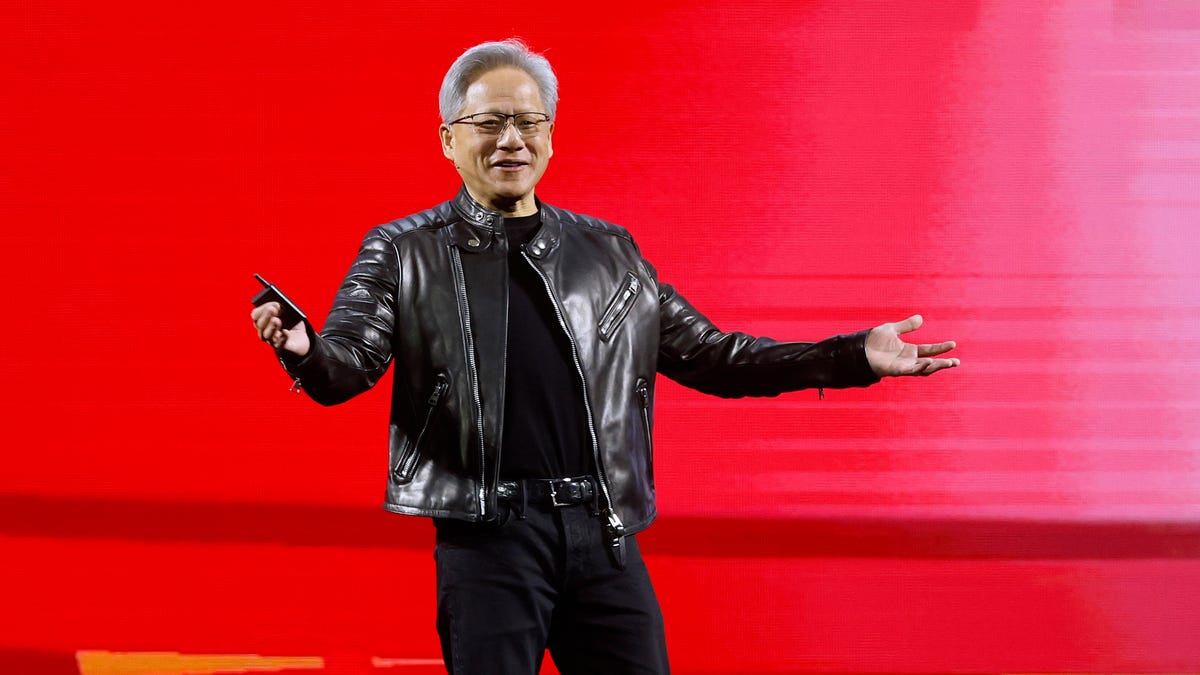

Hovering around an all-time high, Berkshire's market cap is now $1.15 trillion -- making it the sixth-most valuable U.S. company behind Apple (NASDAQ: AAPL), Microsoft, Nvidia, Amazon, Alphabet, and Meta Platforms.

With Berkshire up around 50% in just the last three years, some investors may be concerned that the stock has run up too far, too fast. Here's an overview of the moving parts that make up Berkshire, and if the value stock is still worth buying now despite the meteoric surge.

![31 Top Social Media Platforms in 2025 [+ Marketing Tips]](https://static.semrush.com/blog/uploads/media/0b/40/0b40fe7015c46ea017490203e239364a/most-popular-social-media-platforms.svg)

%20Abstract%20Background%20SOURCE%20Apple.jpg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)