Strategy hits the pause button on Bitcoin after $5.9B loss

Strategy paused Bitcoin purchases between March 31 and April 6, 2025. Bitcoin fell below $80,000 after Trump announced new US trade tariffs. Strategy’s current Bitcoin holdings stand at 528,185 BTC. Michael Saylor’s company, Strategy, has halted its Bitcoin purchases for the first time in recent memory, marking a shift from its regular buying spree. This […] The post Strategy hits the pause button on Bitcoin after $5.9B loss appeared first on CoinJournal.

- Strategy paused Bitcoin purchases between March 31 and April 6, 2025.

- Bitcoin fell below $80,000 after Trump announced new US trade tariffs.

- Strategy’s current Bitcoin holdings stand at 528,185 BTC.

Michael Saylor’s company, Strategy, has halted its Bitcoin purchases for the first time in recent memory, marking a shift from its regular buying spree.

This development comes amid a sharp correction in crypto markets, which fell in response to US President Donald Trump’s new 10% tariff on nearly all foreign goods.

The pause in Strategy’s Bitcoin accumulation, confirmed in a 10-Q filing with the US Securities and Exchange Commission (SEC) on April 7, coincided with a broader wave of investor caution after Trump also threatened to double tariffs on Chinese imports to 50%.

Strategy holds 528,185 BTC

According to the SEC filing, Strategy made no Bitcoin purchases between March 31 and April 6.

The company still holds 528,185 BTC, accumulated since 2020 when it first adopted a Bitcoin-centric treasury strategy under Saylor’s leadership.

While the firm did not sell any of its holdings during this recent pause, it recorded $5.91 billion in unrealised losses on its Bitcoin holdings in the first quarter of 2025.

This sharp decline in value reflects Bitcoin’s fall below $80,000, a reversal from the gains seen after Trump’s re-election.

The SEC document did not clarify whether the pause was temporary or part of a broader strategic shift, but it highlighted that market conditions and geopolitical uncertainty have influenced acquisition activity.

Trump warns of 50% China tariffs

The pause in Strategy’s Bitcoin buying was not an isolated decision.

It coincided with market instability triggered by Trump’s tariff policies, which have caused disruption across traditional financial markets and digital asset exchanges.

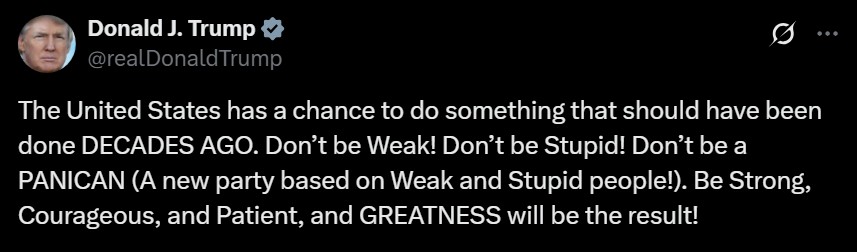

On April 7, the president posted on X, formerly Twitter, stating: “Be Strong, Courageous, and Patient, and GREATNESS will be the result.”

However, investor sentiment deteriorated sharply after Trump escalated threats to increase tariffs on Chinese imports from 34% to 50% unless Beijing removed its retaliatory measures.

This added further pressure on asset prices globally, leading to capital outflows and a slump in risk-on assets, including cryptocurrencies.

Strategy’s unrealised losses raise concerns about BTC treasury model

The $5.91 billion in unrealised losses has drawn attention to the potential risks of a Bitcoin-focused corporate treasury model.

Although Strategy has long advocated for Bitcoin as a store of value, recent events have reignited debates about volatility exposure.

The company’s unrealised losses in the first quarter illustrate how geopolitical developments—such as changes in US trade policy—can directly impact balance sheets tied to crypto assets.

While Strategy did not comment in the SEC filing on its future acquisition plans, the absence of new purchases during a period of heightened market uncertainty suggests a more cautious stance in the short term.

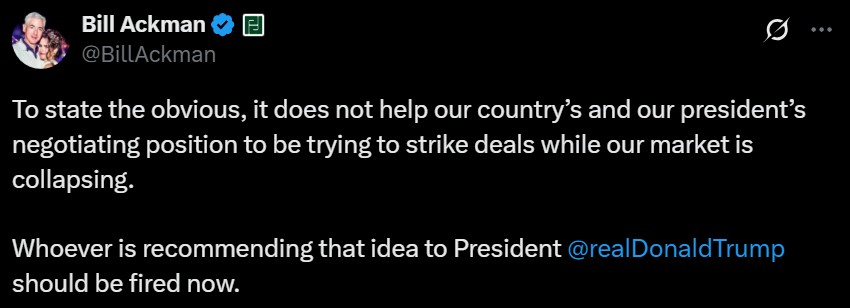

Ackman calls for tariff reversal

Billionaire investor Bill Ackman, who previously voiced support for Trump, criticised the new tariffs and their impact on market stability.

On April 7, Ackman posted on X that the policies undermine US negotiating leverage and should be reversed immediately.

His comments reflect growing concern among investors about the broader implications of trade policy on asset markets, particularly as stocks and crypto assets come under simultaneous pressure.

Strategy’s decision to pause Bitcoin buying adds to this narrative, suggesting that some firms are now reassessing aggressive crypto accumulation strategies amid macroeconomic headwinds.

Whether this pause turns into a longer-term policy shift may depend on how Bitcoin prices respond to the evolving global economic environment and further political developments.

The post Strategy hits the pause button on Bitcoin after $5.9B loss appeared first on CoinJournal.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)