Stock Market Sell-Off: Should You Buy the Dip on Nvidia Stock?

With shares down nearly 20% year to date, Nvidia (NASDAQ: NVDA) had a rough start to 2025. The massive artificial intelligence (AI) chipmaker has proven vulnerable to trade and geopolitical uncertainty during the opening months of the Trump administration, which could seriously undermine its business in China.Let's dig deeper to determine whether investors should view this dip as a buying opportunity or a signal to stay away from Nvidia stock.Nvidia's China trouble came to a head on April 16 when the Trump administration imposed new restrictions on the exports of its H20 AI chips to the country. This hardware was specifically designed to comply with Biden-era regulations, which blocked sales of its more powerful flagship chips like the A100 and H100 to China. The new ban led to a $5.5 billion impairment charge as Nvidia must now write down the value of its massive inventory and purchase commitments for the H20 program.Continue reading

With shares down nearly 20% year to date, Nvidia (NASDAQ: NVDA) had a rough start to 2025. The massive artificial intelligence (AI) chipmaker has proven vulnerable to trade and geopolitical uncertainty during the opening months of the Trump administration, which could seriously undermine its business in China.

Let's dig deeper to determine whether investors should view this dip as a buying opportunity or a signal to stay away from Nvidia stock.

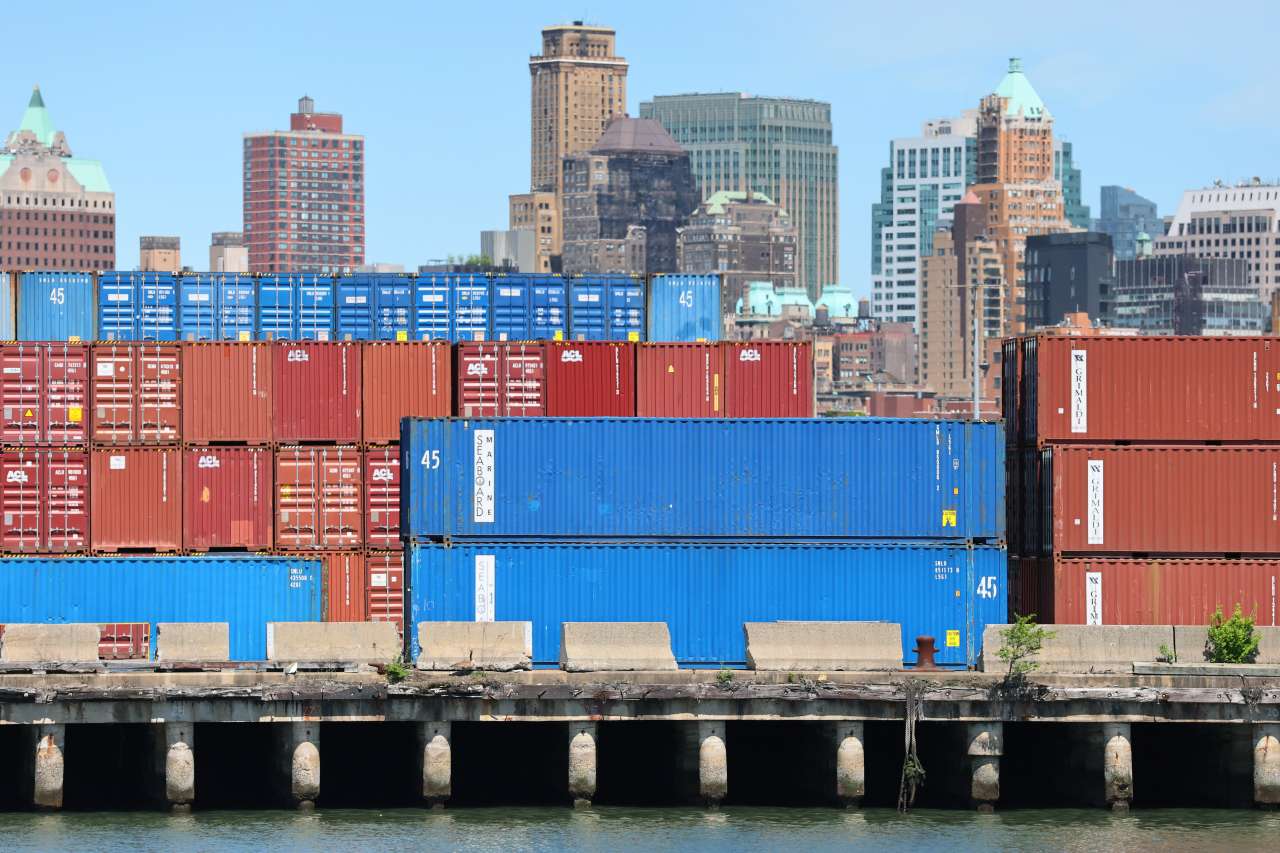

Nvidia's China trouble came to a head on April 16 when the Trump administration imposed new restrictions on the exports of its H20 AI chips to the country. This hardware was specifically designed to comply with Biden-era regulations, which blocked sales of its more powerful flagship chips like the A100 and H100 to China. The new ban led to a $5.5 billion impairment charge as Nvidia must now write down the value of its massive inventory and purchase commitments for the H20 program.