Stock Market Sell-Off: 2 Safe AI Stocks to Buy Amid Tariff Turmoil, According to a Wall Street Analyst

The S&P 500 (SNPINDEX: ^GSPC) earlier this year fell from a record high into correction territory in just 22 days. The historical average is 75 days, according to UBS Wealth Management. That rapid drawdown reflects immense economic uncertainty surrounding the radical changes in U.S. trade policy under President Trump.Dan Ives at Wedbush says cloud and software stocks like Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and CrowdStrike (NASDAQ: CRWD) could be the safest place to invest as Trump's trade war persists. That's because those companies primarily sell services rather than physical goods, and services are not subject to tariffs.Readers should remember there is no such thing as a perfectly safe investment where the stock market is concerned. Shares of Alphabet and CrowdStrike could fall substantially if tariffs have a material impact on economic growth. But I do agree with Ives in principle: Cloud and software companies are theoretically better positioned.Continue reading

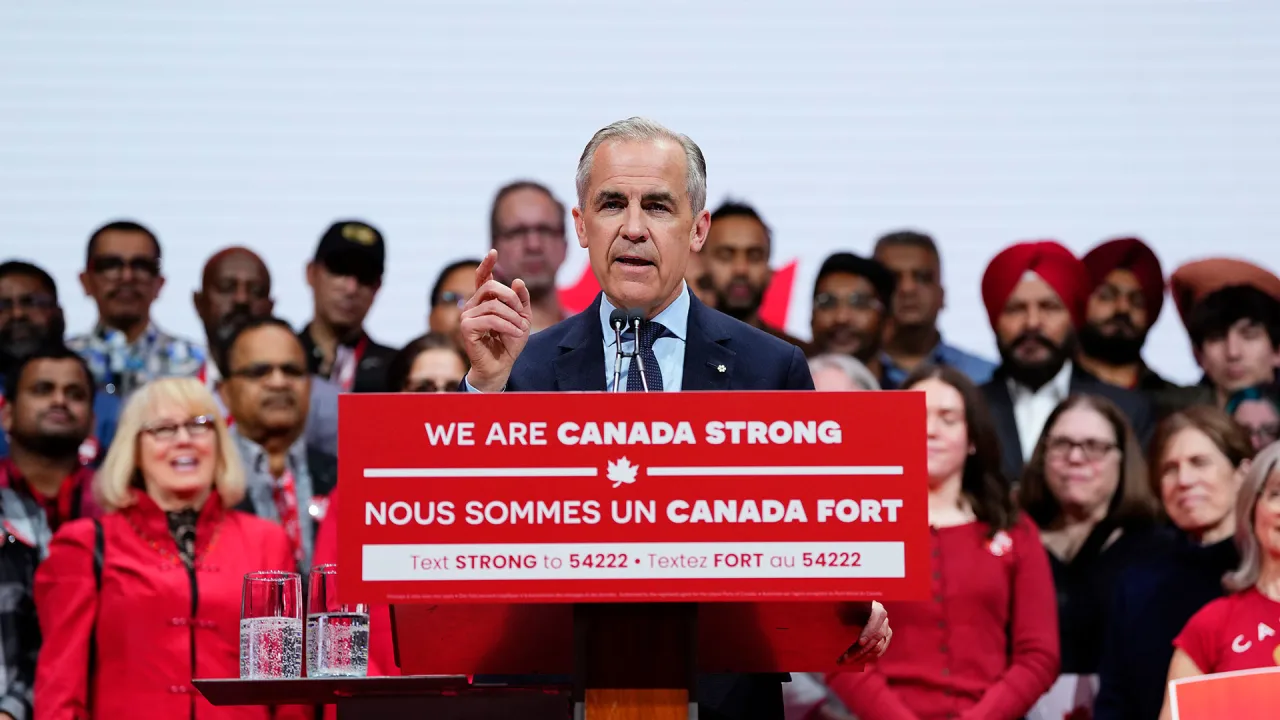

The S&P 500 (SNPINDEX: ^GSPC) earlier this year fell from a record high into correction territory in just 22 days. The historical average is 75 days, according to UBS Wealth Management. That rapid drawdown reflects immense economic uncertainty surrounding the radical changes in U.S. trade policy under President Trump.

Dan Ives at Wedbush says cloud and software stocks like Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and CrowdStrike (NASDAQ: CRWD) could be the safest place to invest as Trump's trade war persists. That's because those companies primarily sell services rather than physical goods, and services are not subject to tariffs.

Readers should remember there is no such thing as a perfectly safe investment where the stock market is concerned. Shares of Alphabet and CrowdStrike could fall substantially if tariffs have a material impact on economic growth. But I do agree with Ives in principle: Cloud and software companies are theoretically better positioned.

![AI Experts Don’t Believe AI Tools Will Lead to Mass Job Losses [Infographic]](https://imgproxy.divecdn.com/gcXE1_Da13Oz-JAszjUwb6v5UqMp2MFMjDAIXPbLad0/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9qb2JfbG9zc2VzLnBuZw==.webp)