Stock Market Sell-Off: 2 Dirt Cheap Stocks To Buy Now

Financial markets hate uncertainty. It can cause consumers to hold back their spending and businesses to delay their capital investments until they can forecast the future more accurately. The Trump administration's tariff announcement on April 2 served as a stark reminder of this concept as it sent global equities into a tailspin. Regardless of the potential viability of Trump's plan to bring manufacturing jobs back to the U.S., the administration's unpredictable decisions could put a shadow over the economy for months or even years. In times like these, investors should pivot away from expensive growth stocks to more affordable companies with less downside risk. Let's explore why Super Micro Computer (NASDAQ: SMCI) and Dollar Tree (NASDAQ: DLTR) could make excellent long-term bets.With shares down 63% over the last 12 months, Super Micro's crash didn't start in April. The company is bouncing back from allegations of poor accounting practices, which led to the resignation of its auditor and its near de-listing from the Nasdaq exchange in 2024. However, management has pushed back against claims of wrongdoing and regained compliance with Nasdaq, putting shares in a great position to benefit from strong fundamentals.Continue reading

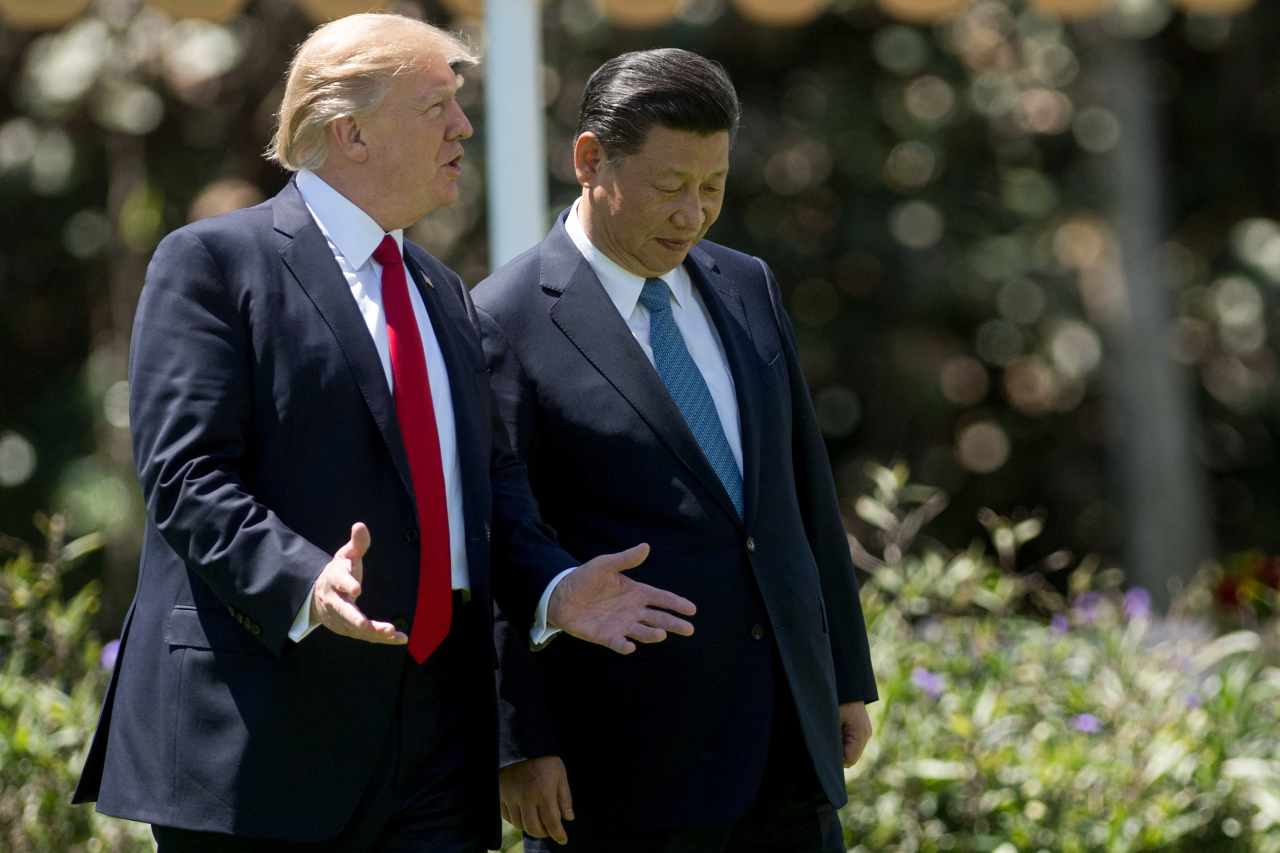

Financial markets hate uncertainty. It can cause consumers to hold back their spending and businesses to delay their capital investments until they can forecast the future more accurately. The Trump administration's tariff announcement on April 2 served as a stark reminder of this concept as it sent global equities into a tailspin.

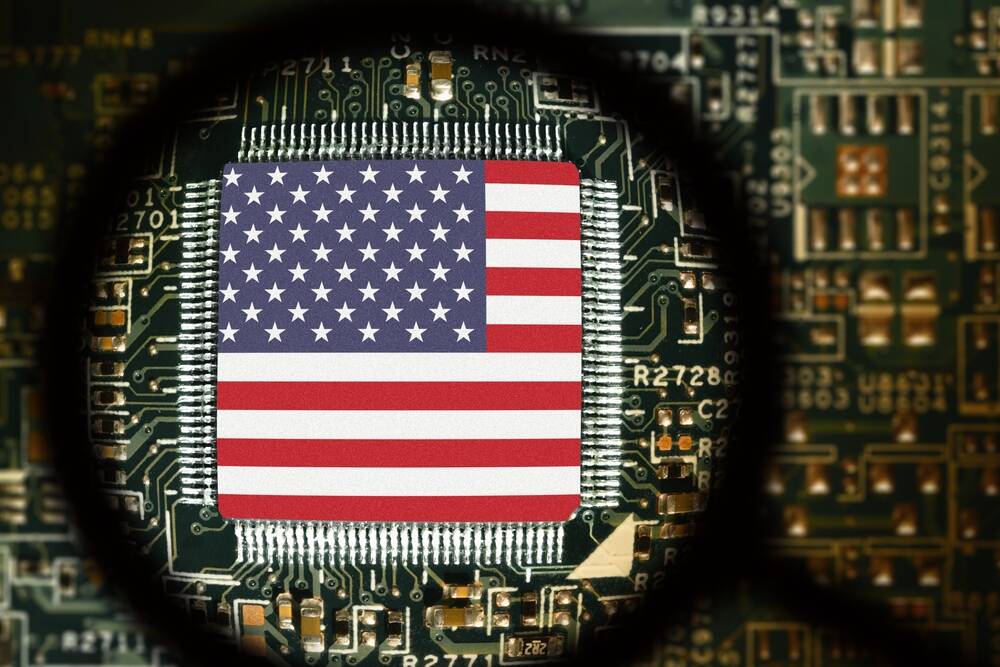

Regardless of the potential viability of Trump's plan to bring manufacturing jobs back to the U.S., the administration's unpredictable decisions could put a shadow over the economy for months or even years. In times like these, investors should pivot away from expensive growth stocks to more affordable companies with less downside risk. Let's explore why Super Micro Computer (NASDAQ: SMCI) and Dollar Tree (NASDAQ: DLTR) could make excellent long-term bets.

With shares down 63% over the last 12 months, Super Micro's crash didn't start in April. The company is bouncing back from allegations of poor accounting practices, which led to the resignation of its auditor and its near de-listing from the Nasdaq exchange in 2024. However, management has pushed back against claims of wrongdoing and regained compliance with Nasdaq, putting shares in a great position to benefit from strong fundamentals.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)