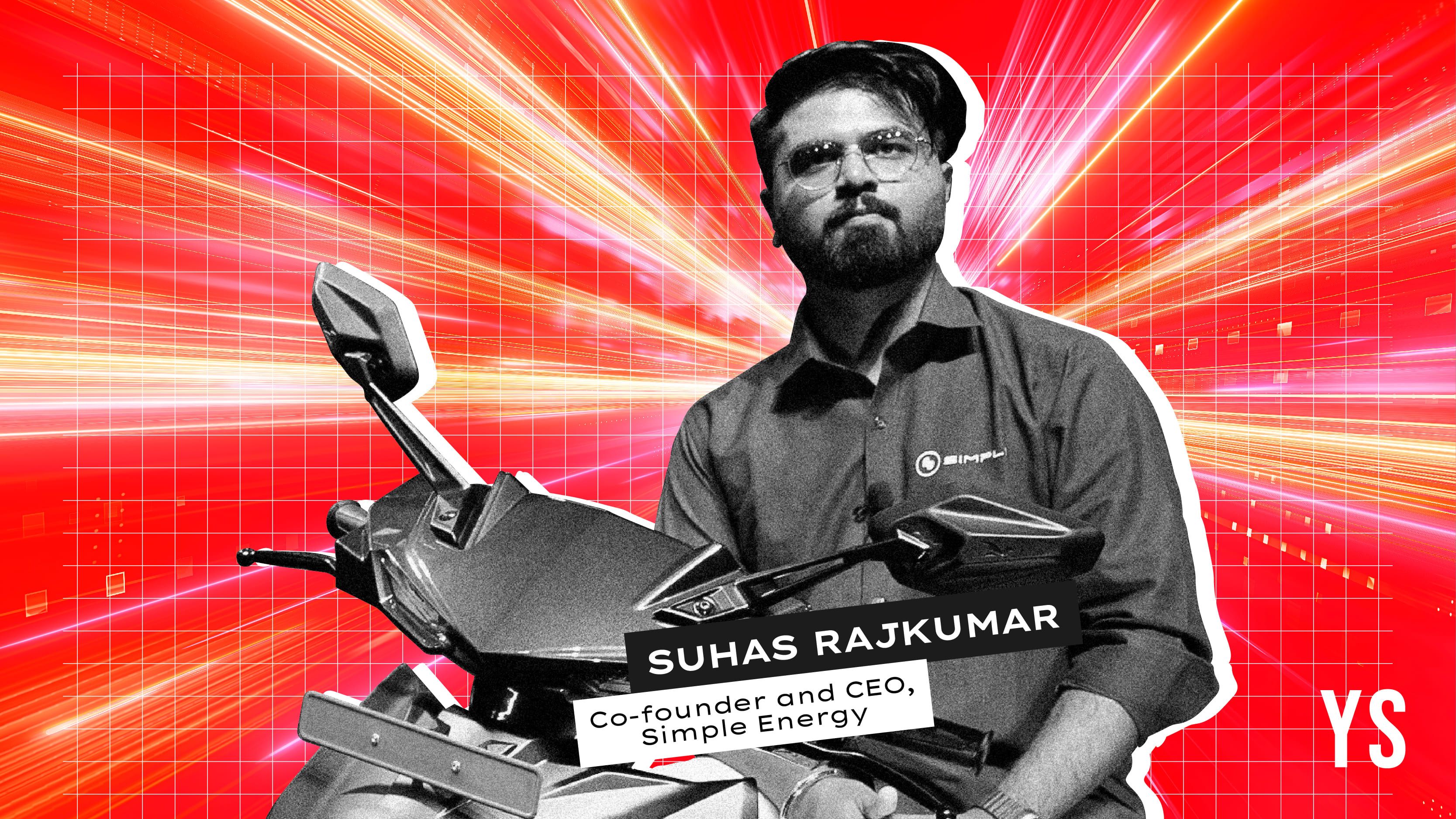

Simple Energy plans $350M IPO in FY27, aims to hit EBITDA profitability before listing

The EV startup is targeting Rs 800 crore revenue for FY26 and a 5% market share by FY27.

Bengaluru-based EV maker Simple Energy plans to come out with an initial public offering between Q2 and Q3 of FY27 with a target to raise Rs 3,000 crore ($350 million)

The announcement comes amidst rival Ather Energy’s public market debut. EV maker Ola Electric had also listed on the bourses in August last year.

Simple Energy, which makes electric scooters, says it has achieved a 500% year-on-year growth. The company is targeting a revenue of Rs 800 crore in FY26 and aims to surpass Rs 1,500 in cumulative revenue over the next 18 months. It also expects to achieve EBITDA profitability by the end of FY26.

This growth is expected to be fuelled by expansion of offline stores. The EV maker plans to open 150 stores and 200 service centres by the end of 2025, using funds from its $20-million Series A round in July 2024.

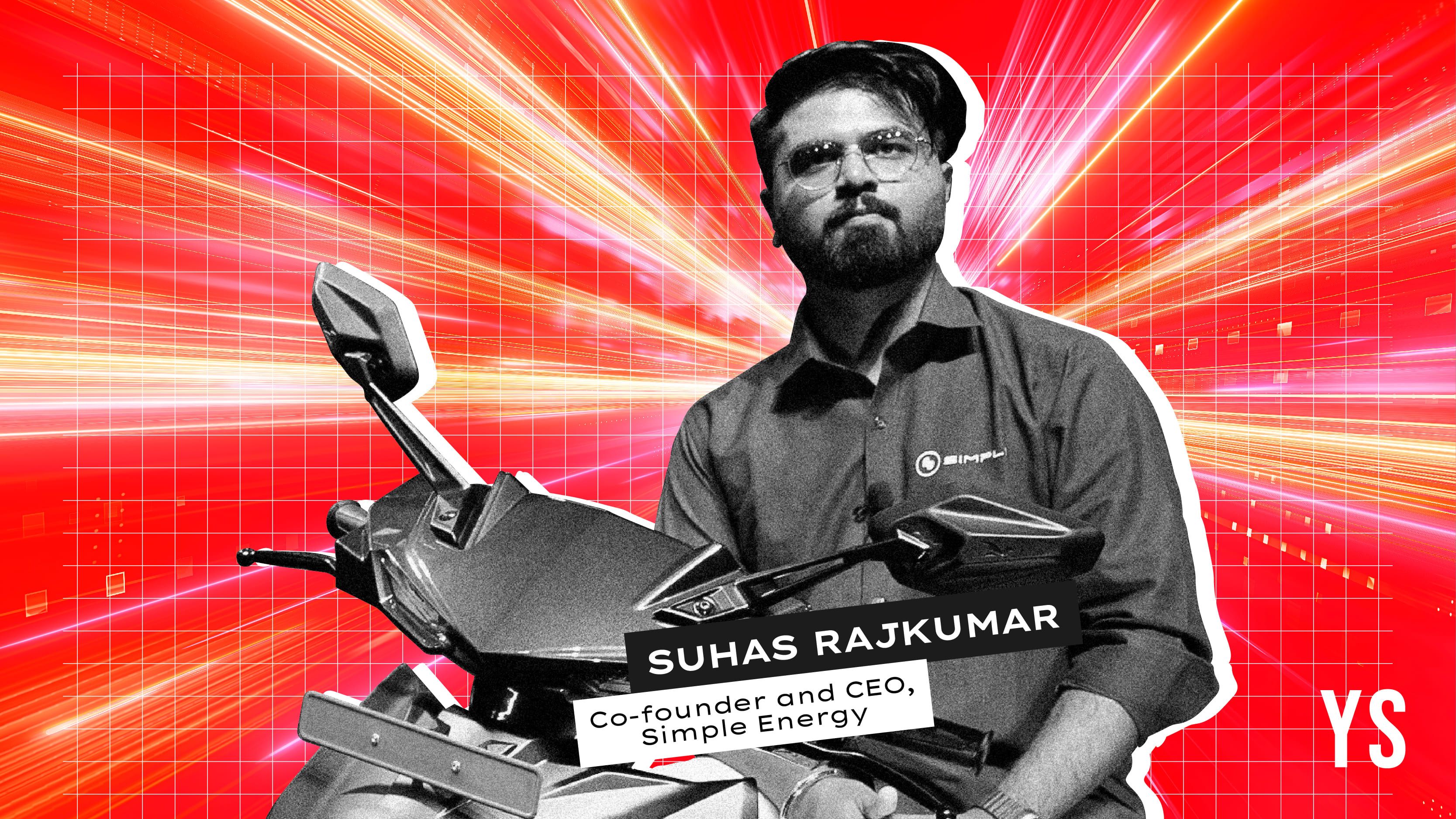

Unlike other EV startups, Simple Energy does not operate an online platform for customers to place orders. Co-founder and CEO Suhar Rajkumar has a simple reasoning for this—lack of service support.

“We cannot give the service support required even if we can deliver the scooter; so we are looking at the brick-and-mortar model,” Rajkumar told YourStory.

According to the national vehicle registry Vahan, Simple Energy sold 269 units in April, accounting for about 0.2% of the EV market. Rajkumar said the company is targeting 5% market share by 2027, helped by rising adoption of electric vehicles in the country.

While Simple Energy is bullish on electric scooters, it has no immediate plans to branch out into electric motorcycles. “I think the bike market will take some time and we want to be observant of it,” said Rajkumar.

Simple Energy is also planning to roll out many SKUs, and a family scooter is expected to be one of them, which will be launched in the run-up to its listing.

Founded in 2019, the company currently has a presence in Karnataka, Maharashtra, Goa, Andhra Pradesh, Telangana, and Kerala.

Simple Energy expects to use 30% of its IPO proceeds for R&D, 50% for general operations, market and product expansion, and the remaining to expand its factories and other production capabilities.

Edited by Swetha Kannan