2025 ‘stimulus checks’ from New York state are coming: Am I getting an inflation refund from the government?

At a time of skyrocketing costs in the U.S., looming tariffs, and fears of a recession, New Yorkers are finally getting some good news: Over 8 million people in the Empire state will receive a sort of stimulus check, or officially, an “inflation refund check” this year, according to Democratic governor Kathy Hochul. The refunds come as Americans continue to battle high inflation, driving up prices on everything from housing to groceries, stemming from the global COVID-19 pandemic and its aftermath. While inflation has steadily decreased from its 2022 high of 9.1%, prices have not re-adjusted to levels before the pandemic, according to Newsweek. Last week, Hochul said “while inflation has driven prices higher . . . it has also driven sharp increases in the state’s collection of sales tax” that “belongs to hardworking New York families and should be returned to their pockets as an inflation refund.” The checks add up to about $2 billion and are allocated as part of the state’s 2026 fiscal budget. It’s the first time the state has issued this type of refund check. Here’s what you need to know. Am I eligible for a New York inflation refund? The inflation refunds are going out to over 8 million people living in New York state who are part of households that fall under set income limits. For couples or families that file joint taxes, households earning up to $300,000 a year are eligible for the refunds. For individuals who file solo taxes, those earning up to $150,000 are eligible. How much can I expect to receive if Iive in New York? Couples or families that file joint taxes and earn up to $150,000 will receive a $400 check; while joint tax filers earning more than $150,000 up to $300,000 will get a $300 refund. Individuals who file solo taxes of up to $75,000 will get a $200 refund; those who earn more than $75,000 up to $150,000 will receive a $150 check. What’s the timeline for the inflation refunds? There’s no clear timeline yet for when the inflation refunds will be sent out, although Hochul has said New York residents can expect the refunds this year. What if I have kids? Is there an additional tax credit? In addition to that refund, the governor announced she will be expanding New York’s child tax credit “for middle class New Yorkers,” giving 1.6 million New York families an annual tax credit of up to $1,000 per child under the age of four, and up to $500 per child aged 4 through 16. The expansion of New York’s child tax credit will benefit approximately 2.75 million children statewide, and will double the size of the average credit going out to families from $472 to $943.

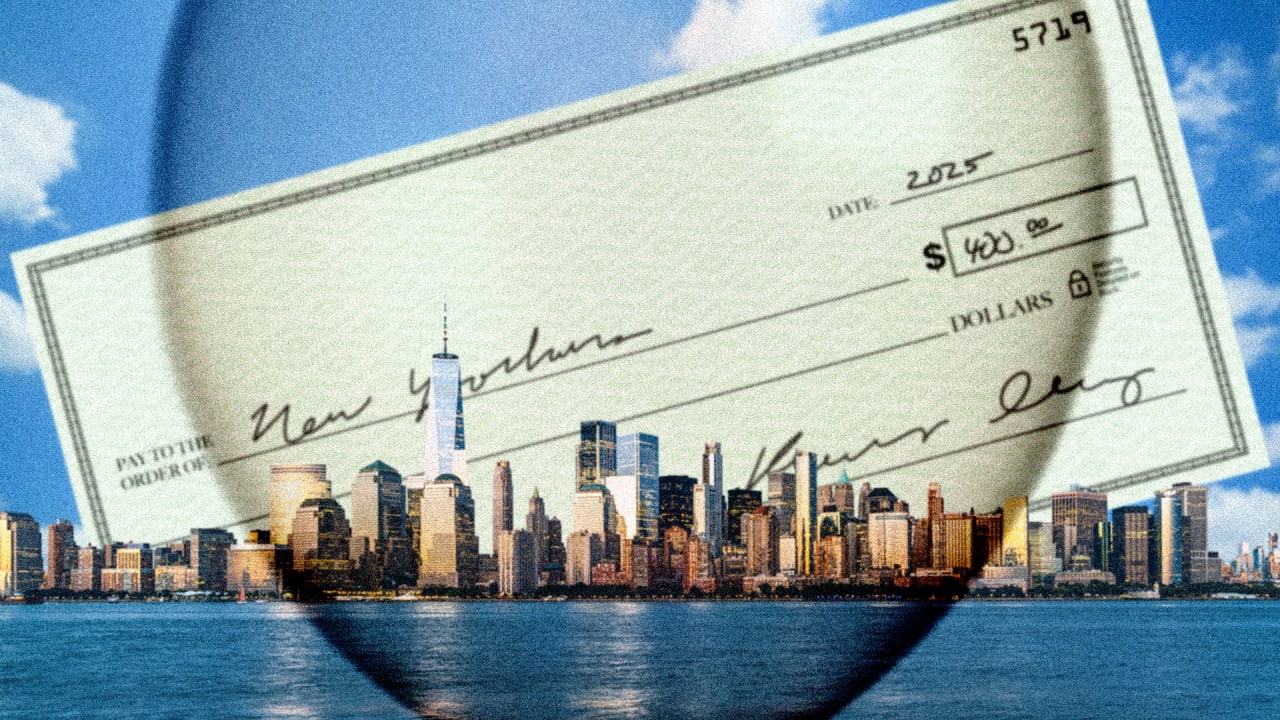

At a time of skyrocketing costs in the U.S., looming tariffs, and fears of a recession, New Yorkers are finally getting some good news: Over 8 million people in the Empire state will receive a sort of stimulus check, or officially, an “inflation refund check” this year, according to Democratic governor Kathy Hochul.

The refunds come as Americans continue to battle high inflation, driving up prices on everything from housing to groceries, stemming from the global COVID-19 pandemic and its aftermath. While inflation has steadily decreased from its 2022 high of 9.1%, prices have not re-adjusted to levels before the pandemic, according to Newsweek.

Last week, Hochul said “while inflation has driven prices higher . . . it has also driven sharp increases in the state’s collection of sales tax” that “belongs to hardworking New York families and should be returned to their pockets as an inflation refund.”

The checks add up to about $2 billion and are allocated as part of the state’s 2026 fiscal budget. It’s the first time the state has issued this type of refund check.

Here’s what you need to know.

Am I eligible for a New York inflation refund?

The inflation refunds are going out to over 8 million people living in New York state who are part of households that fall under set income limits.

For couples or families that file joint taxes, households earning up to $300,000 a year are eligible for the refunds.

For individuals who file solo taxes, those earning up to $150,000 are eligible.

How much can I expect to receive if Iive in New York?

Couples or families that file joint taxes and earn up to $150,000 will receive a $400 check; while joint tax filers earning more than $150,000 up to $300,000 will get a $300 refund.

Individuals who file solo taxes of up to $75,000 will get a $200 refund; those who earn more than $75,000 up to $150,000 will receive a $150 check.

What’s the timeline for the inflation refunds?

There’s no clear timeline yet for when the inflation refunds will be sent out, although Hochul has said New York residents can expect the refunds this year.

What if I have kids? Is there an additional tax credit?

In addition to that refund, the governor announced she will be expanding New York’s child tax credit “for middle class New Yorkers,” giving 1.6 million New York families an annual tax credit of up to $1,000 per child under the age of four, and up to $500 per child aged 4 through 16.

The expansion of New York’s child tax credit will benefit approximately 2.75 million children statewide, and will double the size of the average credit going out to families from $472 to $943.