Novo Nordisk posts strong Q1 as weight-loss revolution claims another victim: WeightWatchers

One day after WeightWatchers said that it would file for bankruptcy, weight loss drug giant Novo Nordisk’s outlook is brightening. Novo Nordisk, the Danish company that produces semaglutide drugs Ozempic and Wegovy, saw its shares rise more than 7% Wednesday, in spite of recent headwinds from widely available copycat versions of its signature weight loss drugs. Following its quarterly earnings report, shares of the company rose to $71.53 before leveling off and settling around $67.70, in spite of lowered expectations for the year. Novo Nordisk lowered its sales growth forecast for 2025, now expecting growth between 13% and 21%, down from the 16% to 24% it projected back in February. The company blamed the dip on slower-than-expected uptake of its branded GLP-1 drugs, largely due to competition from compounding pharmacies, which had been filling the gap as demand for weight-loss meds like Wegovy outpaced supply. FDA crackdown signals end of GLP-1 copycats But that pressure is expected to ease. The FDA recently declared the shortage over and has officially banned large-scale compounding of GLP-1 drugs like semaglutide. With those off-brand versions now illegal in the U.S., Novo and its investors are optimistic sales will rebound in the coming months. The agency has given large compounding pharmacies in the U.S. until May 22 to wind down production of those drugs or face potential enforcement actions. Late last month, a U.S. judge rejected a legal challenge from an industry group representing compounding pharmacies that could have allowed continued production of GLP-1 copycat drugs to continue. While their products can be cheaper for consumers, drugs produced in compounding pharmacies face less regulatory scrutiny than their name brand counterparts. The FDA acknowledges that while compounded drugs are a lawful option that alleviates supply problems, they may not meet the same quality and safety standards. WeightWatchers collapses under pressure The future is decidedly less sunny for longtime weight loss industry stalwart WeightWatchers, which announced that it would pursue Chapter 11 bankruptcy protection on Tuesday. The company has struggled to reinvent itself in the era of widely available weight loss drugs, even as it embraced their rise by pivoting to sell compounded semaglutide through its own online pharmacy. WeightWatchers may be down, but the company insists that it isn’t out. WeightWatchers insists that it will continue to operate normally in spite of its bankruptcy plans, which it described as “transformational” in a press release. “There will be no impact to members or the plans they rely on to support their weight management goals,” the company said. After the process is complete, a new investor group will wield 91% of the company and the remaining chunk of stock will be held by existing shareholders. “The decisive actions we’re taking today, with the overwhelming support of our lenders and noteholders, will give us the flexibility to accelerate innovation, reinvest in our members, and lead with authority in a rapidly evolving weight management landscape,” WeightWatchers CEO Tara Comonte said. “As the conversation around weight shifts toward long-term health, our commitment to delivering the most trusted, science-backed, and holistic solutions—grounded in community support and lasting results—has never been stronger, or more important.” A new generation of GLP-1 drugs promising fast results continues to rock the weight loss industry, which has emphasized dieting and other slow behavioral changes for decades. If WeightWatchers can weather the storm remains to be seen, but complete transformation might be the only option if the 60-year-old company plans to make it in the Wegovy era.

One day after WeightWatchers said that it would file for bankruptcy, weight loss drug giant Novo Nordisk’s outlook is brightening.

Novo Nordisk, the Danish company that produces semaglutide drugs Ozempic and Wegovy, saw its shares rise more than 7% Wednesday, in spite of recent headwinds from widely available copycat versions of its signature weight loss drugs.

Following its quarterly earnings report, shares of the company rose to $71.53 before leveling off and settling around $67.70, in spite of lowered expectations for the year.

Novo Nordisk lowered its sales growth forecast for 2025, now expecting growth between 13% and 21%, down from the 16% to 24% it projected back in February. The company blamed the dip on slower-than-expected uptake of its branded GLP-1 drugs, largely due to competition from compounding pharmacies, which had been filling the gap as demand for weight-loss meds like Wegovy outpaced supply.

FDA crackdown signals end of GLP-1 copycats

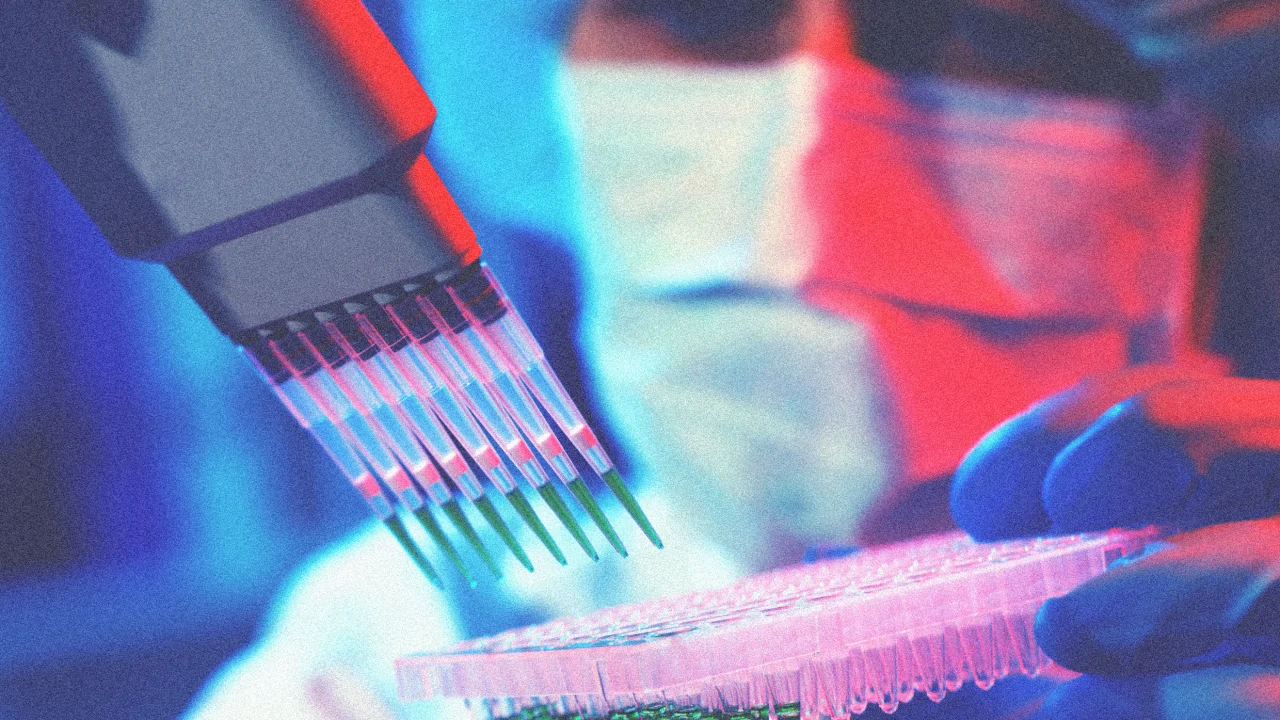

But that pressure is expected to ease. The FDA recently declared the shortage over and has officially banned large-scale compounding of GLP-1 drugs like semaglutide. With those off-brand versions now illegal in the U.S., Novo and its investors are optimistic sales will rebound in the coming months.

The agency has given large compounding pharmacies in the U.S. until May 22 to wind down production of those drugs or face potential enforcement actions. Late last month, a U.S. judge rejected a legal challenge from an industry group representing compounding pharmacies that could have allowed continued production of GLP-1 copycat drugs to continue.

While their products can be cheaper for consumers, drugs produced in compounding pharmacies face less regulatory scrutiny than their name brand counterparts. The FDA acknowledges that while compounded drugs are a lawful option that alleviates supply problems, they may not meet the same quality and safety standards.

WeightWatchers collapses under pressure

The future is decidedly less sunny for longtime weight loss industry stalwart WeightWatchers, which announced that it would pursue Chapter 11 bankruptcy protection on Tuesday. The company has struggled to reinvent itself in the era of widely available weight loss drugs, even as it embraced their rise by pivoting to sell compounded semaglutide through its own online pharmacy.

WeightWatchers may be down, but the company insists that it isn’t out. WeightWatchers insists that it will continue to operate normally in spite of its bankruptcy plans, which it described as “transformational” in a press release. “There will be no impact to members or the plans they rely on to support their weight management goals,” the company said.

After the process is complete, a new investor group will wield 91% of the company and the remaining chunk of stock will be held by existing shareholders.

“The decisive actions we’re taking today, with the overwhelming support of our lenders and noteholders, will give us the flexibility to accelerate innovation, reinvest in our members, and lead with authority in a rapidly evolving weight management landscape,” WeightWatchers CEO Tara Comonte said.

“As the conversation around weight shifts toward long-term health, our commitment to delivering the most trusted, science-backed, and holistic solutions—grounded in community support and lasting results—has never been stronger, or more important.”

A new generation of GLP-1 drugs promising fast results continues to rock the weight loss industry, which has emphasized dieting and other slow behavioral changes for decades. If WeightWatchers can weather the storm remains to be seen, but complete transformation might be the only option if the 60-year-old company plans to make it in the Wegovy era.