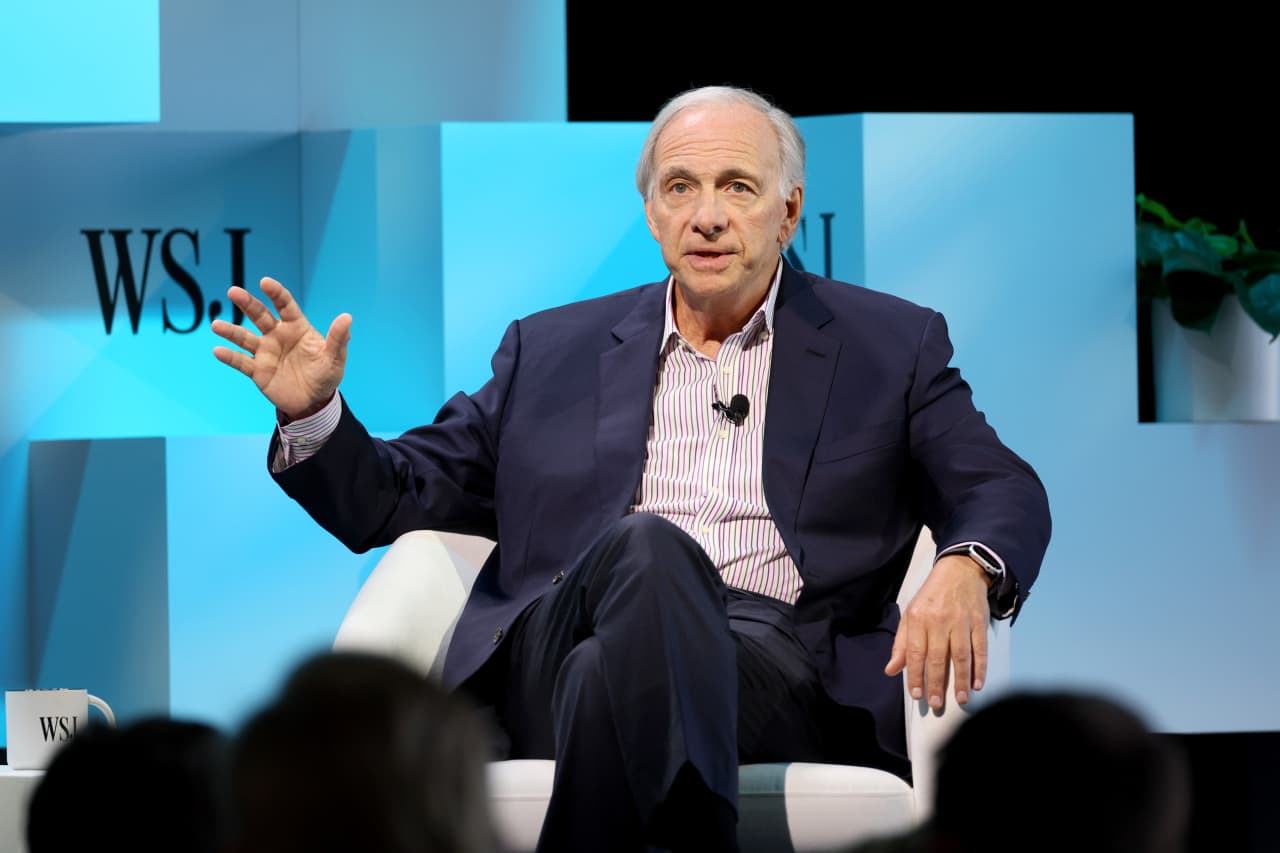

Ray Dalio says tariff turmoil hurt U.S. reputation for reliability

In his view, it’s worth watching the weakening dollar and how the 30-year Treasury trades versus the 10-year bond.

Bridgewater Associates’ billionaire founder Ray Dalio said investors have been left with “an element of trauma or shock or fear” after all the global markets turmoil this week.

“It dramatically affected psychology and attitude about the United States’ reliability,” he said in an interview with Bloomberg Television. “It could have been handled better.”

In his view, it’s worth watching the weakening dollar and how the 30-year Treasury trades versus the 10-year bond for any evidence that investors are turning away from what have long been the world’s safest assets.

“What I’m really most concerned about is the basic supply-demand of debt,” he said.

Asked if some investors would have blown up if President Donald Trump hadn’t pulled back on tariffs, Dalio said “some certainly would, not only just because of the tariffs but because of the capital markets implications.” He added, “there’s a spiral that is reinforcing when the capital markets tighten up.”

While Trump delayed many of his trade tax plans by 90 days on Wednesday, sparking a massive rally in stocks and bonds, the euphoria has quickly faded with investors back to worrying about the possibility of a recession and more corporate defaults. Earlier this week, Dalio said investors are too focused on tariffs and missing the bigger picture of a breakdown in pillars of the global economy.

“It’s likely we’re going to be in a recession,” he said in the Bloomberg interview. “I’m more worried about the greater dynamic of these conflicts” that are “financial, political and the geopolitical because they feed on themselves.”

“This is not a normal recession kind of situation,” he added. “We are changing the monetary order.”

Dalio said that while he’s pleased about Trump’s decision to pivot, he cautioned that the volatility will have lasting effects. “The sense that the capital markets now could lock up in itself creates a change in the way that everyone, most importantly, companies deal with their businesses,” he said.

This story was originally featured on Fortune.com

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)