How FinRight is making PF withdrawals easy and error-free

The Mumbai-based fintech startup provides an AI-driven platform that streamlines PF withdrawals, ensures faster processing of claims, and reduces rejection rates and dependency on intermediaries.

Provident fund (PF) is a crucial retirement savings vehicle, but its withdrawal and transfer is often an arduous process, weighed down by bureaucratic inefficiencies, high rejection rates, and lack of transparency.

Recognising these issues, Amey Kanekar, a software engineer-turned-fintech professional, set up FinRight, a fintech startup in October 2023.

Mumbai-based FinRight is a one-stop platform for resolving various issues and queries related to PF. Targeted at individual users, the AI-driven automation platform streamlines PF withdrawals, ensuring faster, error-free processing of claims, while reducing dependency on traditional intermediaries.

Bridging the gaps in PF access

PF serves as an essential financial safety net for employees. However, accessing it can be challenging, requiring employer approvals, multiple documentation steps, and prolonged waiting periods.

During FY23, over Rs 5.21 crore PF withdrawal and transfer claims were filed. But nearly 25.8% (around Rs 1.34 crore claims) were rejected, according to the Employees' Provident Fund Organisation (EPFO). The rejection rate for final PF withdrawals reached a five-year high of 34%, making it one of the most significant financial hurdles in the country today.

FinRight aims to change this by providing a seamless digital experience that combines AI-powered automation with expert human guidance.

“Most people struggle to understand the rules and processes around PF transfers and withdrawals. The market is cluttered with unorganised PF agents who lack expertise, provide inconsistent service, and charge exorbitant fees. We saw an opportunity to deliver professional, transparent, and affordable solutions to simplify PF claims for everyone,” says Kanekar, Co-founder, FinRight, who has earlier had stints at ICICI Bank, Kotak Mahindra Bank, and CRED,

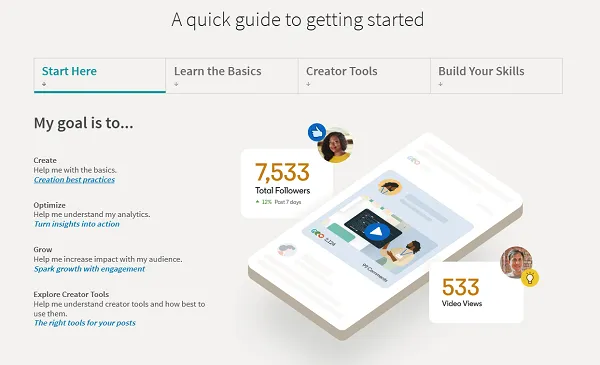

FinRight simplifies the PF claims process using automation and intelligent document recognition that eliminate the need for tonnes of paperwork. It allows individuals to submit, track, and complete financial tasks with ease.

The platform digitally verifies credentials, automates tasks like PF claims and loans, and removes the need for middlemen, thus ensuring faster, hassle-free and more transparent processing.

The startup also employs a team of financial experts who offer unbiased assistance to users.

Users can submit queries through FinRight’s website or connect via WhatsApp to receive personalised guidance from AI tools and financial experts.

AI-driven model

FinRight’s AI-driven algorithm assesses eligibility in real time, flags potential issues before claims are submitted, and also assists users in rectifying errors.

This helps expedite approvals and reduce rate of rejection, which often happens due to incorrect details, missing documents, missing signatures, expired IDs, mismatched names, and lack of employer approval.

“We spot issues using automated document checks and alert users in real-time so they can fix problems before submission and verify details with official records, ensuring accuracy and reducing delays,” says Kanekar.

“Our system is designed to handle every aspect of the PF withdrawal journey from authentication to final disbursal. By integrating AI-driven verification, we minimise errors, significantly accelerate the process, and improve approval rates,” he explains.

Traditionally, users have to navigate complex government portals where processing is done manually. FinRight addresses this issue by directly interfacing with government systems and reducing dependency on intermediaries.

“With our platform, users can complete the entire process in just a few clicks,” sums up Kanekar.

Real-time tracking

The platform also provides real-time tracking and status updates, ensuring complete transparency for users.

“Lack of visibility in the PF withdrawal process leaves users uncertain about timelines and rejections. To fix this, we ensure end-to-end transparency, allowing users to track every step of their claim and proactively resolving issues before they cause delays,” Kanekar notes.

“Digital tools enable FinRight to directly connect with EPFO’s system, automating tasks like checking claim status, verifying account details, and submitting PF withdrawal requests. This integration speeds up processes, reduces errors, and eliminates the need for users to visit EPFO offices,” he adds.

Other services

Apart from PF processing, the startup also offers other kinds of financial assistance, including insurance claim settlements, home loan balance transfers, surrendering unproductive endowment policies, and optimising in-hand salary.

The birth of FinRight

Kanekar began his career as a software engineer. A keen interest in finance led him to pursue an MBA and take up key roles at ICICI Bank and Kotak Mahindra Bank.

“While working at these banks, I got deep insights into how personal finance products work. I was involved in various aspects, from customer acquisition to engagement strategies,” he says.

In 2020, Kanekar joined the fintech company CRED. While working here, he pondered over building a financial company without aggressively selling to customers. This led to the birth of FinRight. Instead of focusing only on sales, the startup aims to solve real, underserved problems in personal finance.

Kanekar was later joined by Akash Shah, his former colleague at fintech firm PhonePe.

Shah joined FinRight as a product consultant. Prior to PhonePe, he had worked at Amazon.

Both Kanekar and Shah have extensive experience in the fintech ecosystem. They bootstrapped FinRight with Rs 40 lakh with their personal savings.

Business model and growth

FinRight operates on a fixed-fee model, and the pricing is determined by the complexity of the case rather than the value of the financial transaction.

“We offer a transparent, fixed-fee model that contrasts with the percentage-based fees commonly charged by others. It doesn’t make sense to charge in percentage terms because the effort involved remains the same regardless of the claim amount,” says Kanekar.

The service fee starts at Rs 2,000 and goes up depending on the effort required to resolve the matter.

Since its launch, FinRight has helped over 7,000 customers in withdrawing their PF. It has assisted in over 15,000 claims, totalling a value of Rs 300 crore.

FinRight’s service provides much-needed relief to individuals facing financial emergencies, home purchases, or other urgent expenses, says Kanekar.

“Eight out of ten people discover problems with their EPF only when they need funds, and that’s a challenge we aim to address head-on.”

Building a holistic ecosystem

FinRight competes with fintech firms such as like Paytm, Lendingkart, PhonePe, and Policybazaar in addressing financial queries and challenges related to personal finance.

Going forward, FinRight plans to tackle broader financial challenges, including taxation, investments, and estate planning. It is set to launch a ‘Get Your EPF Reviewed’ service, enabling users to identify discrepancies in their EPF accounts instantly with just a few clicks.

“Our vision is to build a holistic financial ecosystem where individuals can manage all aspects of their savings and investments effortlessly. PF withdrawal is just the beginning—we are continuously innovating to bring more intelligent financial solutions to users,” says Kanekar.

The startup is in advanced talks to raise about $1.5 million in the coming months to expand its services.

Edited by Swetha Kannan

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)