Fed’s Goolsbee says it’s ‘not realistic’ to expect business or central banks to make major decisions

Despite all the tumult in the markets, the underlying data—which comes in with a lag—suggests the economy is still faring well, Chicago Fed president Austan Goolsbee said.

- The Federal Reserve is continuing to wait for more data before making any decisions about rate cuts. Chicago Fed president Austan Goolsbee refers to himself as a “data dog” that just wants to better assess the state of the economy.

Federal Reserve Bank of Chicago president Austan Goolsbee said the central bank is still waiting for more economic data that will ultimately influence its decision about whether to change interest rates.

April’s CPI report released Tuesday showed overall inflation was at 2.3% while core inflation, which excludes volatile food and energy prices, came in at 2.8%. Goolsbee cautioned these numbers came with a month-long delay.

“They only come out with a lag of a month or so,” he said during an interview with NPR’s Morning Edition. “So we're still kind of holding our breath.”

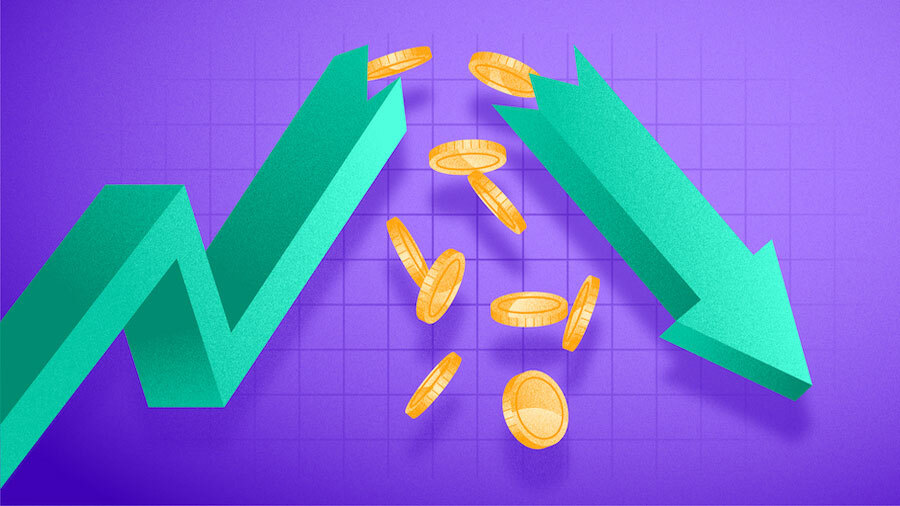

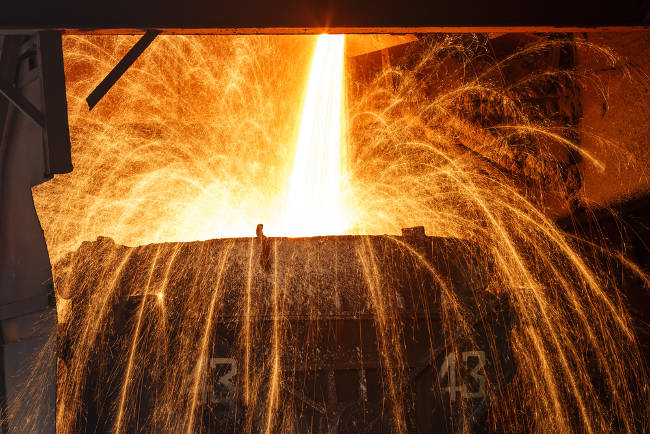

The relatively benign inflation report meant some of the worst fears that the White House’s tariff policy would send prices soaring haven’t come to fruition—at least not yet. Much of the concern from businesses and consumers stems from the lack of certainty about what could happen in the economy. When that happens, they tend to pull back on spending.

“When there are moments of a lot of dust in the air, like what we saw a bit in April, you can go into some of this paralysis, but it still takes some time for that to show up in the numbers,” Goolsbee said.

April saw considerable market turmoil as President Donald Trump implemented a new widespread tariff policy that disrupted much of the U.S.’s trade with the world. The whipsawing nature of the policy put businesses in a holding pattern, as they waited to see where the dust would settle regarding the White House’s trade policy.

“It's just, I think, not realistic to expect businesses or central banks to be jumping to conclusions about long-term things when you've got so much short-term variability,” Goolsbee said. “It's just a very difficult environment.”

The Fed has held off on making any interest-rate cuts so far this year on the grounds the economy is still solid, despite the uncertainty. Federal Reserve Chair Jerome Powell has reiterated throughout the year that the central bank doesn’t need to rush into any decisions one way or the other. The central bank has been in an extended wait-and-see mode as it waits for more hard data about the economy.

“People would ask me, ‘Are you a dove or are you a hawk?,’” Goolsbee said. “I say I don't even know if I like birds.”

Instead, Goolsbee referred to himself as a “data dog” that bases his decisions on objective measurable data about the economy. Right now, he is waiting for more info, Goolsbee said.

“The first rule of the data dogs is, know the difference between the time for walking and the time for sniffing,” he said. The time for sniffing is when you need more information.”

So far, the overall data does show a stable economy. Inflation is still hovering above the Fed’s 2% target, but that’s been a persistent problem that predates any tariff announcements. The unemployment rate is steady at around 4%, a number that hardly indicates the widespread job losses that precede a recession. Consumer sentiment has plummeted over the last month largely on the back of President Trump’s tariff announcements. However, there is a growing amount of research that shows consumer sentiment is becoming increasingly disconnected from consumer behavior. If that holds true for the moment, it means bad feelings about the economy won't necessarily translate into lower spending.

But the Fed pays less attention to day-to-day changes, no matter how drastic they are, Goolsbee said. “It's important to remember that at the Fed our job is to be the steady hand, not respond to the daily gyrations, either of the stock market or of policy pronouncements,” he said. “We've continued to get these numbers that at least suggest that it's going okay.”

This story was originally featured on Fortune.com

![SWOT Analysis: What It Is & How to Do It [Examples + Template]](https://static.semrush.com/blog/uploads/media/86/6a/866a1270ca091a730ed538d5930e78c2/do-swot-analysis-sm.png)