Bitcoin at $81,552 faces risk of bull trap as US-China tensions escalate

QCP Capital warns of a bull trap if China retaliates. Market makers are said to be selling into the rally ahead of May and June. USD/CNY hits 7.35, triggering capital outflows from China. Bitcoin (BTC) surged past $82,000 earlier this week, but the rally’s stability remains in question. At the time of writing, BTC is […] The post Bitcoin at $81,552 faces risk of bull trap as US-China tensions escalate appeared first on CoinJournal.

- QCP Capital warns of a bull trap if China retaliates.

- Market makers are said to be selling into the rally ahead of May and June.

- USD/CNY hits 7.35, triggering capital outflows from China.

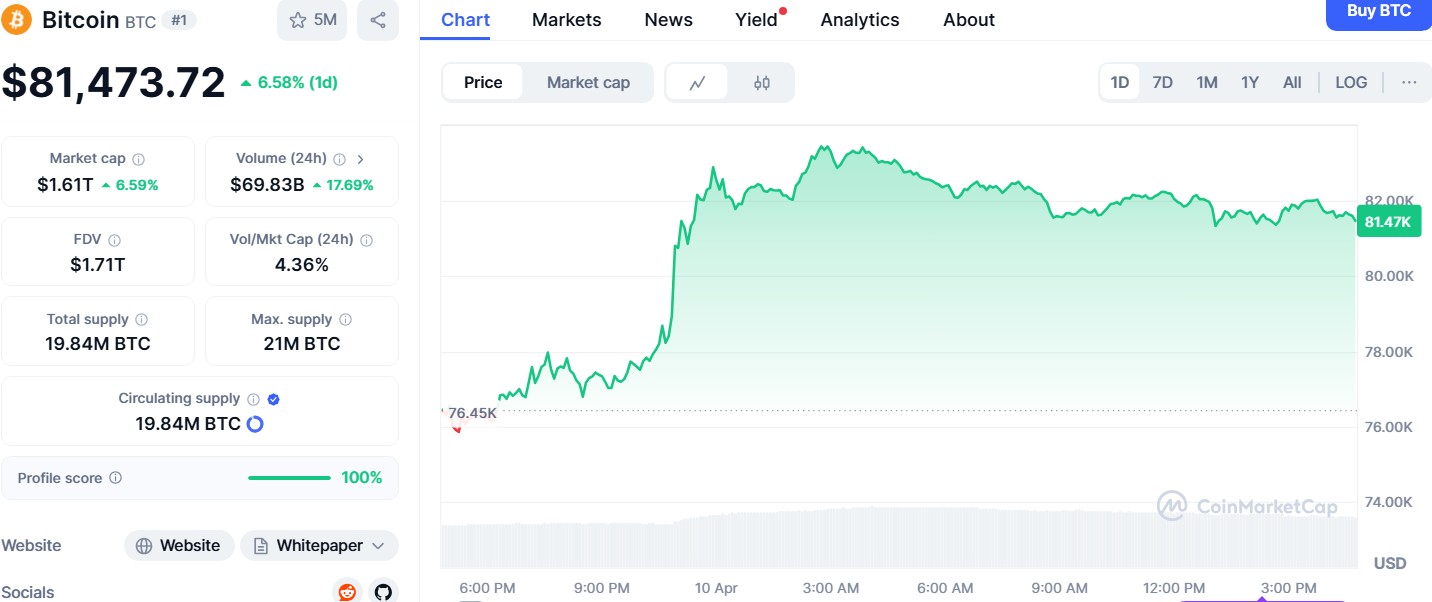

Bitcoin (BTC) surged past $82,000 earlier this week, but the rally’s stability remains in question.

At the time of writing, BTC is trading at $81,473.

Source: CoinMarketCap

Despite a broader rise across global stock and crypto markets, analysts are now warning that Bitcoin could be walking into a classic bull trap as the US-China trade war takes another turn.

Market participants, buoyed by news of tariff pauses for several nations, are bracing for a potential counterstrike from Beijing after President Trump kept restrictions in place for China.

If retaliation materialises, Bitcoin’s upward trend could reverse sharply, fuelled by macro uncertainty.

QCP flags May-June correction

Bitcoin and altcoins rallied alongside equities following a decision by President Trump to roll back some tariffs, but with China excluded from the relief, markets are anticipating aggressive countermeasures from Beijing.

QCP noted that the short-term rally has led to a decrease in crypto volatility, especially on the short end.

However, the firm’s internal trading desk continues to see “topside selling in May and June,” suggesting that many market makers are using the current rally as an exit strategy rather than a long-term vote of confidence.

This view is supported by historical market reactions.

Earlier in the week, a rumour of a broader tariff pause had already created sharp whipsaw movements in stocks and crypto, as the lack of official confirmation caused investor sentiment to shift rapidly.

QCP pointed out that “exuberant rallies” under such uncertain conditions can easily transform into bull traps—situations where prices rise quickly, only to drop sharply, trapping investors in losing positions.

Yuan slide fuels BTC demand

While warnings of a bull trap loom, others see a different side of the coin.

The Chinese yuan (CNY) has fallen to an 18-year low against the US dollar, with the USD/CNY pair reaching 7.35.

This devaluation could become a catalyst for further capital flight from China, according to some market watchers.

Sina, co-founder of 21st Capital, pointed out on X (formerly Twitter) that “when the yuan weakens, capital doesn’t stay put.” Historically, such moves have led to an outflow of funds into gold, foreign assets, and increasingly, into Bitcoin.

For Chinese investors looking to shield their capital from both currency devaluation and trade policy unpredictability, BTC offers a decentralised alternative.

This dynamic positions Bitcoin not just as a hedge, but as an escape valve in a time of mounting financial pressure.

The idea that BTC is becoming a “necessity” in unstable environments is gaining traction, especially in markets facing tight capital controls and weakening fiat currencies.

BTC stability still uncertain

While capital outflows from China may boost short-term demand for BTC, analysts are not yet convinced that Bitcoin has hit a long-term bottom.

Price targets for a meaningful and sustained rebound continue to focus on the $70,000 range, which many technical indicators have flagged as a critical support and resistance level.

The $81,552 price point represents a notable high, but there’s increasing scepticism about whether the current momentum can be sustained without more favourable macroeconomic signals.

Trade dynamics, currency moves, and interest rate policy will all continue to play a role in Bitcoin’s trajectory in the coming weeks.

With global macroeconomic uncertainty colliding with rising investor interest in alternative stores of value, Bitcoin is navigating a highly volatile phase.

While the digital asset may benefit from yuan-driven outflows and tariff fears, any escalation in trade tensions, particularly if China responds aggressively—could turn current gains into short-lived spikes.

The post Bitcoin at $81,552 faces risk of bull trap as US-China tensions escalate appeared first on CoinJournal.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)