Aave DAO approves $24 million AAVE buyback amid rising DeFi institutional interest

439,000 votes support the proposal, with only 2,020 against. AAVE price rises to $133.50 ahead of buyback. Institutional DeFi use expected to triple by 2026. The Aave Decentralized Autonomous Organization (DAO) has approved a six-month token buyback programme worth $24 million, beginning April 9. The initiative, which will see $1 million in AAVE tokens bought […] The post Aave DAO approves $24 million AAVE buyback amid rising DeFi institutional interest appeared first on CoinJournal.

- 439,000 votes support the proposal, with only 2,020 against.

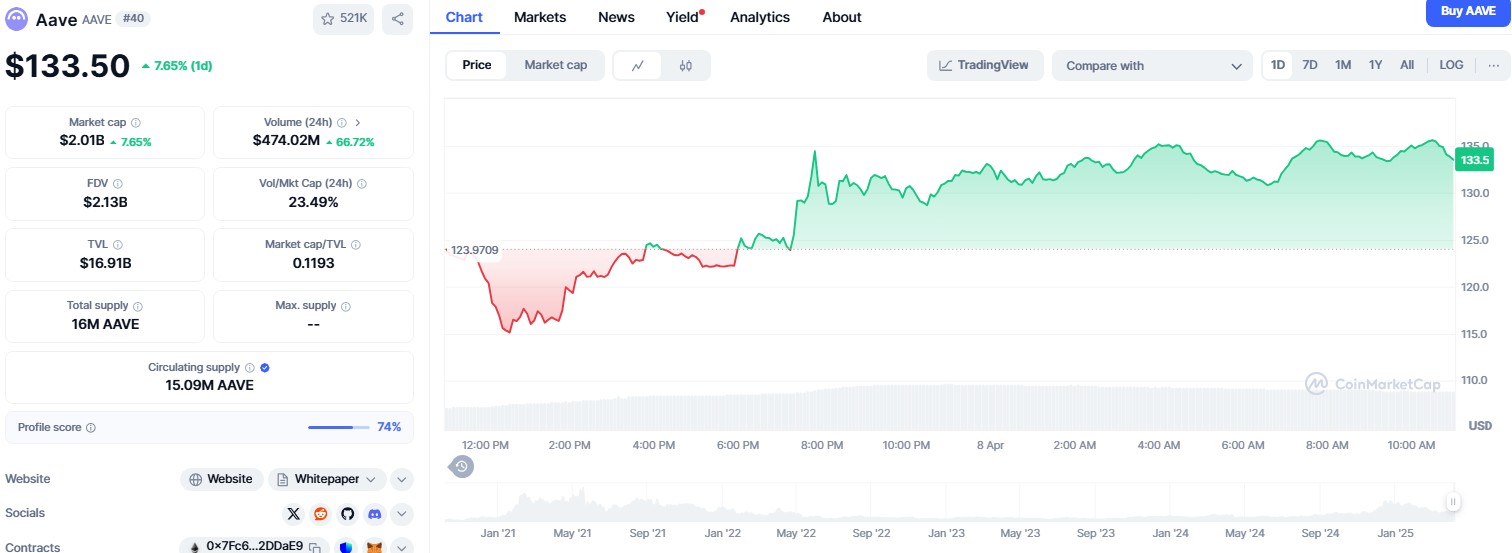

- AAVE price rises to $133.50 ahead of buyback.

- Institutional DeFi use expected to triple by 2026.

The Aave Decentralized Autonomous Organization (DAO) has approved a six-month token buyback programme worth $24 million, beginning April 9.

The initiative, which will see $1 million in AAVE tokens bought back each week, is designed to strengthen the protocol’s long-term financial structure and provide better incentives for stakeholders.

The vote passed with 439,000 votes in favour, comfortably surpassing the required 320,000. Just 2,020 votes were cast against.

This development comes as the decentralised finance (DeFi) sector continues to attract growing institutional interest.

According to new data from Coinbase and EY-Parthenon, 83% of institutional investors plan to increase their digital asset exposure in 2025, with DeFi playing a key role in that expansion.

Aave committee to manage treasury

The buyback plan has led to the formation of the Aave Finance Committee (AFC), which will oversee the protocol’s treasury and ensure funds are managed transparently.

In its initial phase, the AFC will utilise $4 million worth of aEthUSDT from the DAO’s treasury, funding the first month of buybacks.

Each week, $1 million will be used to purchase AAVE tokens, effectively reducing token supply in circulation.

The committee is tasked with implementing financial best practices, maintaining transparency, and aligning incentives across the protocol.

It will also evaluate the results of the buyback pilot, which may be extended depending on performance.

AAVE rises to $133.50 ahead of buyback

The token buyback initiative arrives as AAVE shows signs of modest recovery.

The token is currently trading at $133.50, up from $131.55 earlier in the week.

Source: CoinMarketCap

While the market remains volatile, the price uptick precedes the start of the buyback programme and reflects growing anticipation around the DAO’s financial strategy.

By reducing the available supply of AAVE tokens, the buyback model aims to support long-term token value and improve investor engagement.

The strategy resembles traditional corporate stock repurchase plans, which are becoming more common among decentralised protocols with maturing governance structures.

Institutional DeFi use to triple by 2026

Alongside the Aave initiative, the broader DeFi ecosystem is seeing increased institutional interest.

While only 24% of institutions currently use decentralised finance tools, the figure is expected to triple to nearly 75% over the next two years.

According to the Coinbase-EY Parthenon report, staking, derivatives, and lending are the leading use cases among institutions, followed by cross-border payments, yield farming, and access to altcoins.

Nearly three-quarters of institutions surveyed already hold cryptocurrencies beyond Bitcoin and Ethereum.

This signals a shift toward broader DeFi adoption as firms look for tools that provide more flexibility and decentralisation.

Aave, which enables users to lend and borrow crypto assets without intermediaries, is positioned to benefit from this trend—especially as it introduces mechanisms to better manage protocol-level finance.

Aave buyback strategy may continue

The six-month AAVE buyback plan is structured as a trial but could extend beyond its initial phase.

Aave Chain Initiative founder Marc Zeller has suggested the timeline might be revised based on performance.

The DAO has not made a final decision on further funding, but the strong vote in favour of the current plan indicates community alignment.

As Aave works to adapt its financial strategy to both community and market expectations, the protocol’s ongoing efforts may serve as a model for other DAOs looking to implement treasury management programmes.

With a formal committee now in place and rising institutional focus on decentralised lending platforms, the next phase of growth could see more integration between DeFi protocols and traditional finance players.

The post Aave DAO approves $24 million AAVE buyback amid rising DeFi institutional interest appeared first on CoinJournal.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)