Will Litecoin hit $100? Trump’s tariff pause, ETF hopes fuel debate

Litecoin surges 8% to $78.04 after Trump’s 90-day tariff pause boosts market sentiment. Fidelity’s IRA inclusion and 90% ETF approval odds signal growing institutional interest. Technical resistance at $100 looms, with $80 as the key level for a potential breakout. Litecoin ($LTC) surged 8% to an intraday high of $78.04 on Thursday, capitalizing on a […] The post Will Litecoin hit $100? Trump’s tariff pause, ETF hopes fuel debate appeared first on CoinJournal.

- Litecoin surges 8% to $78.04 after Trump’s 90-day tariff pause boosts market sentiment.

- Fidelity’s IRA inclusion and 90% ETF approval odds signal growing institutional interest.

- Technical resistance at $100 looms, with $80 as the key level for a potential breakout.

Litecoin ($LTC) surged 8% to an intraday high of $78.04 on Thursday, capitalizing on a broader market uplift following US President Donald Trump’s 90-day pause on most newly imposed tariffs.

The White House framed this move as a strategic adjustment, maintaining a 10% baseline tariff while raising duties on Chinese goods, a policy shift that had previously unsettled markets.

The reprieve has sparked optimism, with Litecoin emerging as a standout performer among altcoins, trading at $73.70 with a 4% intraday gain as of this writing.

This rally raises the question: Can Litecoin break through the $100 resistance level amid supportive market conditions?

The tariff pause, detailed in a White House release, has eased pressure on risk assets, including cryptocurrencies, which often react to macroeconomic signals.

Crypto experts on X reflect a surge in bullish sentiment, with traders noting Litecoin’s resilience and speculating on a potential push toward $100.

However, this optimism must be tempered by the broader context. Trump’s tariff strategy, while paused, remains a wildcard, and its long-term impact on global trade could still influence crypto markets.

The short-term rally suggests investor confidence in a stabilization period, but the sustainability of this momentum hinges on policy clarity and market adoption.

Litecoin’s enduring legacy and institutional backing

Litecoin’s ability to weather market cycles bolsters its case.

A CoinShares report highlights that, of the over 24,000 tokens launched since 2014, $LTC is one of the few survivors, ranking behind Bitcoin as the only cryptocurrency with significant valuation since 2011.

This durability is underpinned by practical utility—BitPay data shows Litecoin leading transaction volume on its platform for 22 consecutive months, a testament to its role in payments.

The addition of Litecoin to Fidelity’s no-fee crypto IRA in March, reported by The Block on April 2, 2025, further signals institutional interest, offering tax-advantaged retirement account inclusion. This move could attract long-term investors, potentially supporting a price ascent if market conditions align.

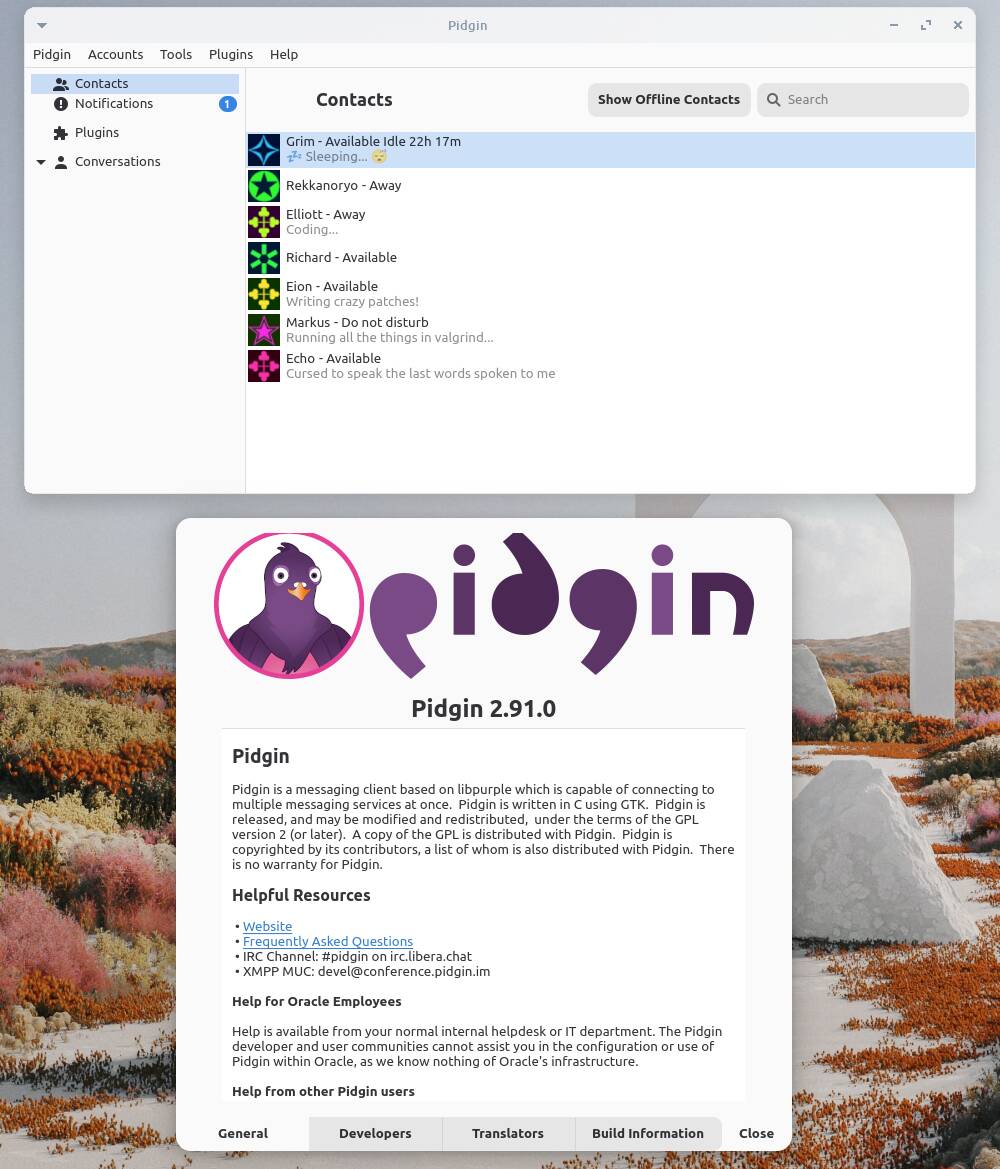

The prospect of a Litecoin exchange-traded fund (ETF) adds another layer of intrigue.

In February, Litecoin joined the Depository Trust and Clearing Corporation (DTCC) ETF eligibility list, a procedural step noted by Crypto Briefing on February 19, 2025.

Hashdex’s March 18 amendment to include Litecoin in its Nasdaq Crypto Index US ETF, covered by Cointelegraph, has fueled speculation.

Bloomberg analysts James Seyffart and Eric Balchunas estimate a 90% approval odds by year-end, citing regulatory parallels with Bitcoin and Ethereum ETFs.

This institutional tailwind could drive demand, though the SEC’s historical caution on market manipulation and custody risks, as noted by ETF.com’s Sumit Roy in Blockworks on February 11, 2025, warrants scrutiny.

The establishment narrative of inevitable ETF approval should be questioned—regulatory hurdles remain, and past delays suggest uncertainty.

Technical challenges test the $100 threshold

Technically, Litecoin faces a steep climb.

TradingView charts depict a descending channel since its late 2024 peak above $140, with a failed $100 resistance test in early March triggering a drop to $65.

The current $73.70 price reflects a recovery, but momentum indicators like the RSI Divergence, which signaled bearishness earlier this month, indicate fragility.

The $60-$68 range is a critical support zone, while a sustained move above $80 could challenge the channel’s upper boundary, setting the stage for a $100 retest.

Historical price action offers perspective.

Litecoin hit an all-time high of $412 in May 2021, per CoinMarketCap, but has struggled to reclaim triple-digit levels consistently. The February 3, 2025, 27% drop after initial tariff announcements, reported by LiteFinance on April 7, underscores its sensitivity to macroeconomic shifts.

A successful $100 breach would need sustained buying pressure, potentially from ETF-related news, but the current consolidation pattern suggests resistance could persist without a catalyst.

Balancing optimism with realism

Can Litecoin hit $100? The tariff pause has provided a short-term boost, amplifying its 8% surge and pushing it closer to key levels.

Institutional moves like Fidelity’s IRA inclusion and the 90% ETF approval odds from Bloomberg analysts offer a bullish foundation.

These developments could attract capital, especially if the SEC greenlights an ETF by late 2025.

Yet, skepticism is warranted. The SEC’s cautious stance, as echoed by Roy, and Litecoin’s declining market rank (from top 10 to 19, per CoinCodex on March 7, 2025) raise doubts about its ability to sustain momentum.

Technical resistance at $100, reinforced by a double-top pattern noted by Finance Magnates on January 20, 2025, poses a significant barrier.

A drop below $68 could see it revisit $55, aligning with bearish forecasts from CCN.com on January 5, 2025, predicting a $56 low.

The tariff pause’s impact is temporary—Trump’s broader economic agenda, including potential retaliatory measures from China, could reverse gains.

Litecoin’s fate also depends on Bitcoin’s trajectory; a stall below $100,000, as noted by FXStreet on January 16, 2025, could drag altcoins down.

If $LTC breaks $80 with strong volume and ETF news materializes, $100 is achievable by mid-2025.

Otherwise, it risks consolidation or decline. Investors should monitor SEC developments, on-chain activity, and global trade dynamics, as these will shape Litecoin’s path in this volatile landscape.

The post Will Litecoin hit $100? Trump’s tariff pause, ETF hopes fuel debate appeared first on CoinJournal.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)