Unpacking Mantra’s OM crash requires forensic study — CertiK exec

Mantra founder and CEO John Mullin has begun an $80 million burn of OM tokens to regain users’ trust following the token’s sudden crash earlier in April. However, the question of the underlying reasons for the OM crash remains unanswered, blockchain investigators told Cointelegraph.Unpacking Mantra’s OM crash requires a detailed forensic study rather than just basic blockchain analysis, Natalie Newson, senior blockchain investigator at the blockchain security firm CertiK, said.“A full forensic investigation, akin to what we saw post-FTX, would be needed to substantiate claims of calculated exploitation,” Newson told Cointelegraph, highlighting challenges of tracing over-the-counter (OTC) transactions.Newson’s perspective on the OM crash came days after Mantra released its post-crash statement, asking centralized exchange partners to collaborate on further unpacking the incident.Onchain activity versus opaque OTC dealsAddressing the OM token crash, CertiK’s Newson stressed the importance of distinguishing between public onchain activity and the “more opaque nature of OTC deals.”Mantra CEO Mullin publicly disclosed that the Mantra team “has done a small amount of OTCs” up to $30 million of OM tokens in an interview with Coffeezilla on April 15.Mantra’s founder and CEO, John Mullin, in an interview with Coffeezilla. Source: YouTubeUnlike traceable transactions on centralized exchanges, OTC crypto transfers involve a method of buying and selling cryptocurrencies outside of exchanges, designed to enable deep liquidity and big trades while mitigating the volatility of prices.“In this case, the accumulation of approximately 100 million OM by a whale appears to have been the result of secondary market transactions — not necessarily direct activity from Mantra insiders,” Newson said.Analysis by Arkham or Nansen is not enoughAs previously mentioned, Mullin denied allegations that the OM crash resulted from an insider token dump, claiming that the blockchain analytics platform Arkham “mislabelled” some of the wallets.Newson said that data from Arkham and similar platforms like Nansen would be insufficient to confirm or deny insider involvement.“To confirm coordinated insider behavior, it would likely require more than just basic wallet tracing on platforms like Arkham or Nansen,” Newson said, adding:“Blockchain analytics tools can provide directional clues, but without access to offchain agreements and centralized exchange records, drawing definitive conclusions would be difficult.”Newson is not alone in highlighting the complicated nature of tracing transactions in the OM token crash.Related: Mantra OM token crash exposes ‘critical’ liquidity issues in crypto“There are ways to get data from the node, but it does not seem to be easy to get a full history,” Whale Alert’s co-founder Frank Weert told Cointelegraph.Mullin previously said that the team has been considering hiring a forensic auditor following the OM crash, but had made no decisions as of April 16.Arkham did not respond to multiple Cointelegraph inquiries to comment on the Mantra incident.Magazine: Altcoin season to hit in Q2? Mantra’s plan to win trust: Hodler’s Digest, April 13 – 19

Mantra founder and CEO John Mullin has begun an $80 million burn of OM tokens to regain users’ trust following the token’s sudden crash earlier in April. However, the question of the underlying reasons for the OM crash remains unanswered, blockchain investigators told Cointelegraph.

Unpacking Mantra’s OM crash requires a detailed forensic study rather than just basic blockchain analysis, Natalie Newson, senior blockchain investigator at the blockchain security firm CertiK, said.

“A full forensic investigation, akin to what we saw post-FTX, would be needed to substantiate claims of calculated exploitation,” Newson told Cointelegraph, highlighting challenges of tracing over-the-counter (OTC) transactions.

Newson’s perspective on the OM crash came days after Mantra released its post-crash statement, asking centralized exchange partners to collaborate on further unpacking the incident.

Onchain activity versus opaque OTC deals

Addressing the OM token crash, CertiK’s Newson stressed the importance of distinguishing between public onchain activity and the “more opaque nature of OTC deals.”

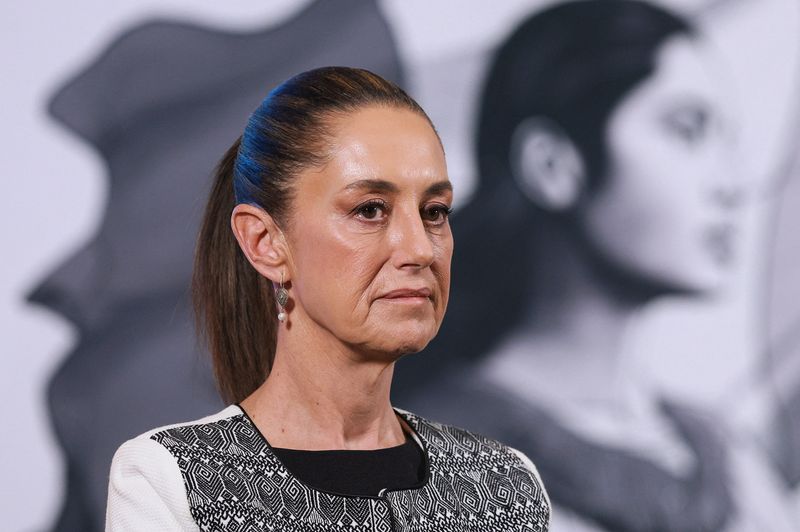

Mantra CEO Mullin publicly disclosed that the Mantra team “has done a small amount of OTCs” up to $30 million of OM tokens in an interview with Coffeezilla on April 15.

Unlike traceable transactions on centralized exchanges, OTC crypto transfers involve a method of buying and selling cryptocurrencies outside of exchanges, designed to enable deep liquidity and big trades while mitigating the volatility of prices.

“In this case, the accumulation of approximately 100 million OM by a whale appears to have been the result of secondary market transactions — not necessarily direct activity from Mantra insiders,” Newson said.

Analysis by Arkham or Nansen is not enough

As previously mentioned, Mullin denied allegations that the OM crash resulted from an insider token dump, claiming that the blockchain analytics platform Arkham “mislabelled” some of the wallets.

Newson said that data from Arkham and similar platforms like Nansen would be insufficient to confirm or deny insider involvement.

“To confirm coordinated insider behavior, it would likely require more than just basic wallet tracing on platforms like Arkham or Nansen,” Newson said, adding:

“Blockchain analytics tools can provide directional clues, but without access to offchain agreements and centralized exchange records, drawing definitive conclusions would be difficult.”

Newson is not alone in highlighting the complicated nature of tracing transactions in the OM token crash.

Related: Mantra OM token crash exposes ‘critical’ liquidity issues in crypto

“There are ways to get data from the node, but it does not seem to be easy to get a full history,” Whale Alert’s co-founder Frank Weert told Cointelegraph.

Mullin previously said that the team has been considering hiring a forensic auditor following the OM crash, but had made no decisions as of April 16.

Arkham did not respond to multiple Cointelegraph inquiries to comment on the Mantra incident.

Magazine: Altcoin season to hit in Q2? Mantra’s plan to win trust: Hodler’s Digest, April 13 – 19

![Which Countries Have Invested the Most Into AI Development [Infographic]](https://imgproxy.divecdn.com/qnTgGmUnhhtyx1NChJZ7bBc4fHuHc9BC8NoXo_nBWUE/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9pbnZlc3RtZW50X2luZm8yLnBuZw==.webp)

.jpg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)