XRP Trapped in Range; Oregon Sues Coinbase over XRP as Unregistered Securities

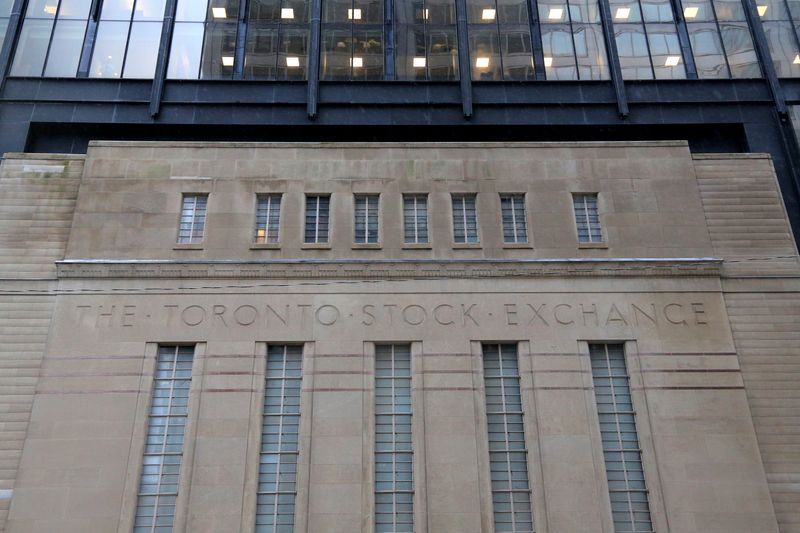

Oregon Attorney General Dan Rayfield has filed a lawsuit against Coinbase, accusing the publicly traded crypto exchange of violating the state’s securities law. The complaint claims that XRP and other digital assets available on Coinbase are unregistered securities.Meanwhile, the XRPUSD H1 chart indicates range-bound movement. The price has repeatedly tested an intraday support level but has yet to produce a strong bullish breakout above the recent swing high.Coinbase Faces Oregon Lawsuit for Securities ViolationsAnnounced on April 18, the lawsuit is part of what the Oregon Department of Justice called an effort to address a lack of enforcement by federal agencies. “States must fill enforcement vacuum being left by federal regulators who are abandoning these cases under Trump administration,” the department said.Coinbase’s Chief Legal Officer Paul Grewal responded on April 21, expressing his frustration in a post on X. Justin Slaughter, Vice President of Regulatory Affairs at Paradigm, noted that the complaint lists several tokens, including Aave, Avalanche, Uniswap, Near Protocol, and wLUNA, but not LUNA, Cointelegraph reported.The Oregon AG just filed a lawsuit against coinbase, claiming 31 tokens are unregistered securities. That’s 18 more than the SEC named. It includes heavyweights like $UNI, $AAVE, $FLOW, $LINK, $MKR… and yes, even $XRP. pic.twitter.com/bu8YEVPM6m— Cryptopolitan (@CPOfficialtx) April 22, 2025The complaint alleges that Coinbase made these assets available for trading through its main platform and Prime service, and that they qualify as securities under Oregon law. It does not explain the inclusion or exclusion of specific wrapped assets.You may want to read at FinanceMagnates.com: SEC Drops Coinbase Lawsuit as Crypto Task Force Promises Regulatory Clarity.Coinbase Adds XRP Futures After LawsuitYarden Noy, a partner at DLT Law, said a ruling that these assets are securities would not set binding precedent, even within Oregon. However, he noted the decision could still be used in arguments by regulators and plaintiffs.Ripple Labs, the issuer of XRP, previously faced a similar lawsuit from the SEC. That case was dropped in March. Coinbase added XRP futures to its derivatives platform on April 21, shortly after the Oregon complaint was filed. This article was written by Tareq Sikder at www.financemagnates.com.

Oregon Attorney General Dan Rayfield has filed a lawsuit against Coinbase, accusing the publicly traded crypto exchange of violating the state’s securities law. The complaint claims that XRP and other digital assets available on Coinbase are unregistered securities.

Meanwhile, the XRPUSD H1 chart indicates range-bound movement. The price has repeatedly tested an intraday support level but has yet to produce a strong bullish breakout above the recent swing high.

Coinbase Faces Oregon Lawsuit for Securities Violations

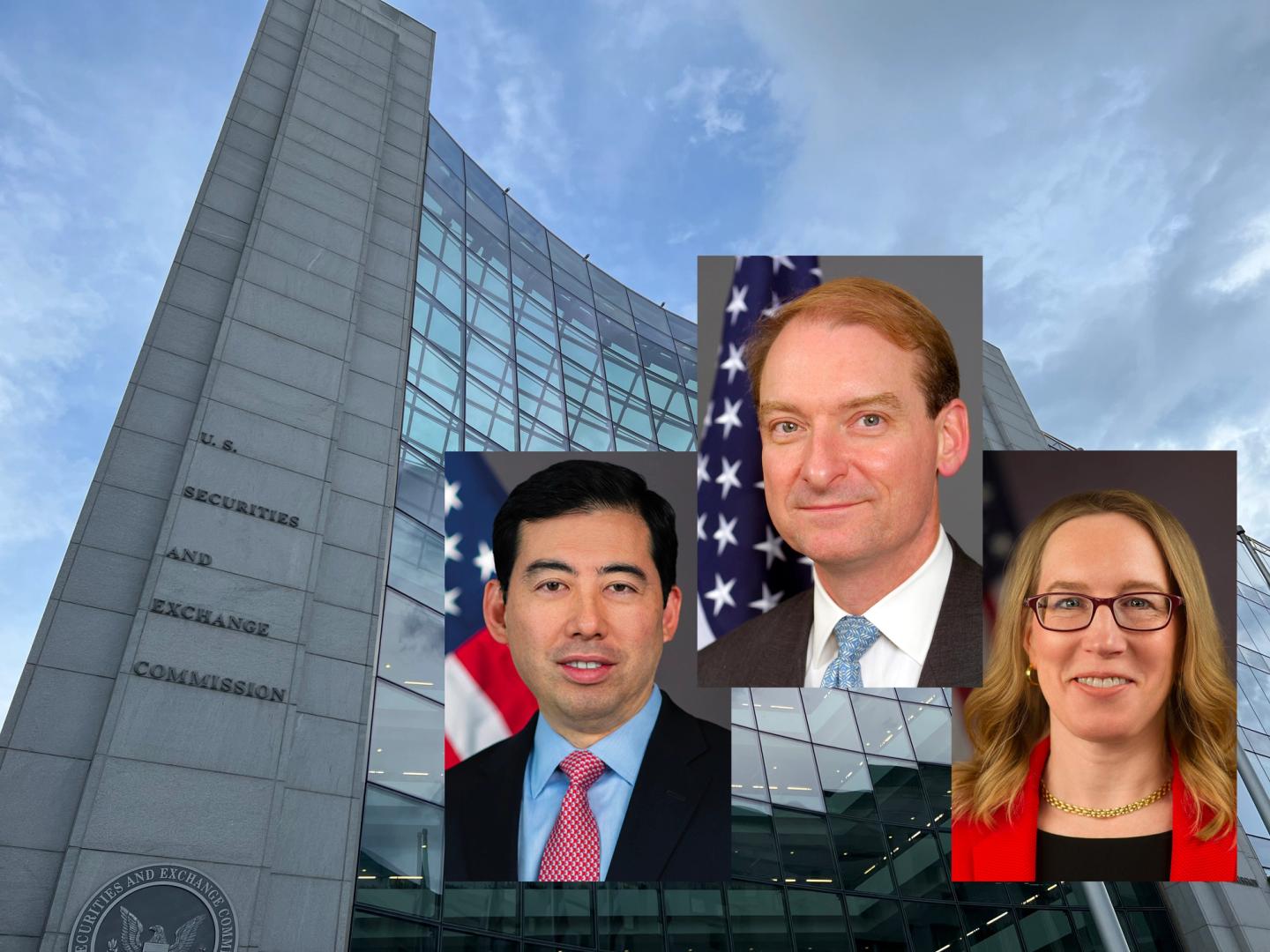

Announced on April 18, the lawsuit is part of what the Oregon Department of Justice called an effort to address a lack of enforcement by federal agencies. “States must fill enforcement vacuum being left by federal regulators who are abandoning these cases under Trump administration,” the department said.

Coinbase’s Chief Legal Officer Paul Grewal responded on April 21, expressing his frustration in a post on X. Justin Slaughter, Vice President of Regulatory Affairs at Paradigm, noted that the complaint lists several tokens, including Aave, Avalanche, Uniswap, Near Protocol, and wLUNA, but not LUNA, Cointelegraph reported.

The Oregon AG just filed a lawsuit against coinbase, claiming 31 tokens are unregistered securities. That’s 18 more than the SEC named. It includes heavyweights like $UNI, $AAVE, $FLOW, $LINK, $MKR… and yes, even $XRP. pic.twitter.com/bu8YEVPM6m— Cryptopolitan (@CPOfficialtx) April 22, 2025

The complaint alleges that Coinbase made these assets available for trading through its main platform and Prime service, and that they qualify as securities under Oregon law. It does not explain the inclusion or exclusion of specific wrapped assets.

You may want to read at FinanceMagnates.com: SEC Drops Coinbase Lawsuit as Crypto Task Force Promises Regulatory Clarity.

Coinbase Adds XRP Futures After Lawsuit

Yarden Noy, a partner at DLT Law, said a ruling that these assets are securities would not set binding precedent, even within Oregon. However, he noted the decision could still be used in arguments by regulators and plaintiffs.

Ripple Labs, the issuer of XRP, previously faced a similar lawsuit from the SEC. That case was dropped in March. Coinbase added XRP futures to its derivatives platform on April 21, shortly after the Oregon complaint was filed. This article was written by Tareq Sikder at www.financemagnates.com.

![Which Countries Have Invested the Most Into AI Development [Infographic]](https://imgproxy.divecdn.com/qnTgGmUnhhtyx1NChJZ7bBc4fHuHc9BC8NoXo_nBWUE/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9pbnZlc3RtZW50X2luZm8yLnBuZw==.webp)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)