Mid-market GCCs driving India tech industry growth: Report

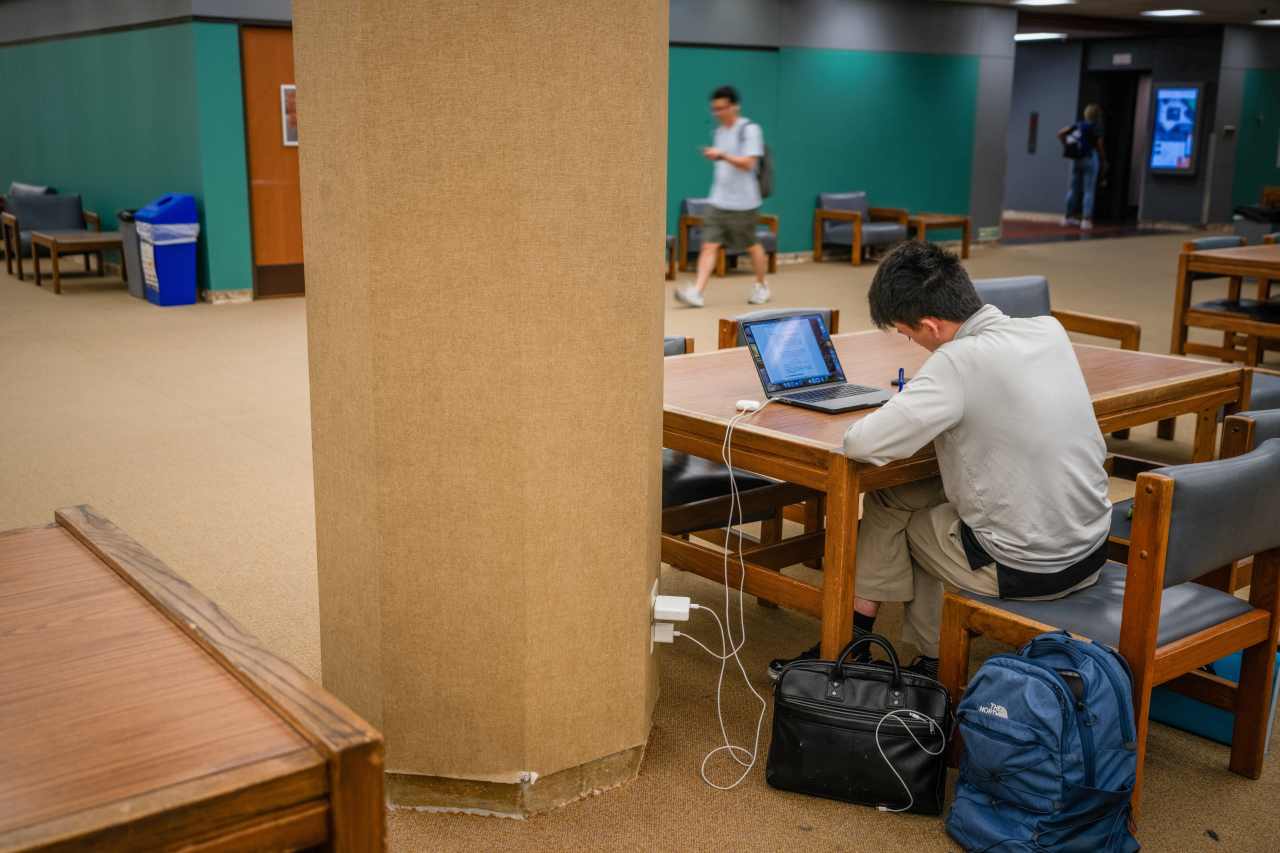

The GCC segment in India has started to attract companies whose revenue ranges between $100 million and $1 billion.

Global Capability Centres (GCCs) continue to be a key growth sector for the tech industry in India, contributing nearly one-third of the industry’s total exports and attracting a growing number of mid-market players.

India now houses over 480 mid-market GCCs, employing more than 210,000 professionals, and over 680 mid-market GCC units, according to a report by Nasscom and Zinnov.

The report, titles 'India’s GCC Leap: Capturing Global Mid-Market Momentum,' revealed that the mid-market segment accounts for 27% of all GCCs and 22% of total GCC units in the country.

Mid-market GCCs refer to capability centres established by mid-sized enterprises with annual global revenues typically ranging between $100 million to $1 billion.

According to the report, over 45 new mid-market GCCs have set up operations in India in the past two years alone, accounting for nearly 35% of total GCCs, and 30% of total GCC units during this period.

Nasscom President Rajesh Nambiar said, “The next wave of global capability will not come from size, but from speed, specialisation, and strategic influence. With world-class talent and a vibrant digital ecosystem, mid-market GCCs are no longer just delivery engines but are emerging as cultural innovation labs and centres of excellence, driving R&D, product innovation, and enterprise digitization for global impact.”

Despite operating at around 40% the scale of their larger counterparts (non-mid-market GCCs), mid-market GCCs are consistently delivering transformative outcomes across product innovation, enterprise agility, digital maturity and deepening niche skill capabilities. Their strategic focus and lean operating models have resulted in a 1.3X higher presence in transformation hubs, with a maturity curve advancing 1.2X faster than non-mid-market GCCs, the report noted.

It added that India is today home to 47% of global product management talent for mid-market GCCs and over 25% of their deeptech workforce, cementing its position as a global hotspot for next-gen capabilities in AI/ML, cybersecurity, cloud, and data science. Nearly 60% of end-to-end product and platform ownership in enterprise portfolios—particularly across ER&D segment—is being driven from India by mid-market GCCs.

Zinnov CEO Pari Natarajan said, “The most underrated transformation in India’s tech landscape is the rise of mid-market GCCs. These centers aren’t just scaled-down versions of large enterprises; they’re rewriting the playbook. Operating at 40% the scale, they’re 1.3x more likely to be transformation hubs and 1.2x faster in traversing the maturity curve.”

In terms of market distribution, Bengaluru, Hyderabad, Delhi-NCR, and Chennai remain leading destinations for mid-market GCCs, attracting 74% of all new GCC units established. In addition to Bengaluru, Hyderabad has rapidly emerged as a leading talent hotspot for mid-market GCCs in the last 5 years, contributing 25% of talent growth.

Edited by Kanishk Singh

.jpg)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)