The most powerful people in the world are bond vigilantes, who ‘boxed in’ Trump, top economist says

"And the traders, of course, trump Trump, and they forced him to back down to market discipline."

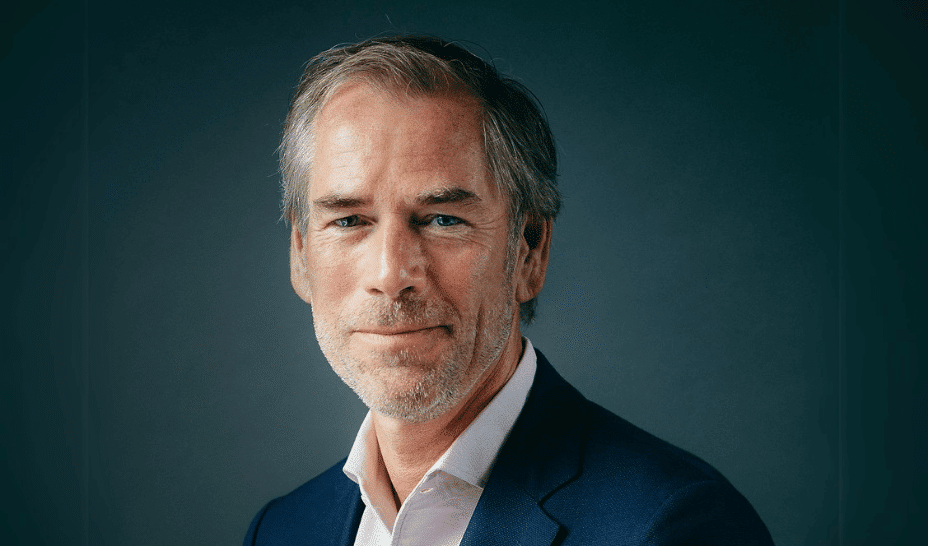

- Economist Nouriel Roubini remains bullish on the U.S., even after the tariff-induced market selloff, and has said its fundamental advantages will still be in place, regardless of who is president. That's as so-called bond vigilantes made their presence felt in financial markets after President Donald Trump unveiled his "Liberation Day" tariffs.

Financial markets have been swinging on President Donald Trump's executive orders, off-the-cuff statements, and social media posts, but traders can flex their muscles too.

In fact, bond investors caused Treasury yields to spike after Trump unveiled his steeper-than-expected global tariffs on "Liberation Day" last month. And that market turmoil reportedly spurred him to pause his reciprocal duties for 90 days.

The lesson was not lost on Nouriel Roubini, an economist and CEO of the consultancy Roubini Macro Associates, who remains bullish on the U.S. because its fundamental advantages will remain in place, regardless of who is president.

"Over the medium term, the fact that the U.S. is very innovative implies that whatever Trump does doesn't matter," he told Bloomberg TV on Thursday. "So tech trumps tariffs. Tech trumps Trump too. And the traders, of course, trump Trump, and they forced him to back down to market discipline. The most powerful people in the world are the bond vigilantes, and so I think he is boxed in."

The term “bond vigilantes” was coined by Wall Street veteran Ed Yardeni in the 1980s, referring to traders who protested huge deficits by selling off bonds to push yields higher.

The perceived power of bond vigilantes was famously illustrated in the early 1990s, when U.S. yields jumped as investors dumped Treasuries amid fears about federal deficits in what became known as the Great Bond Massacre.

James Carville, who was an adviser to President Bill Clinton at the time, mused that he would like to be reincarnated as the bond market: “You can intimidate everyone.”

While the U.S. budget deficit is in even worse shape than it was back then, the bond market has also been sensitive to concerns that Trump's aggressive tariffs will inflict long-term damage to the attractiveness of U.S. assets like Treasury debt.

Any reduction in demand for U.S. bonds would come as the supply has been soaring, with the Treasury Department needing to find buyers for a massive amount of debt to cover annual deficits that have exploded to $1 trillion and more.

'American exceptionalism will remain'

For his part, Roubini sees tariffs weighing the U.S. economy, but that impact will be more than offset by its technological advances in emerging areas like artificial intelligence, robotics, quantum computing, and fintech, among others.

Last month, he estimated that tech innovations will increase U.S. potential growth by 200 basis points from 2% to 4% by 2030, while tariffs would drag down growth by 50 basis points, even assuming a permanent average rate of 15% after negotiations.

“So Tech Trumps Tariffs even if Mickey Mouse or a clown were to run the US! It doesn’t matter and American exceptionalism will remain and be resilient regardless of Trump given the hyper dynamism and innovations of the US private sector,” he wrote in a post on X on April 10, a day after Trump announced his 90-day tariff pause.

A critical part of Roubini’s thesis is that the nature of innovation itself is shifting from producing an “initial growth spurt that fizzles out over time” to exponential growth that accelerates and gives first-movers enduring advantages versus followers.

He pointed to DeepSeek’s AI model that shocked Silicon Valley earlier this year, saying it’s not a revolution but an evolution that owes its existence to U.S. companies like OpenAI and their years of outsized investments.

“MAG-7, hyperscalers and tech firms (in Nasdaq) could not care less about tariffs,” he added. “They gotta continue and increase massive Ai capex to avoid becoming obsolete relative to each other.”

This story was originally featured on Fortune.com

![The Most Visited Websites in the World [Infographic]](https://imgproxy.divecdn.com/3KPmuOfGXy00YRzOoNbqLzjer0DNjeNRDdEboVf734o/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9tb3N0X3Zpc2l0ZWRfd2Vic2l0ZXMyLnBuZw==.webp)