Work-Bench’s new $160 million venture fund doubles down on New York enterprise tech investing

Why a 12-year bet on the New York tech ecosystem is paying off.

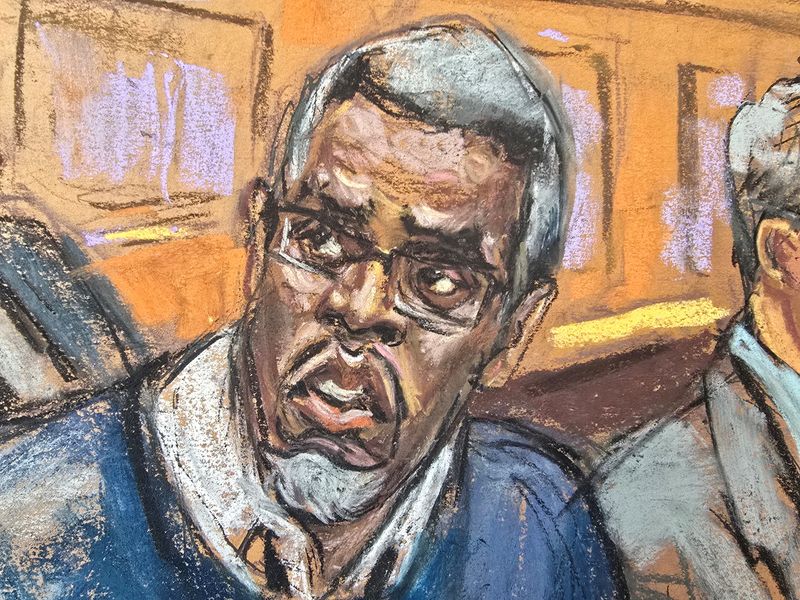

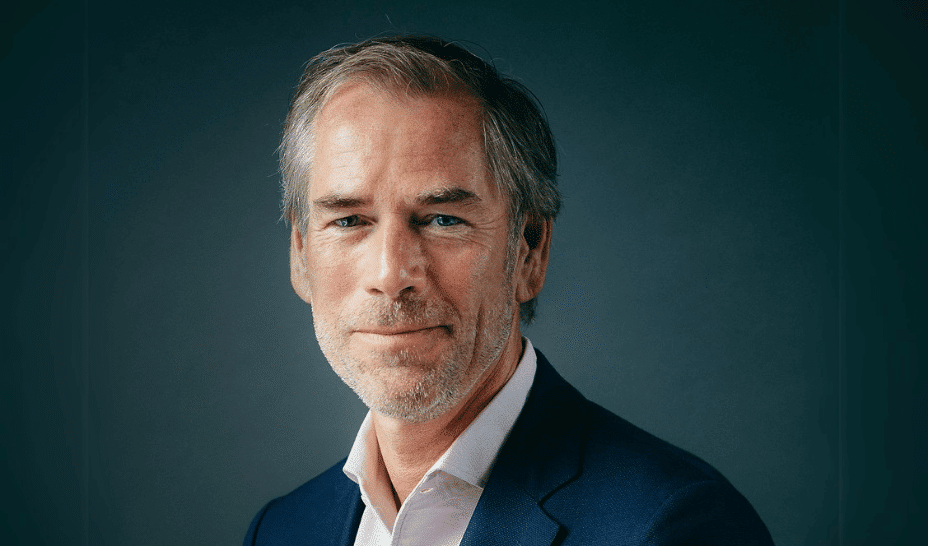

12 years ago, Jessica Lin and Jonathan Lehr made a bold bet on Silicon Valley venture capital: Most investors were trying to fit a square peg in a round hole. They saw VCs sniffing around the Google and Facebook campuses to find some new startup, which would then inevitably need to find early customers at Fortune 500 companies like JP Morgan. Lin and Lehr had the idea to flip the model of software investing by starting with the customer community, figuring out their pain points, and then finding the best early startups solving that problem. “We’re not trying to buy a lottery ticket to find the next Facebook,” Lehr told. “Within the enterprise, you can make it a game of 3D chess.”

The natural place to test out the thesis was New York, where a concentration of enterprise software customers is based, so that’s where Lin and Lehr started Work-Bench over a decade ago with a $10 million first fund. The bet has paid off. Work-Bench just closed a $160 million fourth fund with the same operating framework as its first, just at a much larger scale, and in a far more mature New York tech ecosystem. “We figured startups should build near their customers,” Lehr said from Work-Bench’s offices near Madison Square Park. “Thankfully, that has played out.”

Work-Bench is one of a crop of venture outfits that helped build the foundation of the contemporary New York tech scene, along with firms like AlleyCorp, Union Square Ventures, and BoxGroup. In the early 2010s, Lehr was working full-time at Morgan Stanley, where he helped bring startups into the bank. After his day job, he hosted an enterprise-focused tech meetup to bring together the “suits and the hoodies,” as he put it, where a startup's sales development rep could meet a potential customer from JP Morgan over drinks, rather than over a cold call.

Lehr and Lin, who was working at Cisco, met through a “professional arranged marriage,” as she put it. Their first backer, the legacy printing company R.R. Donnelley, introduced them, provided their initial funding, and set them up in a 32,000 square foot office space on 16th and 5th, with the initial idea of creating a startup accelerator.

While Work-Bench evolved into a more traditional venture model, that first office became a hub where the firm hosted companies and events—around 200 a year, before the lease ended before COVID. “OG people in New York will remember that space very fondly,” Lin said. (Work-Bench still hosts monthly events, though usually at other tech companies' offices, like Ramp.)

Lin and Lehr attribute Work-Bench's longevity to its laser focus on sales, which is rooted in building community and serving as a connector between corporations and early-stage companies. “For the startups at pre-seed, and seed,” Lehr said, “customers are like oxygen, so you're giving them the right intro at the right time, which helps them.”

It’s also knowing where to roll up their sleeves and help their portfolio companies, such as with the key zero-to-one challenge of building a customer profile and figuring out who to sell to. “The reality is that you can build a great product, but if you don't have distribution as well, success is going to be very challenging,” Lin said.

Lehr highlighted a few wins out of Work-Bench’s roster of startups. One, an identity verification company called Socure, grew up in the firm’s old office. Work-Bench introduced Socure to Bank of America, which became its first major customer and helped the startup secure more clients and funding. Socure’s last round in 2021 valued the company at $4.5 billion. Another seed investment from Work-Bench, the mental healthcare platform Spring Health, was last valued at $3.3 billion in a 2024 funding round.

Lehr said that around 50% of Work-Bench’s investments are in New York-based startups, with the firm typically focused on leading $2 million to $6 million pre-seed and seed rounds, though it will also do follow-on checks into Series A and B rounds.

Despite the continued fear over the liquidity crunch making it harder for venture firms to raise from limited partners, Lehr said that the fourth fund was Work-Bench’s smoothest raise yet, largely because of its consistent approach. “In some ways, we’re very boring,” Lin told me. “If you ask us, what's new, quite frankly, nothing's new.”

The caveat, of course, is the rise of AI, though Lehr noted that the hype around adoption has impacted deal sizes and company growth, but not necessarily sales cycles, which is Work-Bench’s bread and butter.

“We’re still doing exactly what we set out to do 12 years ago,” Lin said. “It's just enterprise, seed, New York City, go to market.”

Leo Schwartz

X: @leomschwartz

Email: leo.schwartz@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter. Subscribe here.

This story was originally featured on Fortune.com