Saudi Arabia wants to build its post-oil future with massive AI data centers — Trump and U.S. tech have big incentives to oblige

In a geopolitical chess game with billions at stake, Saudi Arabia, the U.S. and Nvidia all have something to gain.

President Donald Trump hit the sands of Saudi Arabia on Tuesday, kicking off a Gulf tour at the Saudi-U.S. Investment Forum—joined by tech CEOs including Nvidia’s Jensen Huang, OpenAI’s Sam Altman, AMD’s Lisa Su, and Tesla’s Elon Musk.

Saudi Arabia’s AI ambitions were front and center as Trump made clear he is looking for even more U.S. investment from the Kingdom, seeking an additional $400 billion above the $600 billion Crown Prince Mohammed bin Salman already promised in a January phone call with Trump.

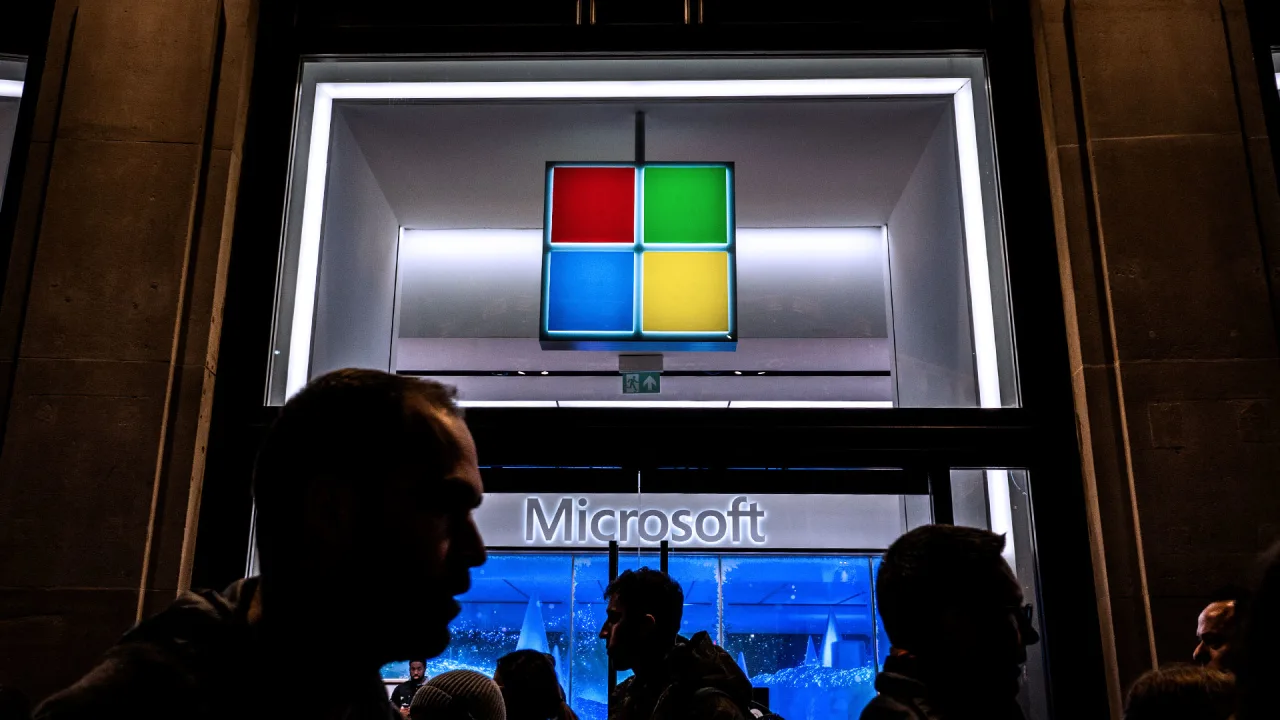

That means deals are being made. In advance of the meeting yesterday, the Crown Prince launched Humain, a new company to develop and manage AI in Saudi Arabia. On Tuesday, Trump granted Humain, as well as United Arab Emirates-based AI firm G42, increased access to U.S.-made advanced AI chips, particularly from Nvidia—easing prior export control restrictions implemented under the Biden administration that limited the Saudis' access to cutting-edge American technology. Finally, Humain announced strategic partnerships with Nvidia and AMD to leverage their AI chips and infrastructure to establish Saudi Arabia as a global leader in AI.

Humain announced it would build massive AI data centers in Saudi Arabia to train and deploy the Kingdom’s sovereign AI models. Over the next five years the country will construct data centers packed with hundreds of thousands of Nvidia’s most advanced chips and a projected capacity of up to 500 megawatts. The first deployment will be 18,000 of Nvidia’s latest chips to power a Saudi supercomputer.

Foreign policy and technology experts say the U.S. and Saudi negotiations around AI, with American tech companies in the mix, are the equivalent of a geopolitical chess game with billions—even trillions—of dollars at stake. Saudi Arabia, with its Vision 2030 initiative, wants to move away from its oil dependency, while gaining regional dominance as the Middle East’s AI leader and as a global soft power in the sphere of tech decision-making. The U.S. has plenty of interest in playing along: Companies like OpenAI, Alphabet's Google, Meta, and Musk’s xAI are seeking deep-pocket money for their own R&D, data centers, and expansion. And the U.S. government wants to keep Saudi Arabia in its orbit rather than having the Kingdom dependent on Chinese technology—at a moment when China's Belt and Road Initiative (BRI) includes significant AI and digital infrastructure investments across the Middle East.

"The deals celebrated today are historic and transformative for both countries and represent a new golden era of partnership between the United States and Saudi Arabia," the White House said in a statement on Tuesday.

Embedded in the AI supply chain

The fact that Humain has been founded by the Kingdom’s Public Investment Fund, [the sovereign wealth fund that invests tens of billions of dollars of Saudi Arabia's oil profits,] reflects the fact that this is an area of strategic priority for the Saudi government, said Andrew Leber, assistant professor in the department of political science and the Middle East & North African Studies program at Tulane University. “The public investment fund has enormous capital to put towards projects that they think will ultimately put Saudi Arabia at the center of global supply,” he said. “If Saudi Arabia is deeply embedded in the AI production process for Silicon Valley, for a country like the United States, that in turn further centers them in the global economy.”

Humain is essentially the embodiment of Saudi Arabia’s global and regional AI ambitions, added Martin Marayakam, a policy analyst who specializes in emerging technologies and security at Johns Hopkins School of International Studies. He explained that Riyadh understands it cannot become a global AI superpower—the real race is between the United States and China—but leading in AI development and deployment, at least in the Middle East, hits several of the Crown Prince’s targets for the country’s long-term vision.

“This isn’t simply an economic imperative for a country and government whose entire economy is based on oil exports,” he said. “It is a geopolitical move in line with Saudi Arabian aspirations for regional leadership in the Middle East and specifically in the Arab world—one of Humain’s main goals is, unsurprisingly, to become the leading developer of Arabic-language LLMs."

But some experts cited concerns about the national security risks of opening up so much access for Saudi Arabia’s AI ambitions, as well as the consequences of allowing the Kingdom so much economic and geopolitical influence.

“Ever since the Trump administration came into power, Saudi Arabia has been lobbying consistently to [get taken] off the restricted list," said Janet Egan, senior fellow, technology and national security, at the Washington, D.C., think tank Center for a New American Security, referring to the list of countries the U.S. restricts from purchasing advanced AI chips. “The thing I'm worried about at the moment is that America makes short-term trade deals for short-term benefit—signing away any restrictions on chips—that undermine the United States’ long-term strategic advantage.”

She emphasized that from a security perspective, it does make sense to do some partnerships with Gulf states like Saudi Arabia and the UAE. “We do want to bring them closer into the democratic orbit, even though they're non-democratic nations,” she said. “But the idea of giving them unrestricted access when they have the energy, the capital, the money, the regulatory cut-through because of authoritarian regimes–when they outgrow the need for the U.S., I think that's a real issue.” The U.S. has a very strong hand, she added: “They have a lot of leverage, and should use it, not throw that away easily.”

An enticing opportunity for U.S. tech firms

In the age of AI, commercial ambitions, strategic alliances, and geopolitical maneuvering are becoming inseparable. Nvidia has been at the forefront of lobbying efforts to ease U.S. export controls on advanced AI chips. Meanwhile, OpenAI doubled down on this agenda in January with its economic blueprint, "AI in America," urging policymakers to welcome investments from Middle Eastern nations. The report argued that if countries like the UAE and Saudi Arabia aren’t funneled into U.S. tech infrastructure, their capital will inevitably flow to China instead.

And companies like Scale AI, a startup backed by Amazon that was valued at more than $13 billion last year, are setting up shop in Saudi Arabia and other Gulf states. Scale AI announced Monday that it would open an office in Saudi Arabia by the end of the year. In an example of the intertwining fortunes of the AI industry and the U.S. government, Michael Kratsios, who leads the U.S. Office on Science and Technology Policy, was most recently managing director at Scale AI (and before that was Trump’s Chief Technology Officer during his first term).

Saudi Arabia is not new to investing in the U.S. tech landscape, of course. The PIF was a big investor in Twitter and Uber, for example, as well as in the Softbank Vision Fund and the Blackstone Infrastructure Fund. But the Kingdom’s vision of becoming an AI hub—and tech companies’ desire to support that—is now coalescing into an overarching objective, which was on display at last October’s Future Investment Initiative in Riyadh, often dubbed "Davos in the Desert."

“They've got the funding and the size of the economy and the heft, they can compete with the UAE in terms of how much funding and permitting and offers they can throw around it to make AI happen there,” said Egan, of the Center for a New American Security.

And with a network of powerful AI data centers, Saudi Arabia is betting it could become economically indispensable to the kinds of supply chains that will become increasingly vital for countries like the United States, said Tulane University’s Leber.

“They really believe the promises of Silicon Valley executives, that this is an area where, if they invest money up front now, there will be a sizable non-oil revenue stream for them in the future,” said Leber. “They really want to get in on the ground floor of this.”

This story was originally featured on Fortune.com