Meet the startup taking on Nintendo, Xbox, and PlayStation

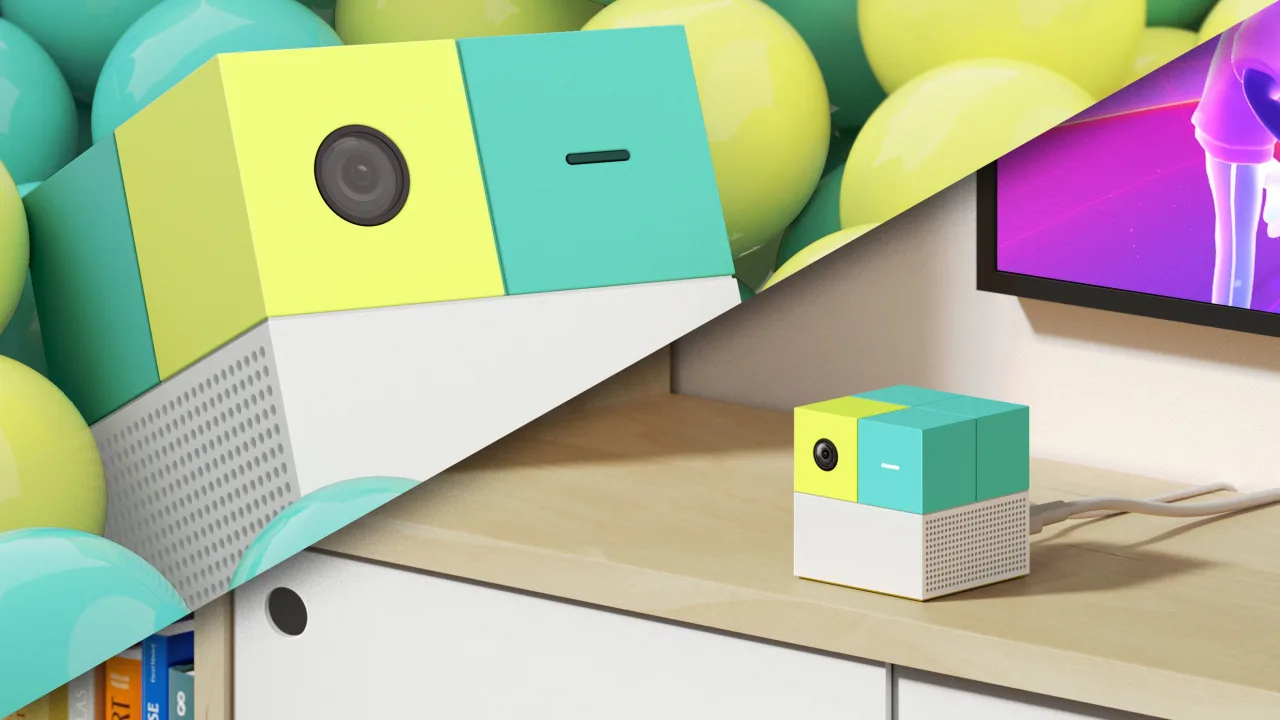

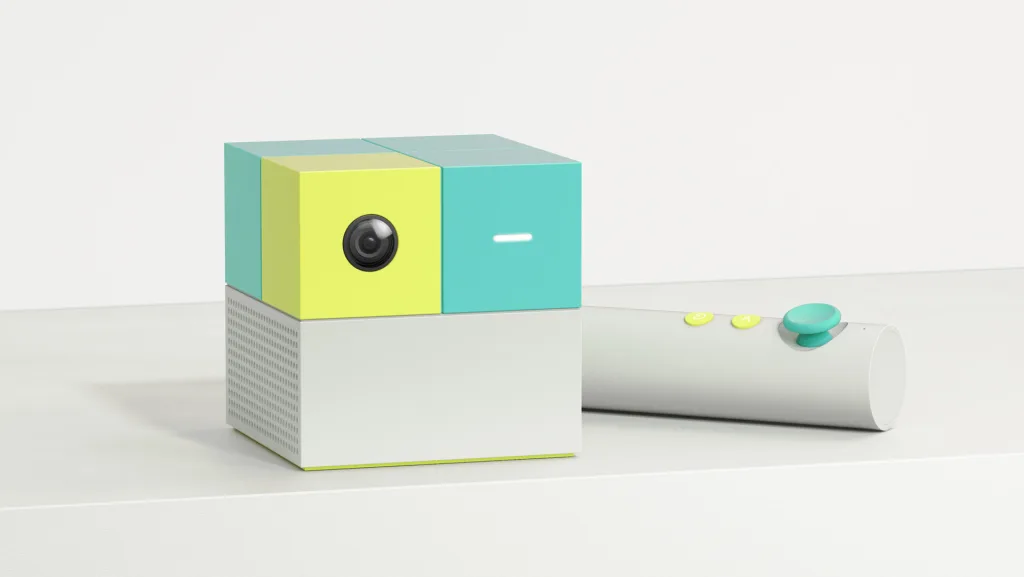

Switch, PS5, and XBox might be the biggest names in video games, but David Lee and a group of entrepreneurial alums from companies like Apple, Google, Microsoft, and Meta are carving out a niche market with Nex, a new alternative. The company’s Nex Playground device has sold more than 200,000 units. Instead of buying individual games, families buy a subscription-based collection of 40-plus titles. Like the old Nintendo Wii, Nex focuses on family-friendly, movement-based games. The Nex device plugs into TVs for motion-controlled experiences. Instead of controllers, the device uses a built-in camera that enables you to play games by moving your hands and feet. With national retail expansion underway across 5,000 stores, Nex positions itself as a simpler alternative to pricier, fancier, thumb-based video games. Fast Company spoke with Lee, the founding CEO, about how Nex competes against industry giants and how the company develops distinct hardware and games. The conversation has been edited for length and clarity. How do you position Nex in relation to Nintendo and Xbox? We all have a focus on core customers. Nintendo went back to what they were doing—handheld gaming and Mario—their biggest franchises. Xbox users are gamers, people who got an Xbox to play games like Halo. When Microsoft was under pressure from PS4’s lower price, they unbundled Kinect and collapsed that system to compete. We come into this space without any of those existing customers. We decided from the ground up to serve motion gaming. The design of our device, the pricing, how we use one camera to track multiple people, moving sensors into software and AI—it’s all about keeping it affordable with a subscription service that takes care of the whole family. Why did you build a dedicated device after starting with mobile apps? Before we built Nex Playground, we were building motion games on phones. What we discovered is that when we create dedicated hardware instead, we have a much deeper relationship with customers. When there’s a device where the only thing it does is bring the family together to play active games, it shows big potential. When you use your TV for a motion-game experience, you pay much more attention to it than you would to a game on your phone. The experience is a lot better, and customers love it more. How are families using Nex in ways you didn’t expect? When we started searching for customers and building our Facebook community, which now has over 20,000 people, we discovered new use cases. We found that when kids come back from school, we have a half-hour where they just play. On weekends, they play when friends come over. [Photo: Nex] We’ve also found that when kids are at school, parents want fitness experiences for themselves. Even grandparents derive benefits when they have something to do with their body. We’re defining what role we play for different people in the family, delivering benefits at different times of day, different days of the week, even different seasons of the year. In summer when kids are off school, we can occupy them and get them moving and learning. What’s your approach to developing games in a saturated market? We’re focusing on safety, privacy, and security first since we’re serving families. We have our first-party teams building games, but we also work with ten studio deals already, with seven games launched. We bring in partners whose games we like, and we share revenue with them. We want to keep our model simple—we have our subscription model and want to supply and delight users all year. We don’t want to open the system to many games that might be low quality. We’re curating a set of content and working with developers who are passionate about creating great things. Our business model is simple, honest, and sustainable—no ads, no in-app purchases. The moment you open to third parties, they think about different ways to make money. For families, we don’t want to overwhelm them—we just want to serve them really well. How do you keep up with hardware competition? We think about our hardware in a similar way to how Amazon thinks about the Kindle or Apple thinks about the iPad. Every year, we want to do something better to create perfect experiences. For example, we improved the remote control from 2023 to 2024. We learned that the joystick was a little hard for young kids to use—I saw my daughter struggling to press it—so we made it simpler. [Photo: Nex] We’re always looking at what problems people face and how to improve. The hardware cycle is yearly, and we might be able to do something new each year. But we’re not thinking about something dramatically different—we have a pretty good long trajectory ahead. A lot of improvements actually come through software. With the same hardware, you get access to new technology we develop as detection technologies get better. We don’t want to force customers to buy new hardware to

Switch, PS5, and XBox might be the biggest names in video games, but David Lee and a group of entrepreneurial alums from companies like Apple, Google, Microsoft, and Meta are carving out a niche market with Nex, a new alternative.

The company’s Nex Playground device has sold more than 200,000 units. Instead of buying individual games, families buy a subscription-based collection of 40-plus titles. Like the old Nintendo Wii, Nex focuses on family-friendly, movement-based games.

The Nex device plugs into TVs for motion-controlled experiences. Instead of controllers, the device uses a built-in camera that enables you to play games by moving your hands and feet.

With national retail expansion underway across 5,000 stores, Nex positions itself as a simpler alternative to pricier, fancier, thumb-based video games. Fast Company spoke with Lee, the founding CEO, about how Nex competes against industry giants and how the company develops distinct hardware and games.

The conversation has been edited for length and clarity.

How do you position Nex in relation to Nintendo and Xbox?

We all have a focus on core customers. Nintendo went back to what they were doing—handheld gaming and Mario—their biggest franchises. Xbox users are gamers, people who got an Xbox to play games like Halo. When Microsoft was under pressure from PS4’s lower price, they unbundled Kinect and collapsed that system to compete.

We come into this space without any of those existing customers. We decided from the ground up to serve motion gaming. The design of our device, the pricing, how we use one camera to track multiple people, moving sensors into software and AI—it’s all about keeping it affordable with a subscription service that takes care of the whole family.

Why did you build a dedicated device after starting with mobile apps?

Before we built Nex Playground, we were building motion games on phones. What we discovered is that when we create dedicated hardware instead, we have a much deeper relationship with customers. When there’s a device where the only thing it does is bring the family together to play active games, it shows big potential.

When you use your TV for a motion-game experience, you pay much more attention to it than you would to a game on your phone. The experience is a lot better, and customers love it more.

How are families using Nex in ways you didn’t expect?

When we started searching for customers and building our Facebook community, which now has over 20,000 people, we discovered new use cases. We found that when kids come back from school, we have a half-hour where they just play. On weekends, they play when friends come over.

We’ve also found that when kids are at school, parents want fitness experiences for themselves. Even grandparents derive benefits when they have something to do with their body. We’re defining what role we play for different people in the family, delivering benefits at different times of day, different days of the week, even different seasons of the year. In summer when kids are off school, we can occupy them and get them moving and learning.

What’s your approach to developing games in a saturated market?

We’re focusing on safety, privacy, and security first since we’re serving families. We have our first-party teams building games, but we also work with ten studio deals already, with seven games launched. We bring in partners whose games we like, and we share revenue with them.

We want to keep our model simple—we have our subscription model and want to supply and delight users all year. We don’t want to open the system to many games that might be low quality. We’re curating a set of content and working with developers who are passionate about creating great things.

Our business model is simple, honest, and sustainable—no ads, no in-app purchases. The moment you open to third parties, they think about different ways to make money. For families, we don’t want to overwhelm them—we just want to serve them really well.

How do you keep up with hardware competition?

We think about our hardware in a similar way to how Amazon thinks about the Kindle or Apple thinks about the iPad. Every year, we want to do something better to create perfect experiences. For example, we improved the remote control from 2023 to 2024. We learned that the joystick was a little hard for young kids to use—I saw my daughter struggling to press it—so we made it simpler.

We’re always looking at what problems people face and how to improve. The hardware cycle is yearly, and we might be able to do something new each year. But we’re not thinking about something dramatically different—we have a pretty good long trajectory ahead.

A lot of improvements actually come through software. With the same hardware, you get access to new technology we develop as detection technologies get better. We don’t want to force customers to buy new hardware to play something new. We think about compatibility and how not to fully obsolete customers. This is a device that can serve your family for years to come.

Given how much attention is paid to Nintendo’s new Switch, how are people discovering Nex?

According to our surveys, roughly 40% of customers hear about us from friends and families. The next-largest segment, about 20%, comes from our online ads. Another 13% first see us in retail stores.

Currently, we’re in 700 Target stores, 100 Walmart locations, and 200 Best Buy stores. This year, we have a national retail expansion to over 5,000 stores. Amazon is also now recognizing us as a new gaming system category—if you look at Amazon video games, they put Nex Playground right next to PlayStation, Xbox, and Switch as top-level tabs, even though we’re way smaller than any of them.

What’s your long-term vision for Nex?

We want to keep kids active, bring families together, and even help keep elderly people active so they can stay independent. We want to tie your family together locally and remotely. We’re happy seeing more grandparents buying Nex for their grandkids and then saying “I want one too.”

![[Weekly funding roundup May 10-16] Large deals remain a no-show](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)

![Epic Games: Fortnite is offline for Apple devices worldwide after app store rejection [updated]](https://helios-i.mashable.com/imagery/articles/00T6DmFkLaAeJiMZlCJ7eUs/hero-image.fill.size_1200x675.v1747407583.jpg)

.jpg)