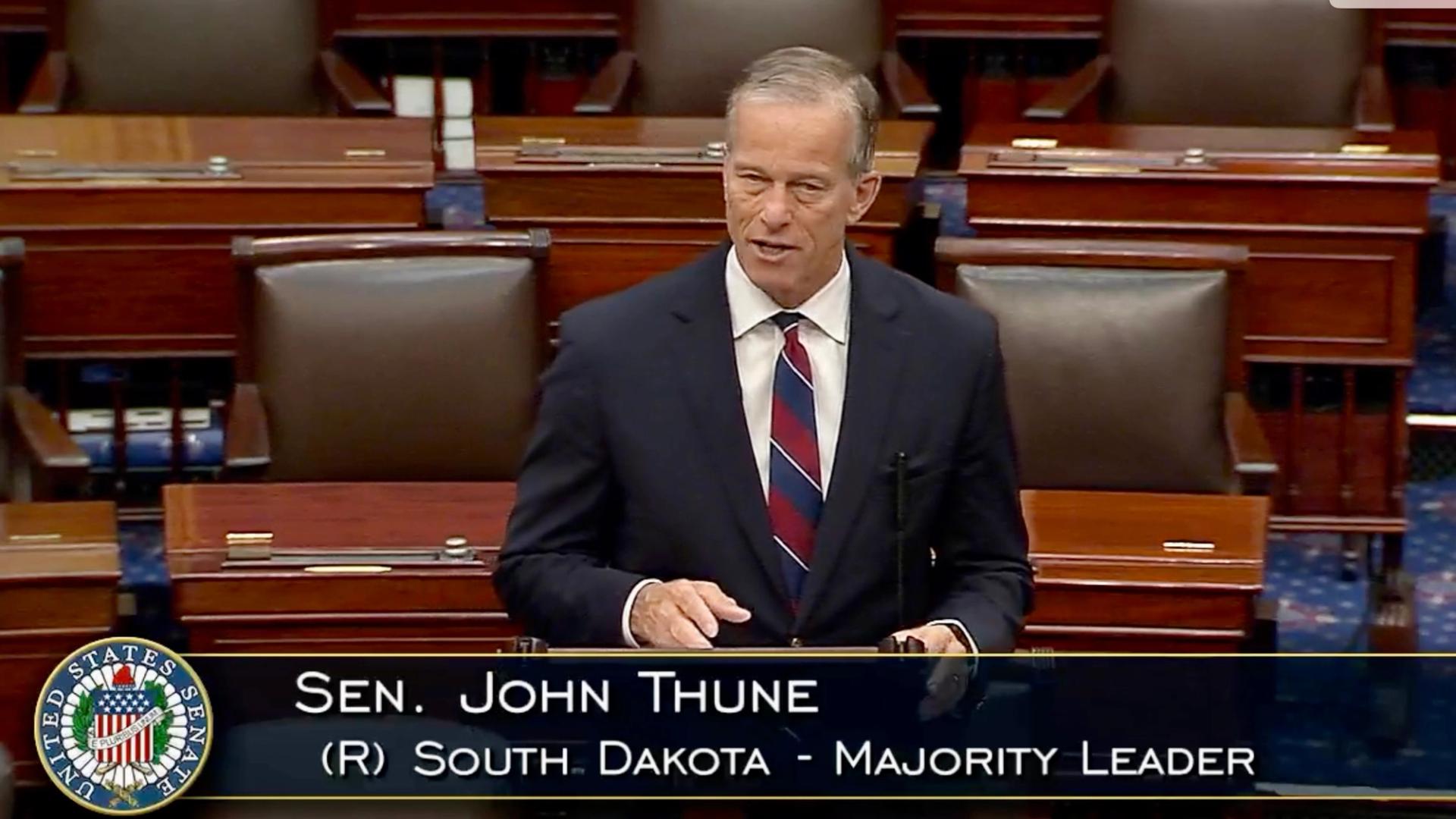

It’s the norm for the Fed chairman and U.S. president to have a meeting—Powell says he’s never asked for a sit-down and ‘never will’

Jerome Powell has fought hard to keep the Fed out of political narratives, and said he would never request a meeting with President Trump.

- Jerome Powell stated he would never initiate a meeting with the president, distancing the Federal Reserve from political influence after Donald Trump has criticized the decision-making of the FOMC. While markets looked for direction, Powell offered a cautious outlook, citing elevated uncertainty and signaling a wait-and-see approach on future economic decisions.

It would be out of the question for the Fed chairman to request an audience with the Oval Office, Jerome Powell said yesterday, even if it is the norm for the president to sit down with the central bank head.

In terms gone by it would be typical for the President of the United States to sit down with the Fed chairman or chairwoman at some point in their administration.

This is a fact Trump and Powell will both be aware of, as such a meeting occurred between the two under Trump's first term.

While the meeting between an incoming president a Fed boss isn't always immediate, speculators might have expected Powell to be summoned to the Oval Office more promptly.

That's because Trump has waged a war of words on the Fed and its decisions about the base interest rate. He pressured the Federal Open Market Committee (FOMC) to hold steady ahead of the election and then pushed the FOMC to axe rates once he won the Oval Office.

There has also been something of a back-and-forth between the two policymakers on job security. The president has claimed he could—and would—fire Powell, while the Fed chairman has said that wouldn't be legal.

Even if analysts might have wished for the rate cut Trump was lobbying for, markets haven't responded well to Trump's perceived meddling in Fed policy.

The FOMC is federally mandated to operate independent of politics, in order to preserve the long-term health of the economy.

So while one might assume the public sparring may have resulted in Powell being summoned to the White House, the fact he hasn't may indicate that Trump doesn't want to spook markets by adding fuel to the speculation that the Fed's independence is under threat.

And Powell made it clear it is not his job to request time in Trump's diary.

At the conclusion of the FOMC meeting yesterday—when Powell confirmed expectations that the base rate would be left unchanged—the Fed chairman said he would never actively try to set up a meeting with Trump.

"I've never asked for a meeting with any president, and I never will," Powell told the press pack. "I wouldn't do that. There's never a reason for me to ask for a meeting, it's always been the other way."

He doubled down: "It's never an initiative that I take… I don't think it's up to a Fed chair to seek a meeting with the president—although maybe some have done so. I've never done so, and I can't imagine myself doing that.

"I think it always comes the other way, a president wants to meet with you—but that hasn't happened."

Powell's take on the economy

Jay Powell's take on the economy has the potential to move markets, but in recent months he's signaled that the outlook is too uncertain to chart a path forward.

Tensions include how aggressive tariff policy may prove to be, how inflationary the duties could prove for consumers, and by how much the economy may slow.

This, in turn, could lead to the Fed's dual mandate of maximum employment and inflation of 2% being in tension.

So while markets were keen to hear the chairman's take, they were ready for a noncommittal response from Powell.

And "wait and see" was the message from the Fed chairman. When asked about his gut instinct when it came to the economy, Powell responded: "My gut tells me that uncertainty about the path of the economy is extremely elevated and that the downside risks have increased.

"The risk is, as we have pointed out in our statement, [is] the risks of higher unemployment and higher inflation have risen but they haven't materialized yet. They're not really in the data yet.

"So that tells me, more than by intuition because I think it's obvious actually that the right thing to do…is await further clarity."

The current base rate of between 4.5% and 4.25% is only "somewhat restrictive," he added: "We think the appropriate thing is for us to wait and see and get more clarity about the direction of the economy."

This story was originally featured on Fortune.com