Is Following Buffett's Lead With Staples Like Coca-Cola the Secret to a Recession-Proof Portfolio?

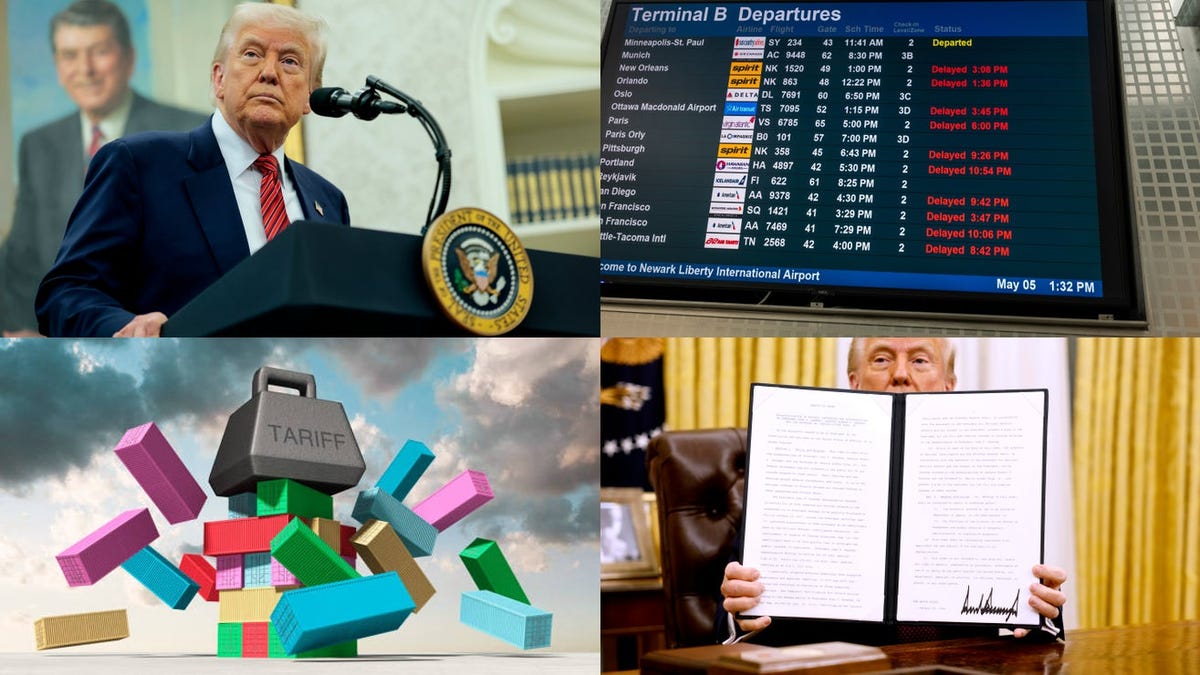

Investors often look for ways to make their stock portfolios more immune to recessions. To do that, they might study the investment philosophy of Warren Buffett.While Berkshire Hathaway's (NYSE: BRK.A) (NYSE: BRK.B) recession strategy may focus on the company's approximately $348 billion in liquidity, Buffett's company continues to hold an extensive portfolio of stocks, and that part of the strategy could revolve heavily around stocks like Coca-Cola (NYSE: KO).Still, Buffett and his team first began buying shares of Coca-Cola in 1988, and Berkshire has not bought additional Coca-Cola shares since 1994. Knowing that, is owning a Warren Buffett investment like Coca-Cola an appropriate way to recession-proof one's portfolio? Let's take a closer look.Continue reading

Investors often look for ways to make their stock portfolios more immune to recessions. To do that, they might study the investment philosophy of Warren Buffett.

While Berkshire Hathaway's (NYSE: BRK.A) (NYSE: BRK.B) recession strategy may focus on the company's approximately $348 billion in liquidity, Buffett's company continues to hold an extensive portfolio of stocks, and that part of the strategy could revolve heavily around stocks like Coca-Cola (NYSE: KO).

Still, Buffett and his team first began buying shares of Coca-Cola in 1988, and Berkshire has not bought additional Coca-Cola shares since 1994. Knowing that, is owning a Warren Buffett investment like Coca-Cola an appropriate way to recession-proof one's portfolio? Let's take a closer look.

![The Most Visited Websites in the World [Infographic]](https://imgproxy.divecdn.com/3KPmuOfGXy00YRzOoNbqLzjer0DNjeNRDdEboVf734o/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9tb3N0X3Zpc2l0ZWRfd2Vic2l0ZXMyLnBuZw==.webp)