Ather Energy mulls reducing size of its IPO: Report

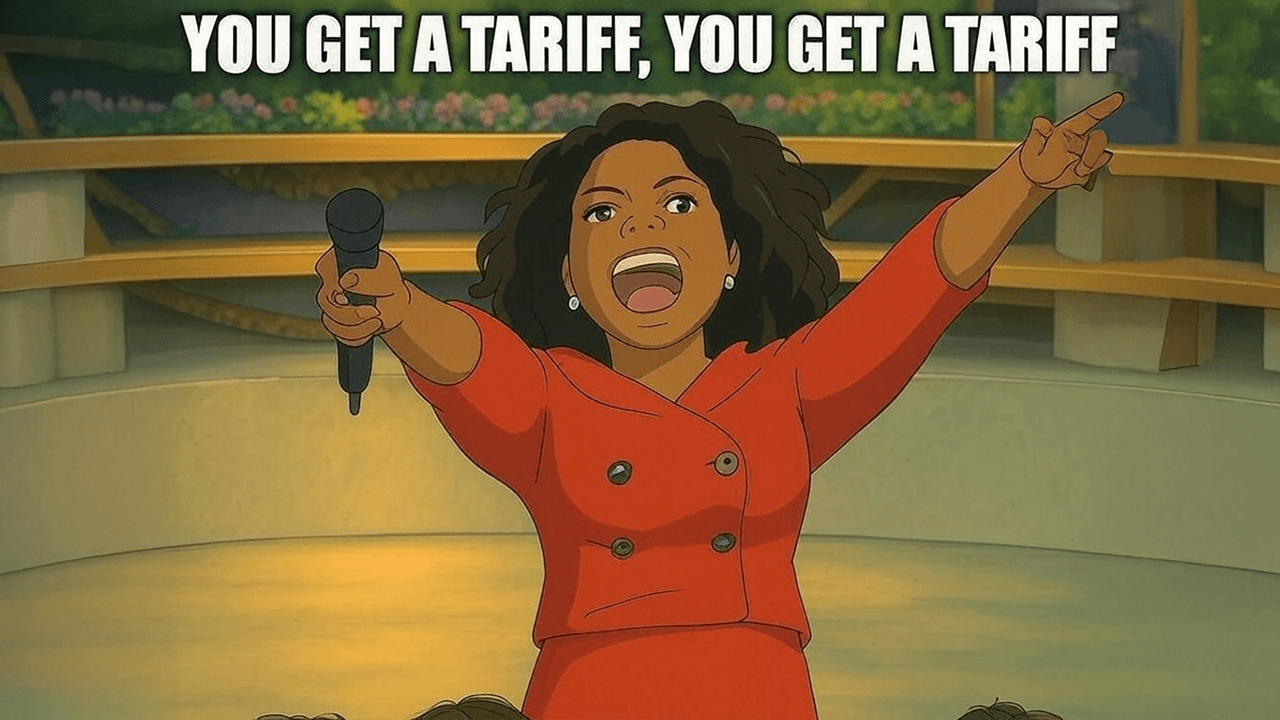

The development comes as Ather Energy’s investors reportedly consider offering fewer shares in the sale as global markets experience volatility due to US tariffs.

Electric vehicle maker Ather Energy is considering reducing the size of its initial public offering by at least $50 million, people familiar with the matter told Bloomberg.

The Bengaluru-based company had earlier set an IPO target of $400 million. According to the report, the cutback in the IPO size comes as investors are looking to offer fewer shares in the sale. Ather is still planning to go ahead with the IPO in the coming weeks.

Ather Energy did not respond to YourStory’s request for comment at the time of publishing this story.

Additionally, the Hero MotoCorp-backed company is also reportedly considering a small reduction in the valuation it is planning to seek, and if investor sentiment worsens, Ather could pursue a private placement instead, Bloomberg reported.

According to the company's draft red herring prospectus filed in September, its IPO included an offer-for-sale of around 22 million shares, with a face value of Rs 1 each. Promoters and co-founders Tarun Sanjay Mehta and Swapnil Jain are each offloading about 1 million equity shares in the IPO.

Ather Energy competes with Bhavish Aggarwal-led Ola Electric in the electric two-wheeler segment, along with legacy brands such as Bajaj Auto and TVS Motor.

The news also comes amid wider stock market volatility as global markets respond to the US imposing a 27% import duty on goods from India, and varied levies on other countries. This has prompted fears of a trade slowdown, leading to investors pulling money away from the stock market.

The EV maker reported a decline in its revenue from operations to Rs 1,754 crore in FY24 from Rs 1,781 crore in the previous year. Ather also reported widening losses for the same period—Rs 1,060 crore compared with Rs 864 crore loss incurred for the financial year ended March 31, 2023.

Edited by Kanishk Singh

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)