2 Reasons Why AppLovin Has a Lot to Prove on May 7

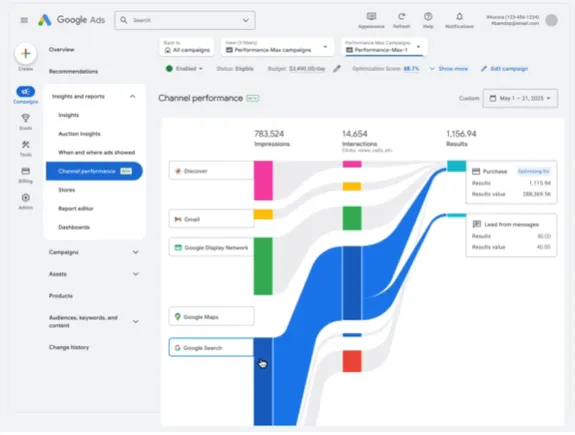

Whenever a stock story is told, the timeframe of that story can make a big difference. For example, AppLovin (NASDAQ: APP) stock is down more than 40% from highs in 2025, which paints a negative picture. But it's also up more than 600% in just the last three years, which is stellar. That said, what happens from here could have a lot to do with what happens on May 7.On May 7, AppLovin is scheduled to report financial results for the first quarter of 2025. Under ordinary circumstances, investors would do well to not overemphasize a single quarter of financial results. But for this advertising technology (adtech) company, these are not ordinary circumstances.These aren't ordinary circumstances for AppLovin for two reasons. First, the stock has an expensive valuation of 20 times sales, valuing the company at nearly $100 billion. In other words, investors' expectations are absolutely sky-high.Continue reading

Whenever a stock story is told, the timeframe of that story can make a big difference. For example, AppLovin (NASDAQ: APP) stock is down more than 40% from highs in 2025, which paints a negative picture. But it's also up more than 600% in just the last three years, which is stellar. That said, what happens from here could have a lot to do with what happens on May 7.

On May 7, AppLovin is scheduled to report financial results for the first quarter of 2025. Under ordinary circumstances, investors would do well to not overemphasize a single quarter of financial results. But for this advertising technology (adtech) company, these are not ordinary circumstances.

These aren't ordinary circumstances for AppLovin for two reasons. First, the stock has an expensive valuation of 20 times sales, valuing the company at nearly $100 billion. In other words, investors' expectations are absolutely sky-high.