Why senior living should be a core part of every long-term financial plan

Senior living is no longer a fallback plan or a fringe concept; it is the next frontier in responsible ageing and an essential part of a modern, responsible financial strategy.

In a country where financial preparedness is finally gaining ground with rising financial literacy, better savings habits, and a shift from mere saving to wealth creation, India remains woefully behind on one crucial front—planning for our golden years.

Most people focus on securing their children’s future, building their dream home, and accumulating a corpus for post-retirement, but rarely think about the kind of life they want for themselves after 60.

And that’s where the concept of senior living deserves a seat at the financial planning table. It answers many of the anxieties we carry about ageing with one empowering choice.

Senior living is rarely considered an essential component of long-term financial planning; a gap is increasingly evident as societal structures evolve. The traditional model, where families provided lifelong care for their elders within their homes, no longer aligns with modern realities and practices.

The combination of increasing prevalence of nuclear family structures, heightened geographic mobility, the practicalities of demanding professional lives, and the rising cost of living has placed a significant onus on individual caregivers and families to prioritise their own well-being.

Consequently, seniors often navigate inadequate financial, social, and emotional support systems, leading them to proactively shape their futures and determine their later years independently. Therefore, senior living must be understood not as a contingency, but as a proactive and dignified choice that warrants the same thoughtful planning as a home loan or a child’s education.

India’s silver tsunami is coming

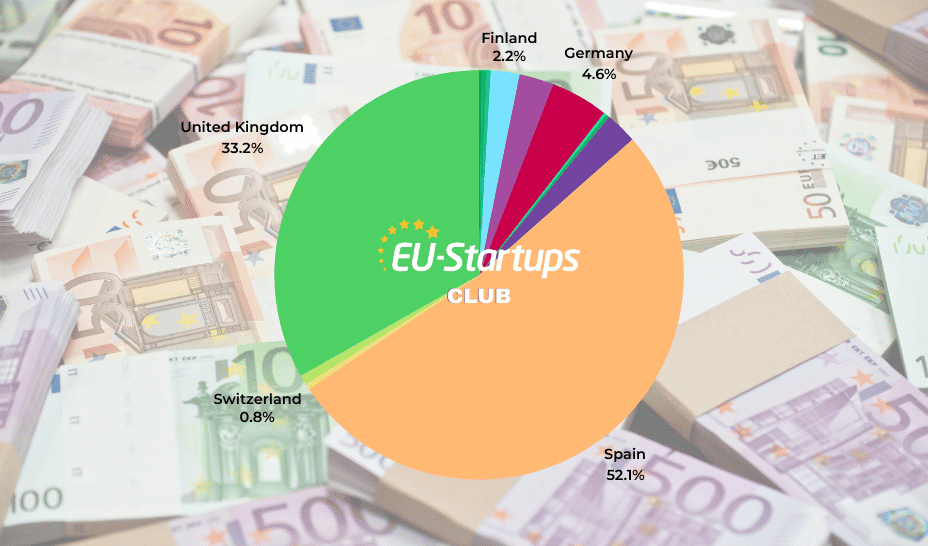

While India’s senior living sector has gained momentum in recent years, it’s still nascent compared to countries like the United States, where over two million seniors reside in independent or assisted living communities.

This tells us that while India has an equally pressing need, we have started the conversation much later than other countries. Despite this, the awareness and integration of senior living into financial planning remains low.

This reluctance often stems from long-standing cultural practices and beliefs. The notion of “ageing at home” is deeply embedded in the Indian psyche, and senior living communities are often misjudged as institutional or isolating.

In reality, these residences offer independent living with built-in medical support, wellness services, and a like-minded community while allowing seniors to spend meaningful, unburdened time with their families.

The financial reality we can’t ignore

A major reason people don’t plan for senior living is the lack of financial awareness. Many believe pensions and savings can cover everything, but the truth is, quality senior living can cost anywhere from Rs 50 lakh to a few crores, depending on location and services. And that’s not factoring in medical inflation, which rises faster than general inflation in India.

What happens too frequently is that families find themselves compelled to make urgent decisions in the face of medical emergencies or the loss of a partner, which results in considerable emotional turmoil and unanticipated financial obligations.

In contrast, a proactive approach that integrates senior living into long-term financial planning affords individuals and their families greater foresight into their futures, thus accounting for autonomy and financial resilience as they enter this phase of life.

Financial freedom means living on your own terms

While the financial case for early planning is strong, the emotional and social advantages are equally vital. Senior living offers crucial connection and support, combating potential loneliness as social circles narrow with age and distance from family. Moreover, these communities provide accessible healthcare, tailored assistance, and empower independent decision-making, preserving dignity and control in later life.

According to a JLL report, about 70% of seniors would prefer independent living if healthcare and community access were assured. Nearly 60% worry about becoming a burden on their children. The report also highlighted that many upper-middle-class families are open to senior living, but lack structured financial planning to support it.

How to factor senior living into your financial plan

The good news is that it’s manageable, provided that one starts planning early on. Here’s how one could possibly approach this:

- Future proofing budgets by estimating living expenses, factoring in rising healthcare and caregiver costs and inflation

- Diversifying income streams and building a personalised safety net by exploring financial instruments like retirement-focused mutual funds, annuities, and senior citizen savings schemes, as well as reverse mortgages

- Leveraging government schemes and subsidies, if and when possible

- Reviewing life and health insurance policies to ensure they cover long-term care needs

- Exploring senior living options and visiting the facilities to assess costs, amenities, and healthcare access

- Planning for emergencies and budgeting for potential short-term stays in senior facilities, which may include post-surgery recovery

- Discussing options with financial advisors and revisiting the plan every three to five years

Why it matters now

India’s senior living sector is expected to grow from $2-3 billion in 2025 to nearly $12 billion by 2030.

The future belongs to those who prepare for it. The time to start this conversation, with your family and financial planner, is not after retirement, but today.

A smarter way to age

Senior living is no longer a fallback plan or a fringe concept; it is the next frontier in responsible ageing and an essential part of a modern, responsible financial strategy. When we plan not just for a longer life, but a better one, we make space for dignity, joy, and independence in our golden years.

Rajit Mehta is the Managing Director and CEO of Antara Senior Care.

Edited by Suman Singh

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![Epic Games: Fortnite is offline for Apple devices worldwide after app store rejection [updated]](https://helios-i.mashable.com/imagery/articles/00T6DmFkLaAeJiMZlCJ7eUs/hero-image.fill.size_1200x675.v1747407583.jpg)

.jpg)