Wealth isn’t about luck: Master these 5 smart strategies

Discover 5 practical and proven strategies to build long-term wealth without relying on luck, shortcuts, or overnight success stories.

We’ve all seen the flashy headlines—stories of crypto moguls, unicorn startups, and lottery winners that promise instant wealth. The internet often makes these sudden breakthroughs seem like the only way to achieve success. However, there's an important truth behind the scenes that many overlook: true wealth isn’t the result of sheer luck. It’s the outcome of careful planning, discipline, and smart choices.

Yes, luck can occasionally play a role, but it’s not something you can rely on. It’s like trying to cross an ocean in a fragile paper boat. The truly wealthy individuals—those who build sustainable wealth over time—don’t rely on chance. They build systems, not secrets. They focus on developing skills, not following shortcuts. Money comes as a byproduct of offering value, patience, and a long-term mindset.

If you're tired of waiting for that “lucky break,” now is the time to take control of your financial future.

But remember, it isn’t about winning the lottery or finding a quick-fix strategy. It’s about principles—five time-tested methods anyone can implement to build wealth gradually and securely.

Let’s jump in.

Five proven steps to grow wealth without luck

1. Develop a high-income skill

Wealth doesn’t start with just earning money—it starts with creating the right kind of income. Simply trading hours for low pay won’t get you to where you want to be. Instead, focus on developing a skill that is in high demand and offers valuable solutions to problems.

High-demand fields like software development, digital marketing, copywriting, data analysis, and even specialised trades such as plumbing and welding can help you earn a premium.

Pro Tip: Invest in refining your skills. Whether through courses, mentorships, or practice, the more expertise you offer, the more valuable you become in the marketplace.

2. Spend less than you earn, and invest the difference

It’s not just about how much you make; it’s about how much you save and invest. Many individuals earn significant amounts but fail to build wealth because they live paycheck to paycheck, spending everything they earn.

Living below your means doesn’t mean you have to deprive yourself—it means you're setting yourself up for freedom. Every dollar you don't spend is an investment in your future.

To grow your wealth, start with these proven investments:

- Index funds or ETFs

- Real estate (rental properties or REITs)

- Systematic Investment Plans (SIPs) or Public Provident Fund (PPF) in India

- Dividend-paying stocks

Pro Tip: Consider budgeting using the 50/30/20 rule and automate your savings so investing becomes a regular habit.

3. Focus on ownership, not just earning

A salary may provide steady income, but it has its limitations. True wealth is built on ownership—owning assets that generate income for you. Whether it’s starting a business, creating a digital product, or building a side hustle, ownership is key.

Even starting small can lead to big results over time. The focus should be on equity—what you own, not just what you earn.

Pro Tip: Start with manageable goals. You don’t need venture capital or viral success. Solve a problem and scale consistently.

4. Harness the power of time and compounding

Compounding is the most powerful tool in wealth-building. The earlier you start, the easier it becomes to build wealth, as your money will begin working for you.

For example, if you invest ₹5,000 monthly at a 12% annual return, you could accumulate over ₹1 crore in 25 years. That’s the magic of compounding and time.

Pro Tip: Stop waiting for the "perfect moment" to begin investing. The best time to start is today—yesterday would’ve been even better.

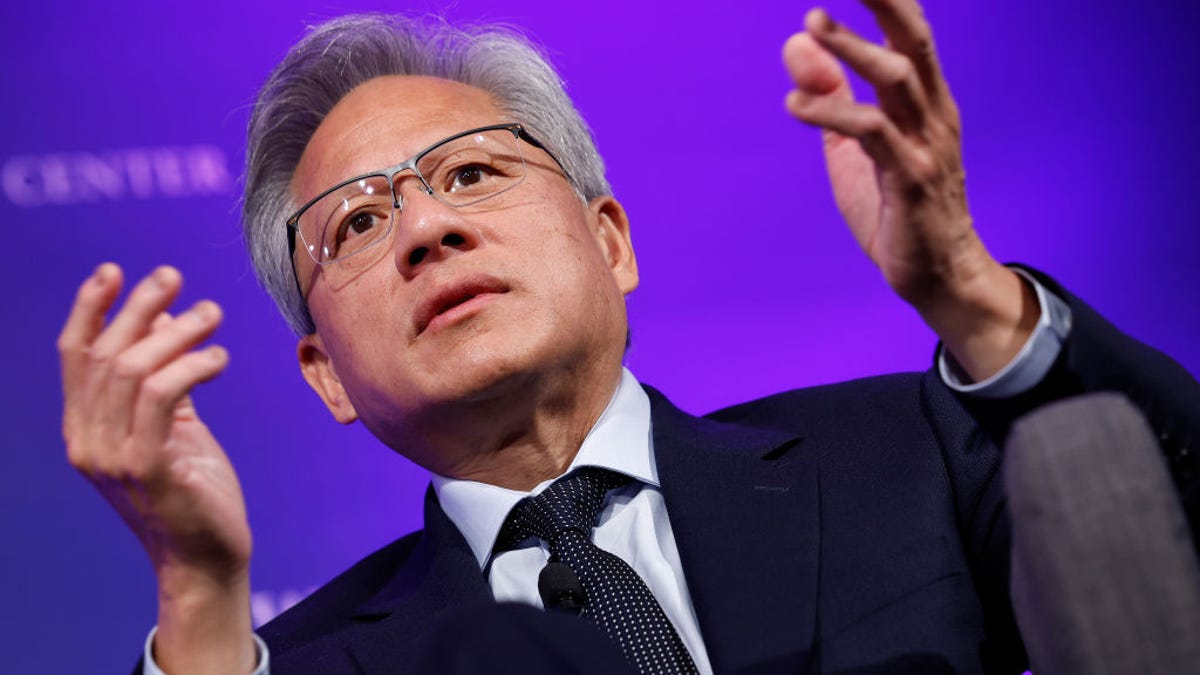

5. Build a strong network of people

Your network is a direct reflection of your net worth. Having the right connections can open doors, offer advice, and provide opportunities. It’s about being around people who inspire you to grow and think bigger.

Join professional events, online communities, and platforms like LinkedIn. Build relationships with ambitious, value-driven individuals. Wealth and success tend to grow when you surround yourself with those who think in terms of progress and abundance.

Pro Tip: Offer value before expecting anything in return. Help others, and the goodwill will often come back to you in ways you can’t anticipate.

Final thoughts

You don’t need luck to build wealth; what you need is leverage: leverage in the form of skills, systems, discipline, and time.

The principles shared above are what self-made millionaires and successful entrepreneurs across the globe rely on. These strategies aren’t glamorous, and they aren’t quick fixes. But they work. And over time, they compound.

The real question isn’t “Will I get lucky?”

The real question is: “Will I start today?”

The blueprint for wealth is already there. It’s up to you to take the first step—and keep moving forward—with purpose and determination.

![How To Align the SEO Process With AI Discovery [Infographic]](https://imgproxy.divecdn.com/9P2R5ZZoepHyBzf0CW-n2EgWRhr-_OdwsznROe_GvnM/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9haV9zZWFyY2hfaW5mbzIucG5n.webp)