Trump economic officials revere billionaire Stanley Druckenmiller, but he says he does not support tariffs over 10%

The administration has disappointed Wall Street amid the stock market’s avoidable tailspin.

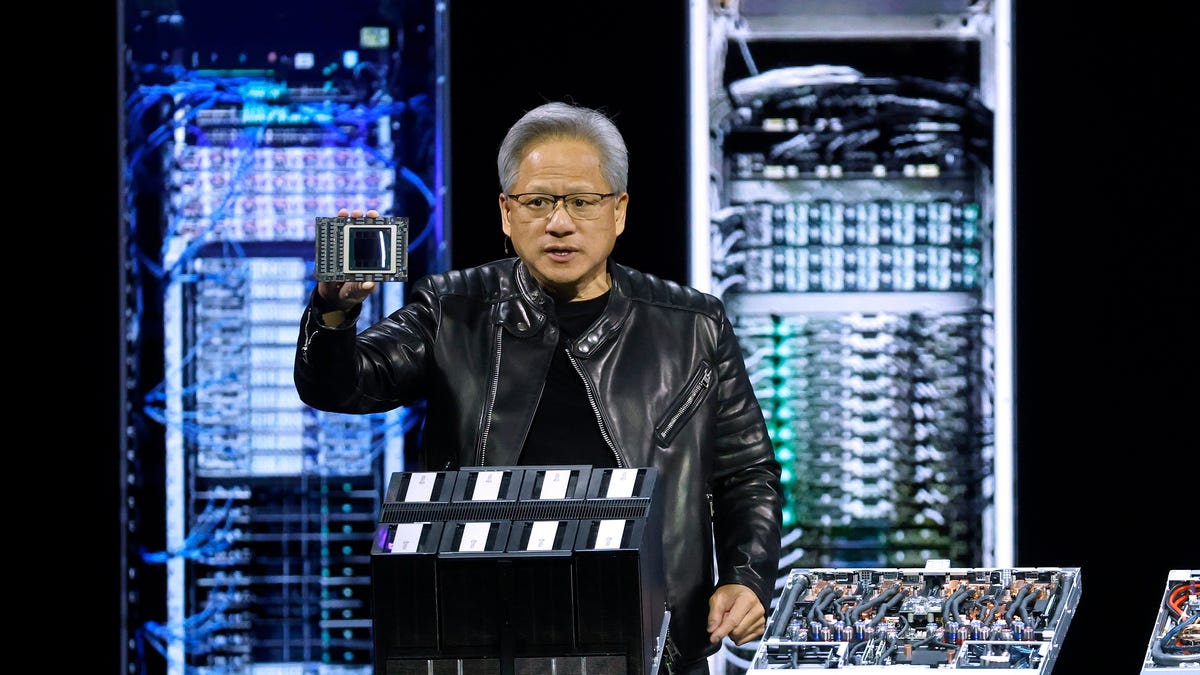

- Stanley Druckenmiller has long been a close mentor and friend of Treasury Secretary Scott Bessent. But Druckenmiller, one of Wall Street’s most revered investors, emphatically distanced himself from President Donald Trump’s sweeping “reciprocal tariffs” and the ensuing market sell-off, reiterating he doesn’t believe taxes on imports should exceed 10%.

Some of the biggest names on Wall Street are lambasting President Donald Trump’s sweeping “reciprocal tariffs,” which have sent global markets into a tailspin. Billionaire Stanley Druckenmiller is a longtime mentor and friend of Treasury Secretary Scott Bessent, who has dismissed concerns of a recession, but one of the world’s most revered investors has emphasized he’s no fan of taxing imports more than 10%.

That 10% threshold is the minimum baseline for the taxes imposed on goods from every U.S. trading partner—as well as the penguins on the uninhabited Heard Island and McDonald Islands—which went into effect Saturday. Many countries and territories are due to be hit with much higher tariffs, including a 50% tax on imports from Lesotho, one of the world’s poorest nations. Even allies like the European Union and Japan were hit with tariffs of 20% or higher.

A global sell-off ensued after Trump presented his chart of reciprocal tariffs Wednesday, with the S&P 500 declining 10.5% over the next two days. Former Treasury Secretary Larry Summers found it was the index’s fourth-worst two-day plunge since World War II, following “Black Monday” in 1987, the 2008 financial crisis, and the onset of the COVID-19 pandemic.

Many of the world’s most famous money managers, including Trump backer Bill Ackman, have suggested the carnage was avoidable. In an interview with CNBC in January, Druckenmiller said the risks from tariffs were overblown relative to their potential rewards, provided they remained below 10%.

The 71-year-old is renowned on the Street for never suffering a down year while running his investment firm, which he founded as a hedge fund in 1981 and then converted into a family office in 2010. He’s also been a big critic of America’s rising deficit. When it comes to paying America’s debts, he said he’d prefer hikes to tariffs than raising income taxes.

“It’s more like they’re the lesser of two evils,” he said.

But when a clip of the interview was shared on X Sunday, Druckenmiller emphatically underlined his opposition to the latest tariff salvo in a rare post on the social-media platform.

“I do not support tariffs exceeding 10%,” he wrote, “which I made abundantly clear in the interview you cite.”

In that January interview, Druckenmiller suggested tariffs should be carefully devised to avoid retaliation. Instead, officials essentially took America’s trade deficit with every nation and divided that number by the country’s total exports to the U.S., halving that proportion to come up with the new tariff rate for each trading partner.

On Friday, China responded with a 34% tax on all American imports, though the Trump administration claims more than 50 countries have already called to negotiate.

The White House and Treasury Department did not immediately respond to Fortune’s requests for comment.

Druckenmiller’s “father-son” relationship with Bessent

To be clear, Druckenmiller has never been a supporter of the president. He backed and hosted fundraisers for Nikki Haley, who ran against Trump in the Republican primary, and said he wouldn’t vote for Trump or Democratic nominee Kamala Harris in the presidential election.

But Druckenmiller reportedly has a very close relationship with Trump’s Treasury secretary, going back to when he hired Bessent at Soros Fund Management in 1991. The pair gained notoriety for their work on the firm’s infamous bet against the British pound, which famously “broke the Bank of England” and generated about $1 billion in profit, per Investopedia.

According to a March report from the Financial Times, people familiar with the matter describe Druckenmiller and Bessent sharing a bond similar to a father and son. The pair still communicate frequently, sources told the FT, though apparently Druckenmiller is now the only one who shares his view on the markets.

Druckenmiller took to X in November to endorse the idea of appointing Bessent as Treasury secretary, citing his more than 30 years of experience as a participant in global markets, rather than eventual Commerce Secretary Howard Lutnick.

“He is innovative in a calm, thoughtful way that will be disruptive but not rattle markets,” Druckenmiller wrote. “This experience makes him the better choice by far.”

In January, however, Druckenmiller suggested he didn’t envy the situation his protégé had inherited.

“I just don’t know how it’s going to work out,” he said.

This story was originally featured on Fortune.com

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)