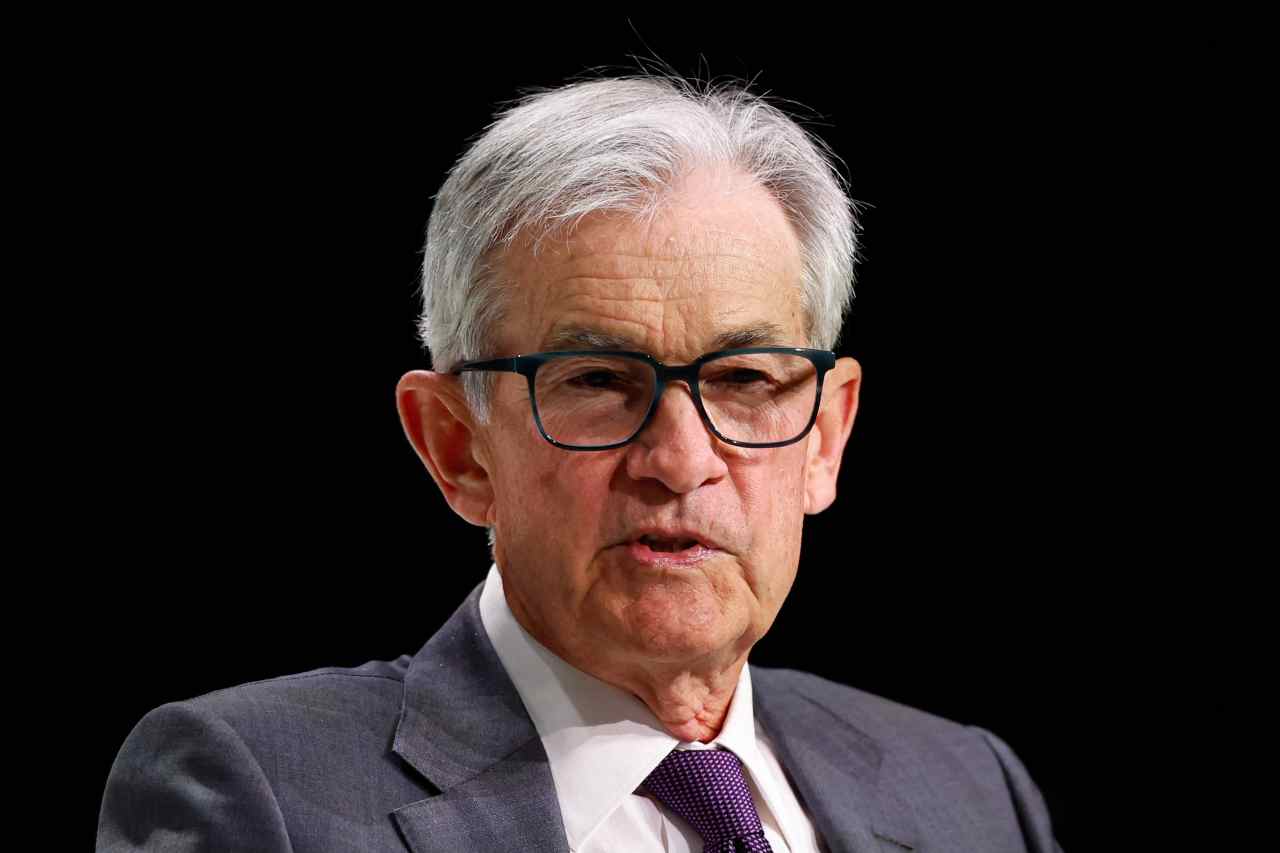

Trade talk between the U.S. and China is boosting markets, but investors are really waiting for Fed Chair Powell to speak

Major Asian markets in China, Japan and South Korea all rose—but by less than 1%. Investors seem to be betting that the Papal Conclave will produce results before the trade negotiations do.

- The S&P 500 sank 0.8% yesterday, taking it down 4.7% YTD, while S&P futures were up 0.6% this morning, premarket. The U.S. government said Treasury Secretary Scott Bessent would travel to Switzerland to meet Chinese Vice Premier He Lifeng, Beijing’s lead economic representative. Investors took hope from the prospect of negotiations between the world's two biggest economic powers, but their eyes were pinned on Fed Chair Jerome Powell.

Markets in Asia rose on the news that the U.S. and China hadn't begun negotiations over the trade-blockade-like 100%+ tariffs they've put on one another—but are about to. The Trump administration said Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer would travel to Switzerland on Thursday, where they're scheduled to meet Chinese Vice Premier He Lifeng, Beijing’s lead economic representative, for meetings that will take place between May 9 and 12.

But investor excitement was tempered by lack of trade deals so far, and by President Donald Trump's statement yesterday at a meeting with Canadian Prime Minister Mark Carney that his administration doesn’t “have to sign deals.”

Major Asian markets in China, Japan and South Korea all rose—but by less than 1%. Investors seem to be betting that the Papal Conclave will produce results before the trade negotiations do.

Also tempering market excitement? Today's interest rate decision announcement from the Fed. Wall Street is almost 100% positive that Fed Chair Jerome Powell won't announce a cut from the central bank's current 4.25% to 4.50% rate, but it's eager to hear what he says about future rate cuts.

Fed funds futures markets suggest a 3% probability of a 0.25 point cut at the Fed meeting, but the probability will rise to 48% at the June meeting, notes Lazard chief market strategist Ronald Temple.

But Temple counsels against optimism. Why? Inflation

"I continue to expect no Fed rate cuts in 2025 due to the reacceleration of inflation that is likely to result from US tariffs," he says. "With every one percentage point increase in the weighted average US tariff on goods equating to about 10 bps of additional core inflation, the current level of tariffs could add 175 bps to core inflation by year end assuming no further policy changes."

And while Temple acknowledges that "assuming no further policy changes" in the Trump administration is a terrible bet, he notes that future tariff moves will likely shift, rather than reduce, the overall tariff environment.

Goldman Sachs chief economist Jan Hatzius is similarly not overly optimistic over shifts in the tariff world. He notes that the "mood music" between the two countries has improved, leading his team to expect the U.S. tariff rate on China to drop from around 160% to a still stratospheric 60% "relatively soon," and that "resilience in the hard economic data has also reassured investors."

But…

"Nevertheless, our 12-month recession risk estimate remains 45%," he writes in a Tuesday note. "Beyond US-China, we still expect further tariff increases in other areas—e.g. pharmaceuticals, semiconductors, and potentially movies—and see a meaningful risk that some of the paused 'reciprocal' tariffs will take effect after all."

Here’s a snapshot of today’s action:

- Asian markets were broadly up this morning on news that trade talks between the U.S. and China will begin in a few days time.

- China’s SSE Composite was up 0.8%. The index is up 2.46% YTD.

- South Korea’s Kospi was up 0.55%.

- Japan’s Topix rose 0.3%.

- By contrast, U.S. stocks sank yesterday and European markets are down this morning.

- The S&P 500 sank 0.8% yesterday. It is down 4.7% YTD.

- S&P futures were up 0.6% this morning, premarket.

- Palantir stock lost 12% yesterday after it delivered a very strong earnings call. Investors appeared to have sold on the news after buying it before the call. The stock is up 44% YTD.

- The Stoxx Europe 600 was down 0.4% in early trading.

This story was originally featured on Fortune.com