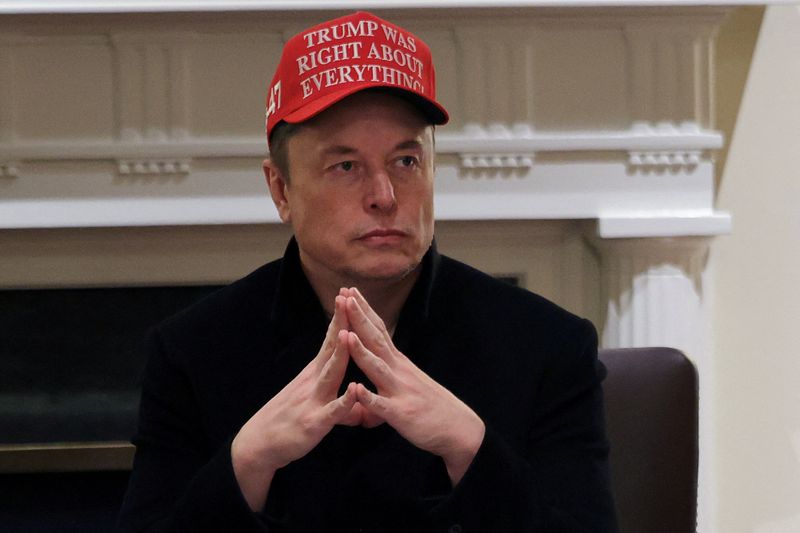

The global monetary order is breaking — Bitcoin is the escape hatch

For decades, U.S. Treasuries have been treated as the world’s safest asset. But that system might be unraveling. This video breaks down why the era of Treasuries as the global reserve asset may be coming to an end—and why a neutral global reserve asset like Bitcoin will rise to take their place. This video covers: • How the U.S. exported inflation via Treasuries and trade deficits • Why tariffs + deglobalization are accelerating the collapse of that system • Why Bitcoin is perfectly positioned as the future neutral global reserve asset • And what this shift means for the next era of investing This shift is happening faster than most people think. Would love to hear your thoughts on if my assumptions are accurate and where things goes from here. submitted by /u/thesatdaddy [link] [comments]

| For decades, U.S. Treasuries have been treated as the world’s safest asset. But that system might be unraveling. This video breaks down why the era of Treasuries as the global reserve asset may be coming to an end—and why a neutral global reserve asset like Bitcoin will rise to take their place. This video covers: • How the U.S. exported inflation via Treasuries and trade deficits • Why tariffs + deglobalization are accelerating the collapse of that system • Why Bitcoin is perfectly positioned as the future neutral global reserve asset • And what this shift means for the next era of investing This shift is happening faster than most people think. Would love to hear your thoughts on if my assumptions are accurate and where things goes from here. [link] [comments] |

![31 Top Social Media Platforms in 2025 [+ Marketing Tips]](https://static.semrush.com/blog/uploads/media/0b/40/0b40fe7015c46ea017490203e239364a/most-popular-social-media-platforms.svg)

![[Webinar] AI Is Already Inside Your SaaS Stack — Learn How to Prevent the Next Silent Breach](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiOWn65wd33dg2uO99NrtKbpYLfcepwOLidQDMls0HXKlA91k6HURluRA4WXgJRAZldEe1VReMQZyyYt1PgnoAn5JPpILsWlXIzmrBSs_TBoyPwO7hZrWouBg2-O3mdeoeSGY-l9_bsZB7vbpKjTSvG93zNytjxgTaMPqo9iq9Z5pGa05CJOs9uXpwHFT4/s1600/ai-cyber.jpg?#)

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)