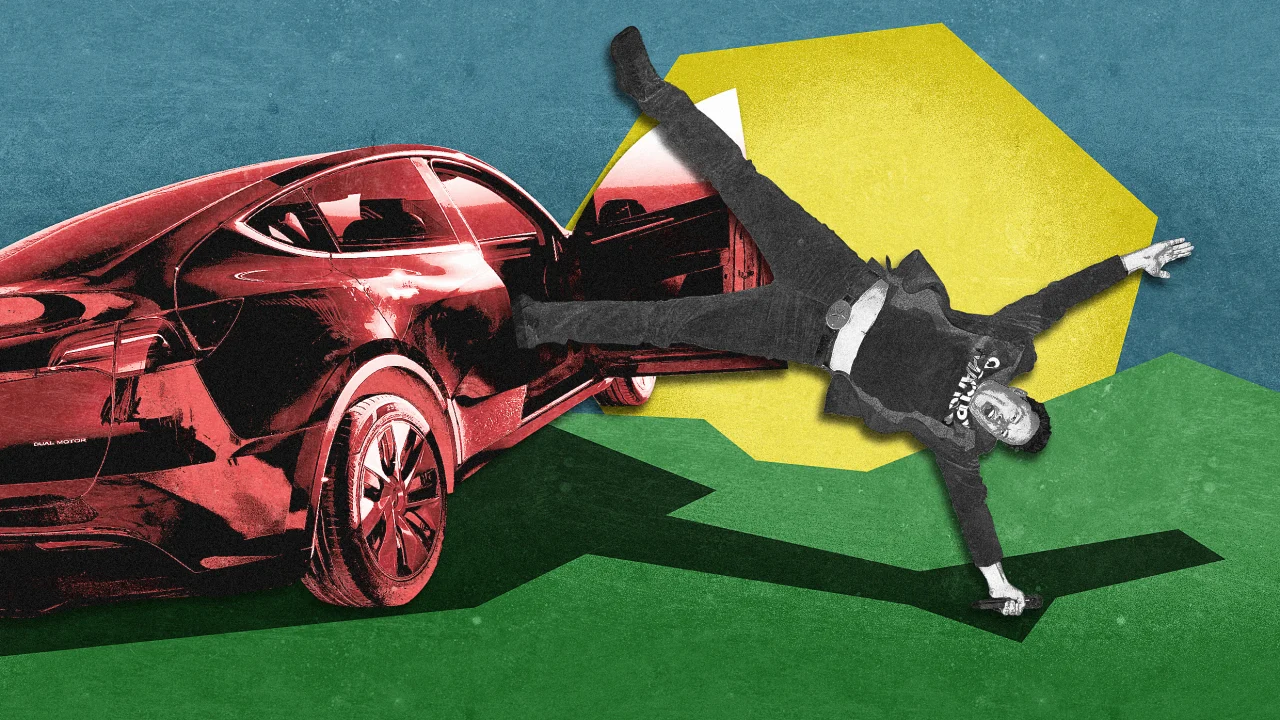

Tesla Stock Jumped Today -- Is It a Buy After Q1 Earnings?

Tesla (NASDAQ: TSLA) stock gained ground today in the lead-up to its first-quarter earnings results, which were published after the market closed. The electric vehicle (EV) leader's share price ended the day up 4.8% amid a 2.5% jump for the S&P 500 and a 2.7% gain for the Nasdaq Composite.Tesla stock jumped along with the broader market today after Bloomberg reported that some manner of trade-war relief could be on the near horizon. According to the outlet, U.S. Treasury Scott Bessent said at a conference today that he anticipated some manner of de-escalation of the trade war between the U.S. and China. Bessent said that negotiations between the two countries on tariffs had not started yet, but the potential for some favorable trade policy developments to emerge helped power big gains for stocks and essentially reversed the impact of bearish trading yesterday. Investors piled back into Tesla stock ahead of its Q1 report, but shares are still down 44% year to date at today's market close. In the Q1 report it published this afternoon, Tesla posted non-GAAP (adjusted) earnings per share of $0.27 on sales of $19.34 billion. Meanwhile, the average Wall Street analyst estimate had targeted per-share earnings of $0.39 on revenue of $21.1 billion. The EV company's auto revenue sank 20% year over year, and overall sales were down 9% in the period. Continue reading

Tesla (NASDAQ: TSLA) stock gained ground today in the lead-up to its first-quarter earnings results, which were published after the market closed. The electric vehicle (EV) leader's share price ended the day up 4.8% amid a 2.5% jump for the S&P 500 and a 2.7% gain for the Nasdaq Composite.

Tesla stock jumped along with the broader market today after Bloomberg reported that some manner of trade-war relief could be on the near horizon. According to the outlet, U.S. Treasury Scott Bessent said at a conference today that he anticipated some manner of de-escalation of the trade war between the U.S. and China. Bessent said that negotiations between the two countries on tariffs had not started yet, but the potential for some favorable trade policy developments to emerge helped power big gains for stocks and essentially reversed the impact of bearish trading yesterday. Investors piled back into Tesla stock ahead of its Q1 report, but shares are still down 44% year to date at today's market close.

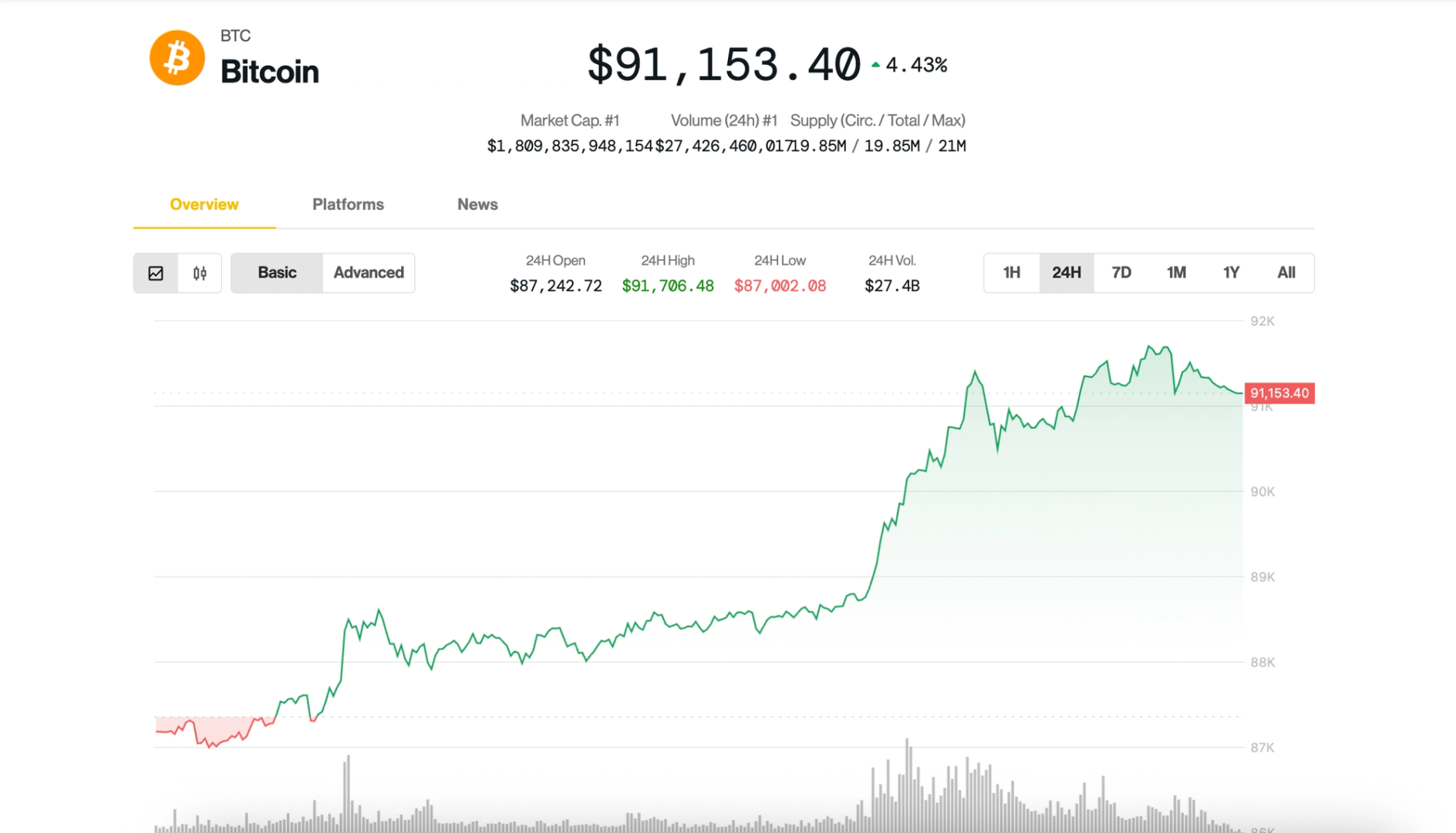

In the Q1 report it published this afternoon, Tesla posted non-GAAP (adjusted) earnings per share of $0.27 on sales of $19.34 billion. Meanwhile, the average Wall Street analyst estimate had targeted per-share earnings of $0.39 on revenue of $21.1 billion. The EV company's auto revenue sank 20% year over year, and overall sales were down 9% in the period.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)