Taking Your Required Minimum Distribution (RMD) Right Now Could be a Brilliant Move for Retirees

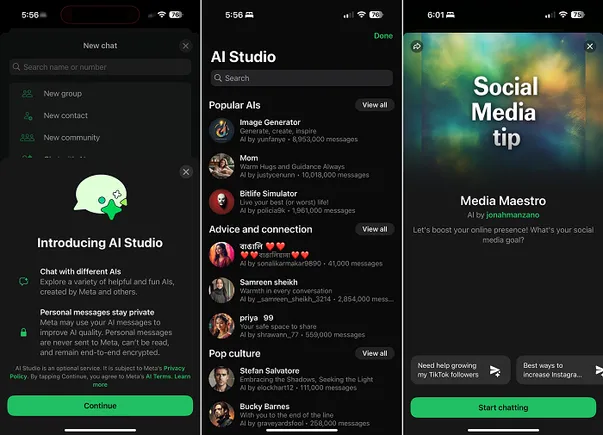

Now's your opportunity to lower your future RMDs with a strategic distribution.

One of the biggest advantages of investing in retirement accounts is the tax advantages. Contributions to an IRA or 401(k) are tax-deductible the year you make them. On top of that, any dividends or capital gains in the account don't incur any taxes either. The only time you'll pay taxes on your retirement savings is when you're ready to spend them.

But you can't put off taxes forever. Eventually, the government wants its take. It also imposes required minimum distributions, or RMDs, on seniors' tax-deferred retirement accounts starting at age 73. If you inherited an IRA, you may also be subject to RMDs regardless of how old you are.

But taking an RMD, especially one where you don't need the money to spend right now, can impose a major tax burden on some households. And the problem can get worse and worse each year as your RMDs get bigger and bigger. However, those who plan to reinvest their RMD outside of their retirement account could benefit from taking their distribution right now. Here's why it could be a brilliant move.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)