Stock Market Crash: 3 Tech Stocks You Can Buy and Hold for the Next Decade

With the stock market falling more than 10% in two days, we have officially witnessed a stock market crash. Stocks, meanwhile, remain volatile given uncertainty over the impact of tariffs and the ongoing trade war.While I would not rush into stocks, this could be a good time to start dipping your toe slowly into high-quality names that you'd want to own for the next decade or more. Let's look at three tech stocks that fit that bill.Despite semiconductors being exempted (for now) from the tariffs slapped on Taiwan, Nvidia (NASDAQ: NVDA) has not been spared in the recent market sell-off. However, it is still the best-positioned company in the world when it comes to benefiting from the buildout of artificial intelligence (AI) infrastructure. It's also left the stock trading at a very attractive valuation with a forward price-to-earnings ratio (P/E) of under 21 times based on this year's analyst estimates and a price/earnings-to-growth (PEG) ratio below 0.4. Stocks with PEGs under 1 are generally viewed as undervalued, so Nvidia's stock is very cheap based on this metric.Continue reading

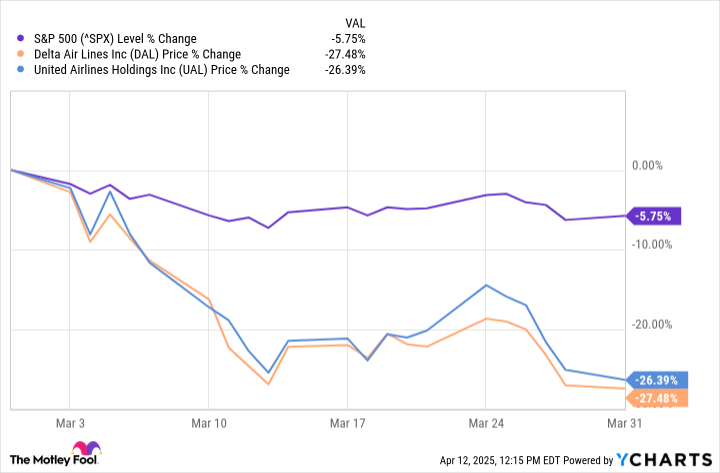

With the stock market falling more than 10% in two days, we have officially witnessed a stock market crash. Stocks, meanwhile, remain volatile given uncertainty over the impact of tariffs and the ongoing trade war.

While I would not rush into stocks, this could be a good time to start dipping your toe slowly into high-quality names that you'd want to own for the next decade or more. Let's look at three tech stocks that fit that bill.

Despite semiconductors being exempted (for now) from the tariffs slapped on Taiwan, Nvidia (NASDAQ: NVDA) has not been spared in the recent market sell-off. However, it is still the best-positioned company in the world when it comes to benefiting from the buildout of artificial intelligence (AI) infrastructure. It's also left the stock trading at a very attractive valuation with a forward price-to-earnings ratio (P/E) of under 21 times based on this year's analyst estimates and a price/earnings-to-growth (PEG) ratio below 0.4. Stocks with PEGs under 1 are generally viewed as undervalued, so Nvidia's stock is very cheap based on this metric.

![How to Find Low-Competition Keywords with Semrush [Super Easy]](https://static.semrush.com/blog/uploads/media/73/62/7362f16fb9e460b6d58ccc09b4a048b6/how-to-find-low-competition-keywords-sm.png)